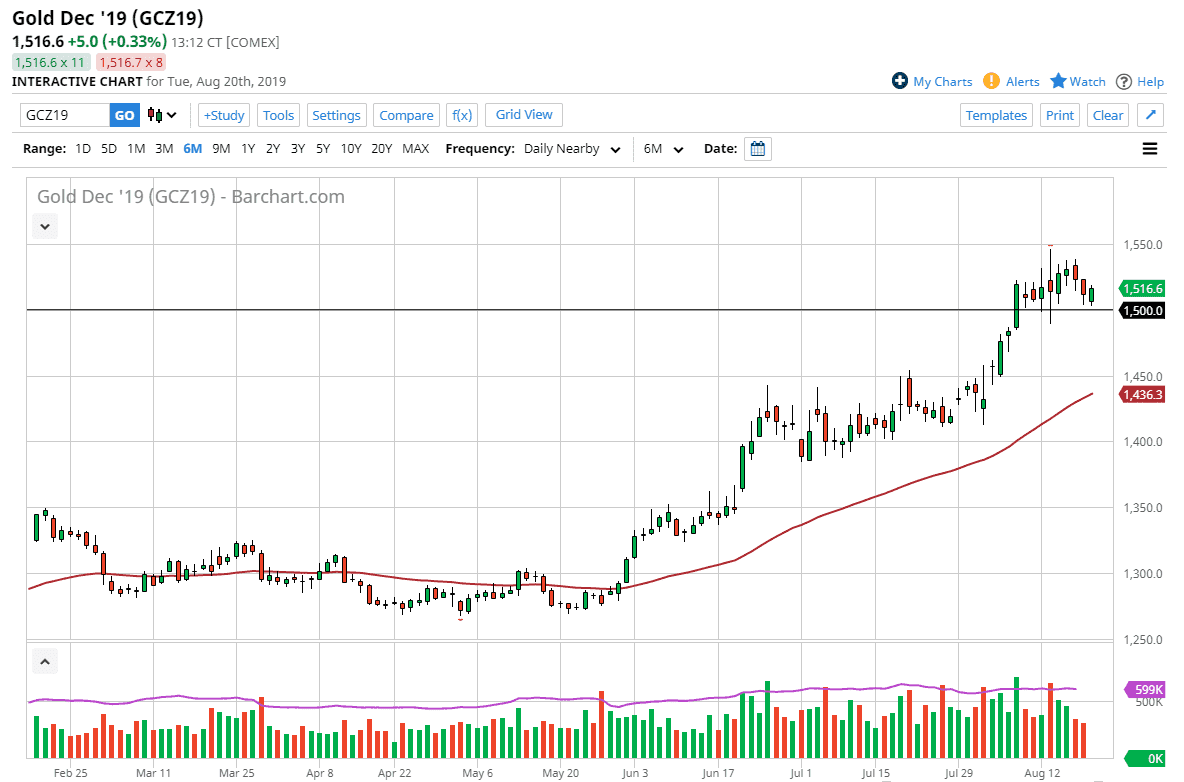

Gold markets rallied a bit during the New York trading session on Tuesday after initially gapping lower, and that of course is a very bullish sign. It looks as if the $1500 level will continue to offer a lot of interest as well, but the market has been a bit overdone, so at this point I think it would not surprise me at all to pull back. In fact, I think it would be very healthy as we had perhaps gotten ahead of ourselves.

Having said that, the market looks to be well supported near the $1450 level, as it was the top of an ascending triangle. Beyond that, we also have the 50 day EMA reaching that level. That’s an area where I would expect to see a lot of buying pressure come back into this market. After all, we are in and uptrend and that certainly is still very much an effect. Pulling back from here and giving up the $1500 level may make some headlines, but at this point it doesn’t really matter. Order flow continues to go to the upside.

Keep in mind that central bankers are meeting in Jackson Hole, Wyoming this week, probably doing everything they can to talk down their respective currencies. This should continue to help precious metals markets in general, which of course gold is the first place people run to. Ultimately, I continue to look at this as a market that should offer plenty of bullish pressure and an opportunity to go long. That being said, if we fall from here I look at this as an opportunity to pick up “value” going forward.

Looking at the chart, if the $1450 level and the 50 day got broken to the downside, it’s possible that we could go down towards the $1400 level. That for me is the absolute “floor” of the market. To the upside though we have a bit of a “ceiling” at the $1550 level. After that, the market starts to look towards the $1600 level which I do think we will eventually hit. Even longer-term than that, I believe that the $1800 level will be targeted. By the time the Jackson Hole meetings are done, I would anticipate a situation where people return to the gold market as central bankers will more than likely continue to talk down their respective currencies and talk about the dovish attitudes.