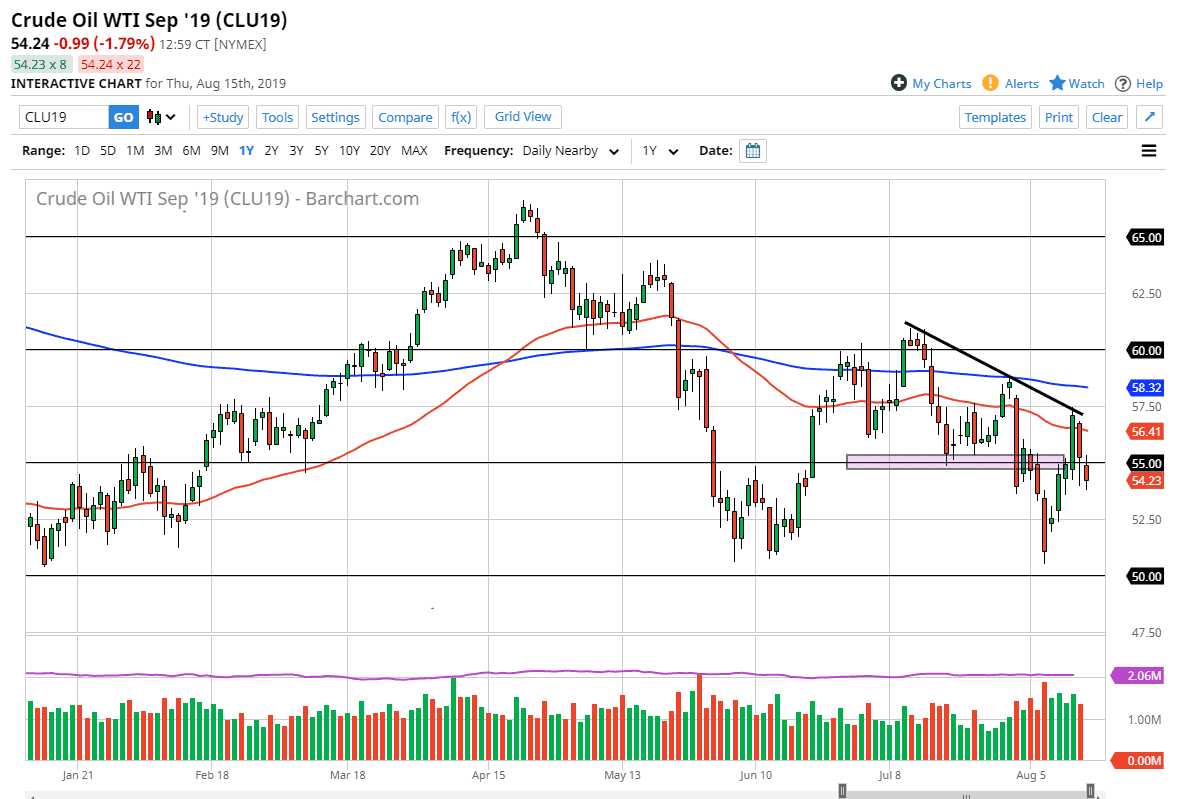

The West Texas Intermediate crude oil market had a rough session on Thursday, breaking down at the open to gap lower, and stay well below the $55 level. We broke down towards the bottom of the candle stick from the trading session on Wednesday, so we rallied quite nicely to reach towards the $55 level. At this point, the market looks very likely to continue to find sellers above though, as the moving averages that I follow are turning lower, and of course there is the trend line that the market has been following.

Beyond the fact that we have a downtrend line and the 50 day EMA turning lower, which of course is pictured in red above, we also have a serious concern about global growth, which of course would be very negative for crude oil. If global growth is going to slow down a bit it’s likely that we will see less demand for crude oil. Beyond that, we have more than enough crude oil coming out of the United States right now to satiate the desires of the domestic market. What can’t be drilled in the Dakotas or Texas can be imported from Canada.

All things being equal I anticipate that we will probably try to rally based upon the candlestick on Thursday, but I also think there is more than enough resistance above to keep this market somewhat. I anticipate that the market is probably going to rally only to fail somewhere closer to the 50 day EMA again, which is near the $56.42 level as I record this video. The market continues to grind lower, not necessarily break down drastically. I don’t expect massive candles or extreme moves during the trading session, but I do think that rallies will continue to struggle to hang onto the gains as the global demand is concerned, the US dollar strengthening is a concern, and beyond that we also have the trade war which is going on, and that most certainly has an effect on demand for petroleum as shipping will slow down. From a technical analysis standpoint, if we can break down below the candle stick on Thursday, we will more than likely go looking towards the $52.50 level initially, perhaps followed by the $51 level which was significant support in the past. If we were to break to the upside, it’s not until we clear the trend line that I have marked on the chart that I think the market could start to pick up serious momentum.