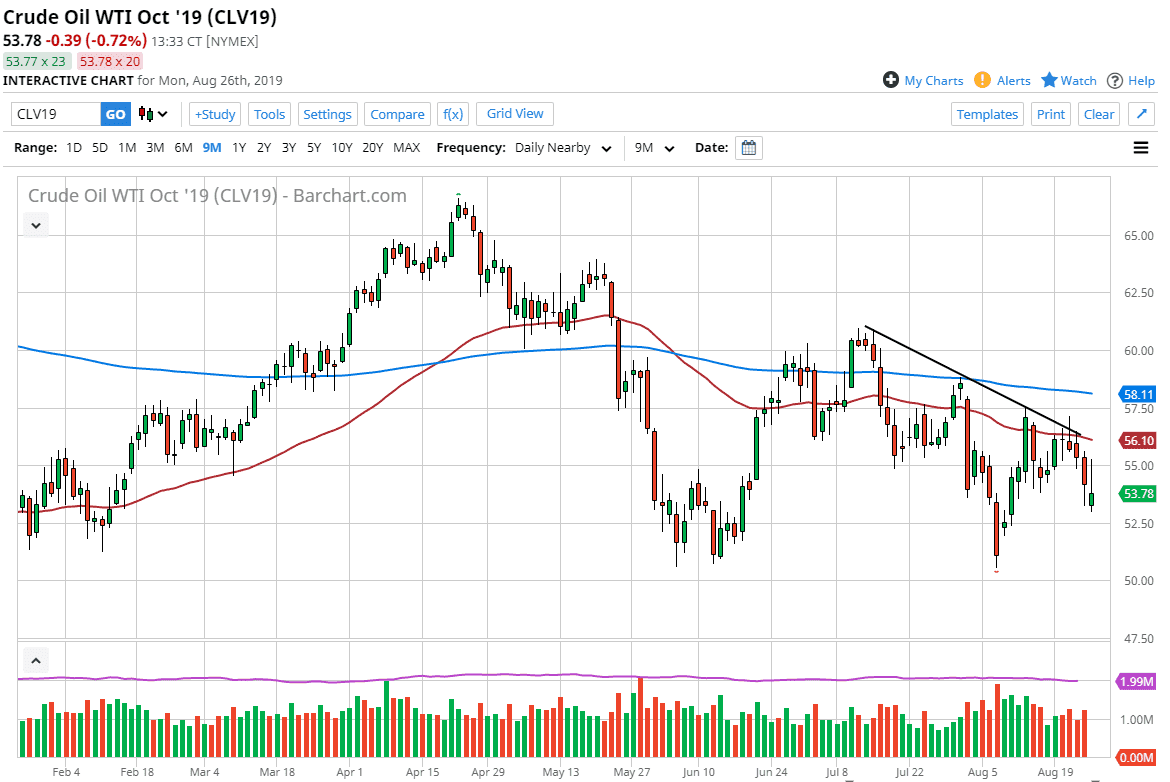

The West Texas Intermediate Crude Oil market initially gapped lower in reaction to the total “risk off” type of situation that we found ourselves in in early Asian trading. At this point, we turned right back around to rally above the $55 level in a reaction to headlines suggesting that the Americans and the Chinese are willing to speak to each other again. Having said that though, it’s obvious that the risk off attitude has come back into the market, as we have found the $55 level be far too resistive.

Beyond that, the 50 day EMA sits right at the downtrend at the $56 level, an area that should be a confluence of significant resistance, thereby pushing the market lower. At this point, it looks as if we are going to form a bit of an inverted hammer so it’ll be interesting to see if we can break down below the bottom of it. If we do, then the $52.50 level will be targeted, followed perhaps by the $51 level which is more or less a “zone” that extends down to the $50 level.

At this point, anytime the market rallies it looks very likely that we are going to roll over and suggest negativity. I think the $50 level underneath will be a massive support level, but it also makes for a huge target but at this point I think it’s going to be more of a grind to the downside. It’s not until we break above the 50 day EMA on a daily close that I would consider buying this market, as it looks to be struggling to the idea of slowing global growth, and that of course should continue to weigh upon demand for crude oil as it certainly will struggle in this type of environment. As long as we have all of these tariffs in effect between the Americans and the Chinese, it’s difficult to imagine a scenario where the idea of oil being in demand is cogent. There is a serious lack of demand due to transpacific shipping, trucking, and the oversupply of the US crude is also a major issue. I believe that oil markets will continue to fail every time they try to rally and I will trade them as such. This is of course until the Americans and the Chinese come together or we get that daily close above the 50 day EMA.