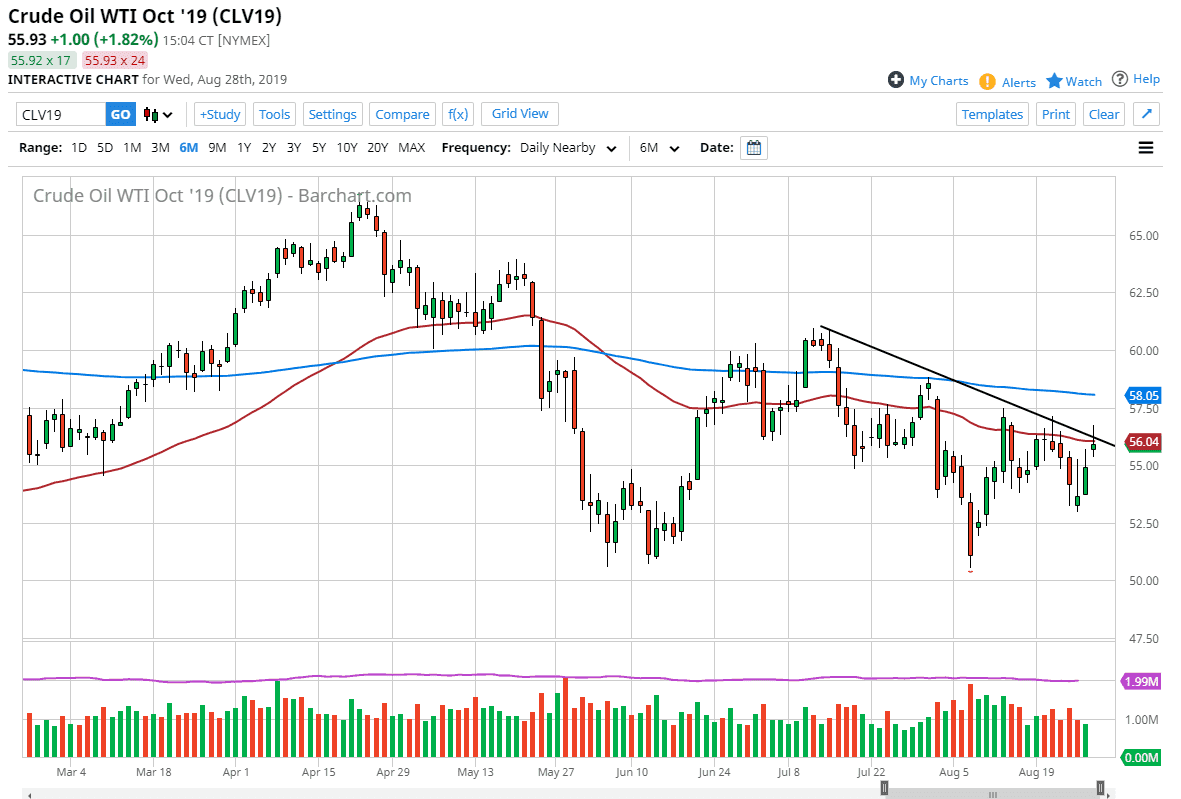

The West Texas Intermediate Crude market gapped higher to kick off the trading session on Wednesday, and then shot even higher after the inventory figures showed 10 million barrels drawn away. At this point, the market has turned around completely though and this shows just how negative things are when it comes to the crude oil market. At this point, it’s very likely that the market is going to continue to find sellers, so at this point the fact that we ended up forming a shooting star shows just how bad things are.

The downtrend line holds things intact, just as the 50 day EMA does. With this, I think the very least we are going to do is drift down towards the $55 level. That’s an area that begins the gap higher, and as a result it’s likely that the market will reach down towards that area. The $55 level is also a large, round, psychologically significant figure, so I think that attracts a lot of attention as well.

With the slowdown in global growth, it makes sense that crude oil will face less demand, even though we did have such a bullish inventory figure. At this point, one simply has to look at the inventory figures of the last couple of years and see how that announcement can have several anomalies, and although this was a huge bullish number, we’ve seen this before. The market has looked directly through it, and now it looks like they are ready to start selling yet again. If we can break down below the $55 level, then it’s likely that we go down to the $53 level.

To the downside, the market should find plenty of support at the $51 level and extending down to the $50 level. That is essentially the “floor in the market”, and as long as we can stay above there things shouldn’t get out of hand. If we do break down below there, it’s very likely that this thing will come undone rapidly. The market continues to be very volatile, but I think it is much easier to short this market than it is to buy it, especially after the candle stick that is formed for the Wednesday session. I remain a seller of this market as it shows it simply cannot hang onto gains for any significant amount of time. A strengthening US dollar of course doesn’t help the situation.