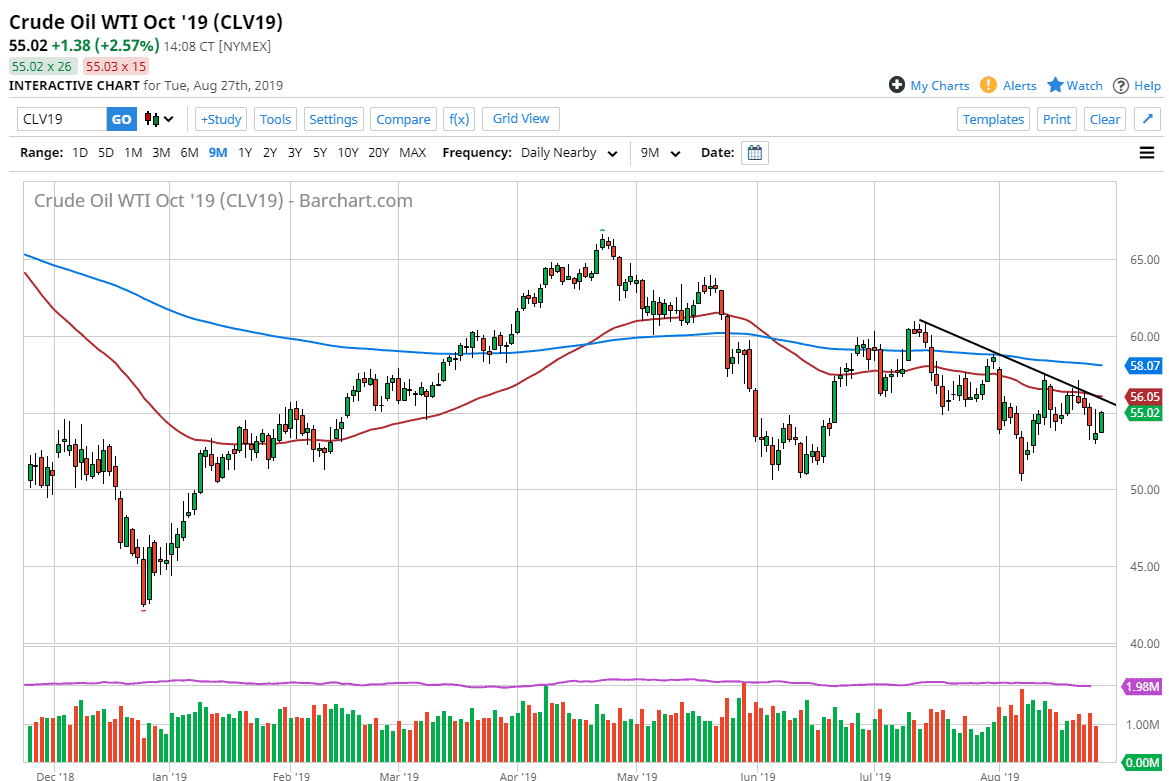

The West Texas Intermediate Crude Oil market should continue to grind a little bit higher in the short term, but I do think that by the end of the day we will find sellers to push this market back down. With that being the case I think you will probably have to go to short-term charts to fire off that short trade, as there is a major convergence of resistance right around the $55 round figure, and of course the 50 day EMA which is just above the $56 level. In other words, I think it’s only a matter time before we can start selling. The downtrend line that will of course offer major resistance as well, and you have to think about the overall geopolitical and global situation.

Looking at this chart, it’s very likely that we will roll over and go looking to lower levels, as there is a significant amount of slow down when it comes to global economics, and that of course means that we will be using less crude oil in theory. The $55 level will almost always attract a lot of attention as it is a large, round, psychologically significant figure. It’s an area that we have seen both support and resistance at recently, so it will continue to cause traders to go back and forth.

We are in a downtrend, at least over the last several months and it’s likely that we will go towards the low again which is closer to the $51 level. That extends down to the $50 level, as it is more of his own to the downside. Ultimately, it’s a very negative market but we always have to look at the alternate scenario. If we can break on a daily close above the 50 day EMA, it’s likely that we will then go looking towards the 200 day EMA above. That means we could go to the $58 level, but that seems to be very unlikely. Another thing that is working against the value of crude oil is going to be the fact that the US dollar continues to strengthen overall. With this, I think it’s only a matter of time before we see a short-term chart that offers some type of exhaustion that we can start selling as this is a market that it’s almost impossible to start buying.