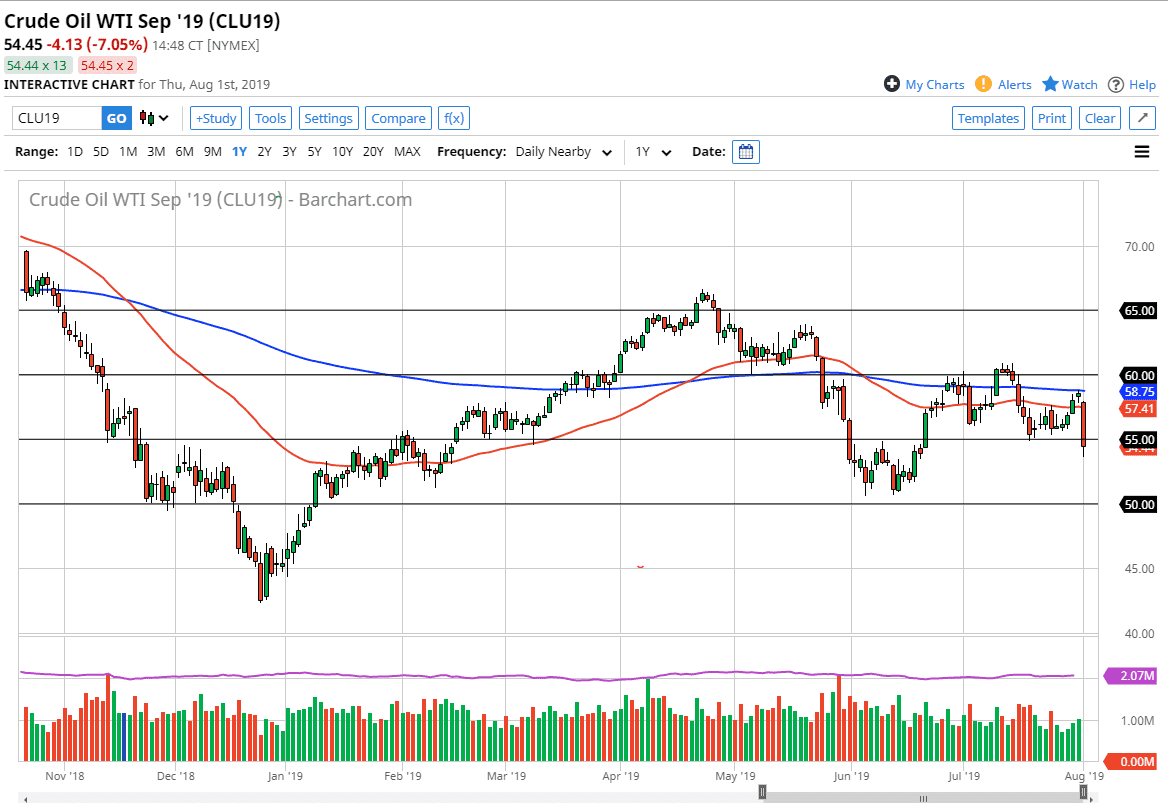

West Texas Intermediate Crude broke down rather significantly during the trading session on Thursday, slicing down towards the $55 level. This is an extraordinarily bullish candle, and at this point it doesn’t look like we have much in the way of momentum to the upside. We did get a little bit of a bounce towards the end of the day but that’s simply position squaring as people probably didn’t want to carry on shorting this market heading into the jobs figure.

All things being equal though, this is horrifically negative based upon the candlestick, and I think at this point it’s only a matter time before sellers will return on short-term rallies. All things being equal, the market is finally showing a proclivity as to directionality in comparison to the last several weeks.

Chinese tariffs

The Chinese are about to get another 10% slapped on their imports by the President of the United States on September 1, as he sent out on twitter during the trading session. In fact, that was a direct correlation to that announcement and risk appetite getting absolutely crushed. Ultimately, the market not only slammed the lower but then broke down through support. The candle stick is very rough looking, but it should be noted that it was a sudden and direct reaction to the tweet.

There are concerns about global demand for crude oil, and if the Chinese are going to have even more trouble exporting, that should drive down demand for petroleum. In a sense, this is a perfect weaponization of tariffs, as the falling oil prices will only help the Americans who produce 75% of the crude oil domestically anyway.

Technical analysis

The technical analysis of course is very negative suddenly, and I think at this point if we break down below the bottom of the candle stick for the trading session on Thursday, we probably go looking towards the $51 level, perhaps even the $50 level. Rallies at this point should be selling opportunities all the way up to the 50 day EMA which is pictured in red. At this point, I suspect it’s only a matter time before the sellers get back involved. After all, the stickiness with the Iranians could even lift this market. If that’s not going to work, what will?