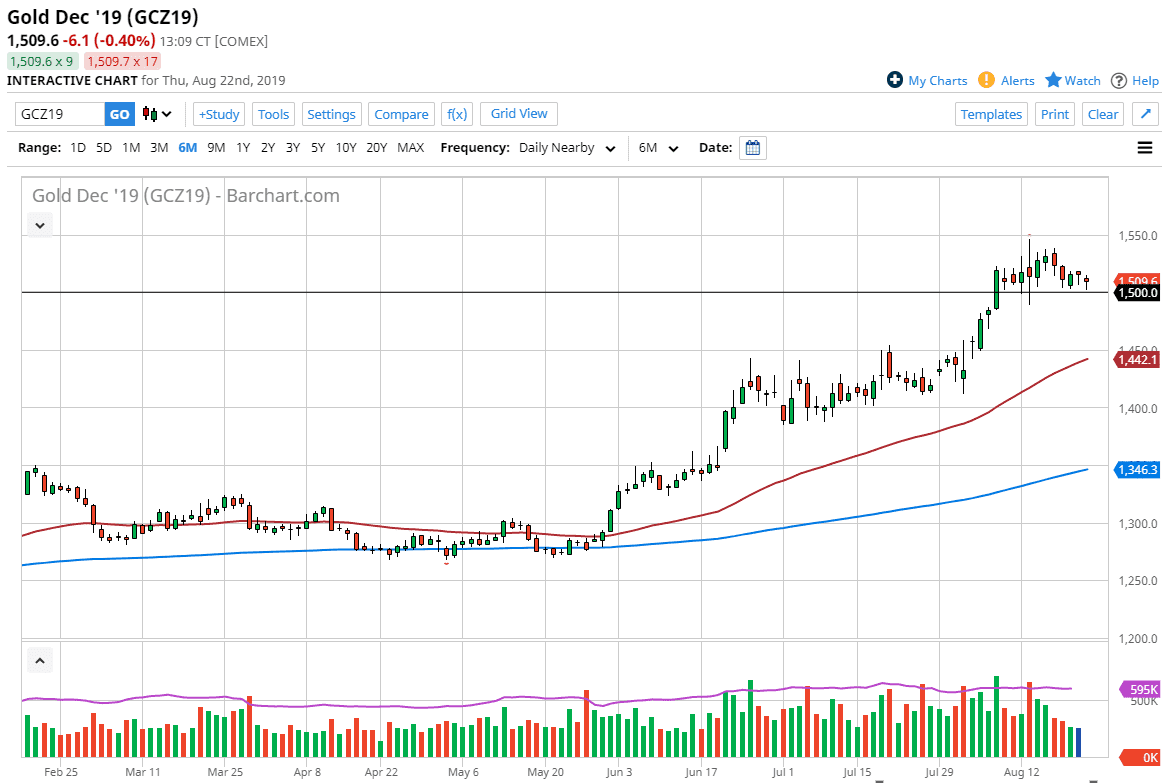

Gold markets initially pulled back a bit during the New York trading session on Thursday but found enough buyers underneath near the $1500 level to turn the market around and form a bit of a hammer. At this point, the market has formed a couple of hammers in a row so one would have to think that’s a very bullish sign. It makes quite a bit of sense that gold would rally in the present environment we find ourselves in, and with central bankers meeting in Jackson Hole, Wyoming currently, I fully expect that they will give comments about becoming even more easy with monetary policy. That is essentially rocket fuel for the gold market.

If we do break down below the $1500 level, there is a significant amount of support down to the $1490 level, and I think at that as the support “zone” that is currently holding the market up. Even if we break down below there, I have no interest whatsoever in shorting the gold market, because we are in a strong uptrend, and the 50 day EMA is about $50 underneath. I believe that the $1450 level will attract a lot of attention not only due to the red 50 day EMA, but a large, round, psychologically significant figure. If you look at the chart, it’s easy to see that gold markets tend to pay attention to every $50, so therefore we should be paying attention.

The $1450 level was the top of the previous ascending triangle that sent the market higher but has not been retested after the breakout yet. It is because of this that I would become even more emboldened to go long of gold if we were to drop down there. All things being equal, I believe the gold will go higher over the longer-term, and I do believe that central bankers will continue to talk about stimulus and easing monetary policy. Both of those are going to continue to push this market higher right along with silver and platinum.

The only reason this market hasn’t completely exploded to the upside is that the US dollar has strengthened quite significantly. With that, I’m actually more bullish of gold in other currencies if you have that ability, especially if you’re talking about currencies such as the Canadian dollar, Euro, and most certainly the British pound. In the typical futures market though, it looks like buying the dips will continue to work.