Gold markets fell a bit during the trading session on Monday, reaching down towards the $1500 mark. We found a bit of support at that level earlier in the day and then a bounce, but later on in the day we reached towards that level again. That is an area that should continue to cause quite a bit of support and I think it does extend down to the $1490 level. If we do break down below there, then it’s likely we will go looking towards the next major support level underneath.

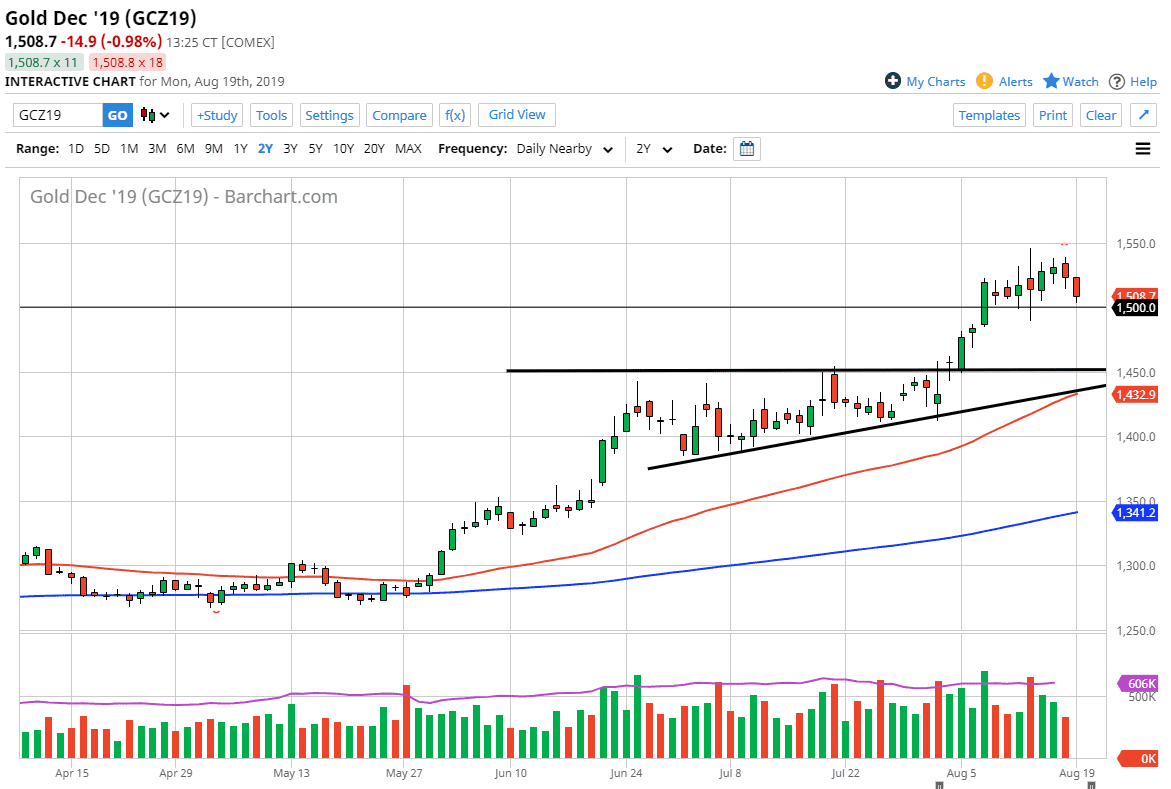

As you can see on the chart, there is an ascending triangle marked. The top of the ascending triangle, which is the $1450 level, should be massive support as it was significant resistance previously. Beyond that, we also have the 50-day EMA which is starting to approach that level as well, painted in red on the chart. I would be more than interested in trying to buy this market on some type of bounce and would also load up on my position size. After all, we have seen a massive move to the upside and of course central banks around the world continue to add stimulus, driving gold higher overall. In this scenario, gold will continue to outperform most other assets.

Looking at this chart, I think that we will probably retest the $1550 level again to the upside, and then eventually the $1600 level. I believe that the $1800 level is probably a longer-term target and therefore I think it’s only a matter of time before value hunters continue to jump into this market on these dips. Quite frankly, it’s not until we break down below the 50-day EMA that I would be concerned about the overall uptrend, and I suspect that the statements coming out of Jackson Hole this week will probably only add more fuel to the fire of monetary policy easing. At this point, I think precious metals in general will continue to attract a lot of money, and therefore I think it’s only a matter of time before we will see some type of headline that has more of a “risk off” feel to it, and therefore it will make gold attractive. In fact, in a bit of irony we are seeing gold in Bitcoin move in the same direction overall. Funny to think that, considering that traders of these assets tend to be at odds most of the time.