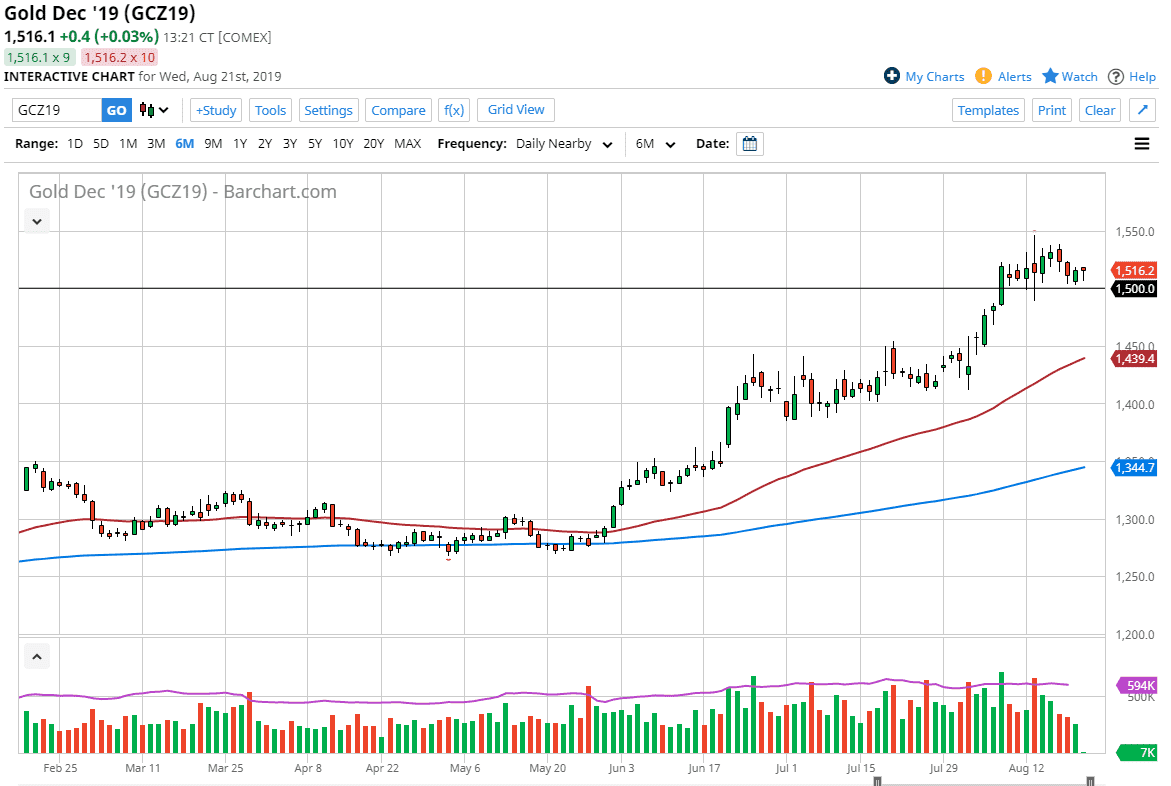

Gold markets initially pulled back during the New York trading session on Wednesday, reaching down towards the $1500 level before finding a bit of support. At the moment, the market are looking to find plenty of interest at the $1500 level, which is a significant round number the people will be interested in them. Ultimately though, I think there is significant amount of support that extends down to the $1490 level to keep this market somewhat afloat.

If we were to break down below that level, then it’s very likely that we could unwind a bit, but I see a massive amount of support near the $1450 level, not only based upon the fact that it is a large, round, psychologically significant figure, but we also have the 50 day EMA reaching towards the level as well, so there will be a certain amount of technical support there as well. Beyond that, we also have that level as a potential top of what could have been drawn out as an ascending triangle before the most recent leg higher. In other words, I think that there will be enough technical confluence there to keep buyers in the market, as a drop of roughly $60 would of course attract a lot of value hunting.

All things being equal, I have no interest in shorting this market because central banks around the world continue to liquefy markets and of course ease monetary policy. Gold is, of course, a major way to get away from loose monetary policy for traders, as they are going to be concerned about potential inflation. Beyond that though, simple wealth preservation is a major function of this market as well. I believe that the $1400 level underneath will essentially be the “floor” in this market, and by the time we would get down there it’s very likely that the blue 200 day EMA may be closer to that level anyway. Overall, I believe that the market will continue to find plenty of buyers on these dips, and I think what we have at this point is a scenario where you simply look for value in nothing else. I have no interest in shorting, as the central bank policies around the world continue to favor higher pricing in the precious metals markets, not only gold but also silver and platinum. All things being equal, I think we go looking towards the $1550 level again.