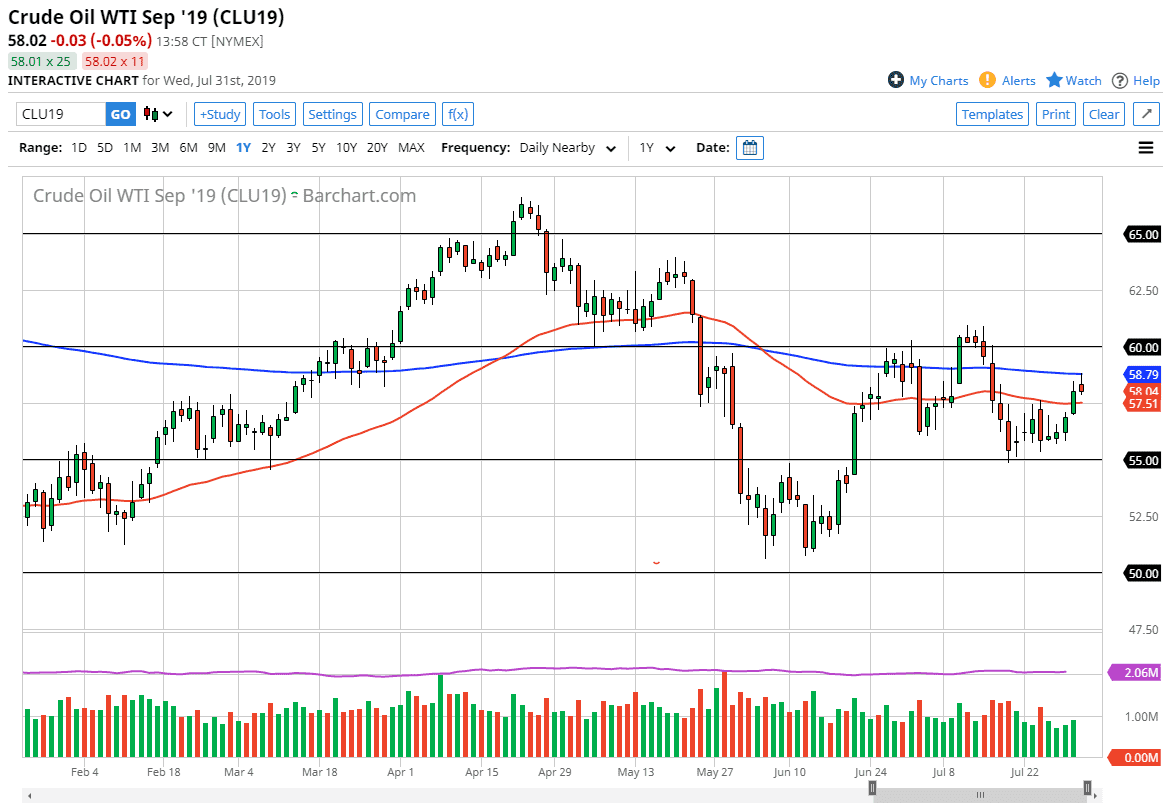

The WTI Crude Oil market originally shot higher during the trading session on Wednesday but found enough trouble at the 200 day EMA to roll over and show signs of weakness yet again. At this point, I think that the market is essentially trading in a $5.00 range, and we are essentially in the middle. At this point, it’s likely that we will continue to see a lot of back and forth trading right around the 50 day EMA as well, so I don’t expect to see much in the market change. We are basically in the middle of the range, so it’s the same thing as “no man’s land.”

I am much more comfortable in buying and selling as the extremes, which of course we are nowhere near. With that in mind I will stay on the sidelines when it comes to crude oil in the short term, expecting a bit of chop back and forth over the next several weeks. Global demand is of course a concern, as we are seeing a weakness around the world that probably affects whether or not economies will have demand for a lot of crude oil.

Not only do we have that bearish turn of events but we also seem to be ignoring any type of tension between the United States and Iran, which is something that’s relatively new for the markets. Ultimately, I think this is a market that continues to be in this range not only due to the fact that we don’t have anywhere to be, but it’s also the worst trading month of the summer. A lot of traders will be away from their desks for the next couple of weeks, so this is a market that I would not expect much in the way of a move. I suspect a lot of chop will continue to be the norm going forward so I believe that you probably will be better off simply waiting for the market to get to the outer edges of the range. At this point, I anticipate that the best way to approach this market is from a range bound system. Perhaps using something along the lines of the stochastic oscillator could come into play here. I believe at this point we are simply waiting for more liquidity to come back into the market, perhaps in September.