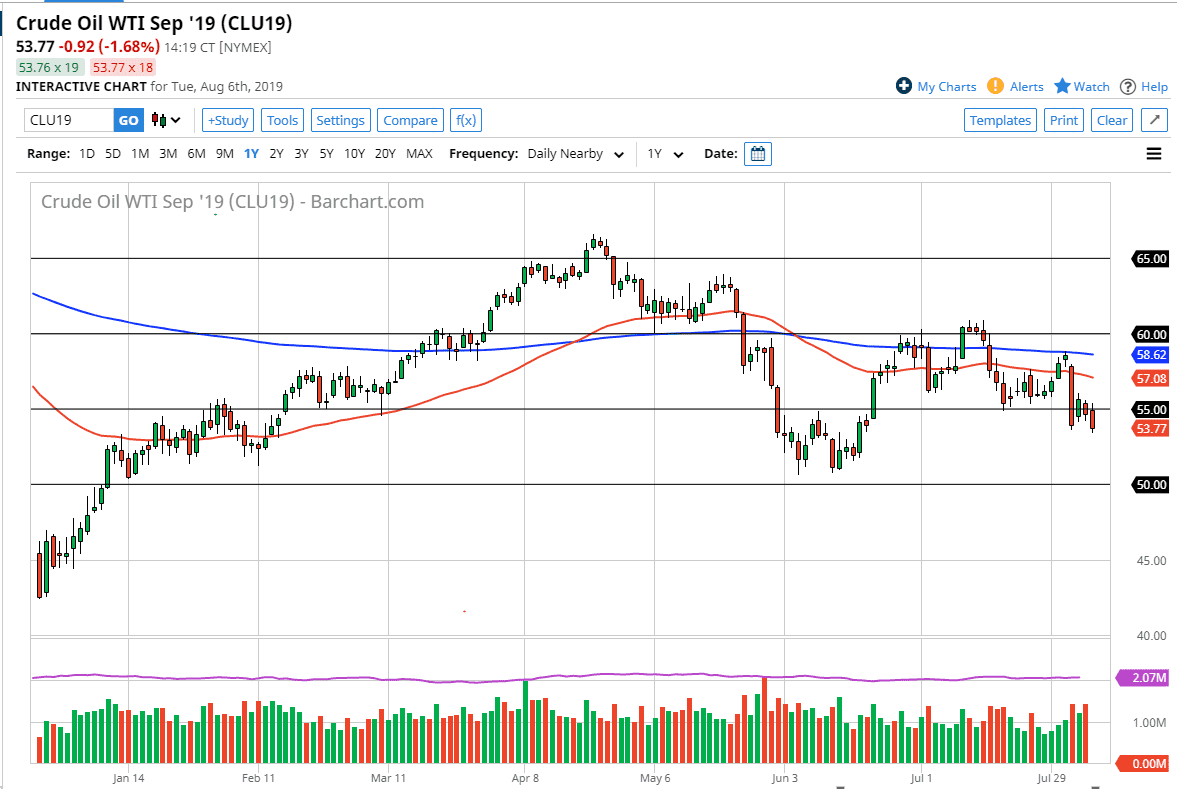

The WTI Crude Oil market initially tried to rally during the trading session on Tuesday but then gave back the gains above the $55 level. By doing so, we reached towards the bottom of the extraordinarily bearish candle stick from last Thursday, and then bounced again. However, by the time we closed trading on Tuesday, we had broken below the candle stick and made a fresh low. At this point, it’s very likely that we are going to continue to struggle.

With the Iranians and the Americans bickering, and of course the Iranians and the British bickering, and oil falling - it shows just how weak crude oil is. We have a major problem with global demand, as it is falling worldwide. Beyond that, we also have plenty of supply coming out of both the United States and Canada, so even though we have seen a little bit of decline in production coming out of some countries, we have had more than enough come out of North America to make up the difference.

Looking at the chart, I believe that there is significant support starting at the $51 level, extending down to the $50 level. All things being equal, I think that is the target but that doesn’t mean that we get there right away. I think you are probably best served by looking for some type of exhaustive candle after a short-term bounce. I think at this point the 50 day EMA, which is painted in red, should be massive resistance so as long as we can stay below there I think we are picking up downward pressure. After all, it is starting to tilt a little bit lower. That being said, I don’t expect the crude oil market to break through the $50 level rather soon.

Add to that the fact that we have the US dollar strengthening, it makes sense that it would take less US dollars to buy a barrel of oil, therefore driving the market lower. With this, I simply look for bounces that I can so on short-term charts, as the downtrend looks to be very much intact. I also would be a seller of the bottom of the candle stick for the trading session on Tuesday, as crude oil simply can’t seem to get a bid for any serious length of time. The fact that we have broken through the bottom of that massive Thursday candle tells me that more sellers have just jumped in.