The Gold markets initially tried to rally on Friday but then fell somewhat as traders have gotten a bit exhausted. It’s not a huge surprise to see this market pull back a little bit as traders had been flocking there recently, perhaps a bit overzealously.

Gold markets have initially tried to rally during the trading session on Friday but then broke down a bit as we continue to see a lot of noise. Overall, this is a market that I think will continue to see buyers based upon the idea of central banks around the world easing monetary policy, and of course fiat currencies getting hammered. The US dollar has rallied a bit, but this is more to do with Treasuries rallying and a run from trouble more than anything else. Overall, I think this market will continue to rally but I also think that we had gotten a bit ahead of ourselves.

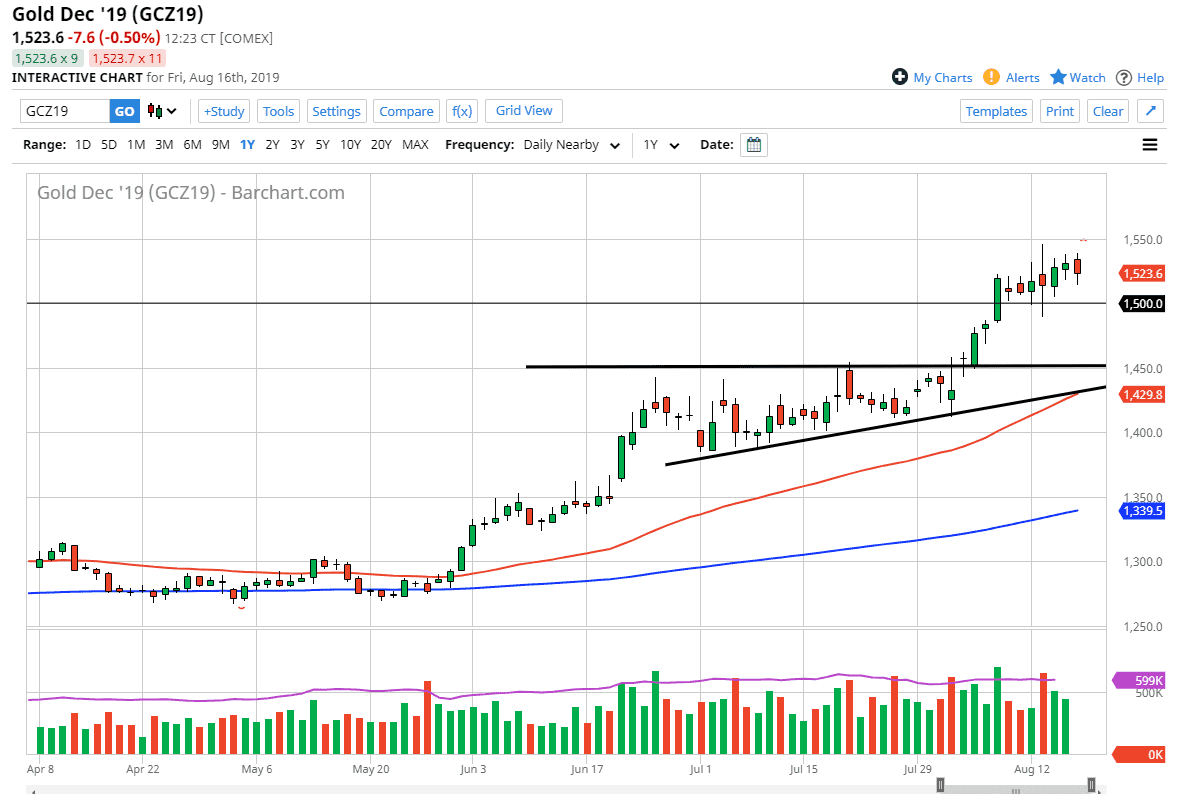

Beyond all of that, the weekly candle stick does look a bit exhaustive, forming something that is not quite a shooting star but close to it. A pullback to the $1500 level is very likely, but quite frankly I think will probably even go down to the $1450 level as it was a significant resistance level that has not been retested significantly. At this point, I’d be a buyer of any dips, and I think that we could go looking towards the $1550 level, and then eventually the $1600 level after that. One thing that should be noted is that the 50-day EMA is starting to reach towards that crucial $1450 level as well, and that will of course attract a lot of longer-term big-money traders.

I don’t see any reason to sell gold, only reasons to buy it. Even if I were told that the market is going to break down from here, I would still wait for a buying opportunity. The conditions are perfect for precious metals to continue to rally, and that is not going to change anytime soon. To the upside I believe that we are still going to go looking towards the $1600 level and then eventually the $1800 level. One thing to keep in mind is that gold does tend to move in $25 increments, which of course is very symmetrical and easy to trade the market by. We are in a bullish trend, and probably will be for the foreseeable future.