By the end of last week, the GBP/USD pair rebounded strongly, reaching the 1.2505 resistance level, its highest in seven weeks, supported by the decline of the US dollar. The recent optimism about the possibility of reaching an agreement between the EU and Britain to avoid a hard Brexit that will negatively affect both sides, before settling around 1.2465 at the time of writing. All indications from the British government, despite the political conflict between them and the opposition, confirm that Johnson is determined to remove the deliver Brexit by the October 31 deadline. The government's stance awaits a response from the EU. Reports of a meeting between Prime Minister Boris Johnson and European Commission President Jean-Claude Juncker could keep the positive mood in place until Monday, but there is still some suspicion that it will last much longer.

GBP/USD will be strongly affected, along with the Brexit developments, by the monetary policy announcement by both the Bank of England and the US Federal Reserve. Carney is sticking to the bank's policy until the Brexit file is finally closed. For the US central bank, expectations are for a quarter-point cut. In any case, the price of the pair may be subject to a new fluctuation in one direction, according to events.

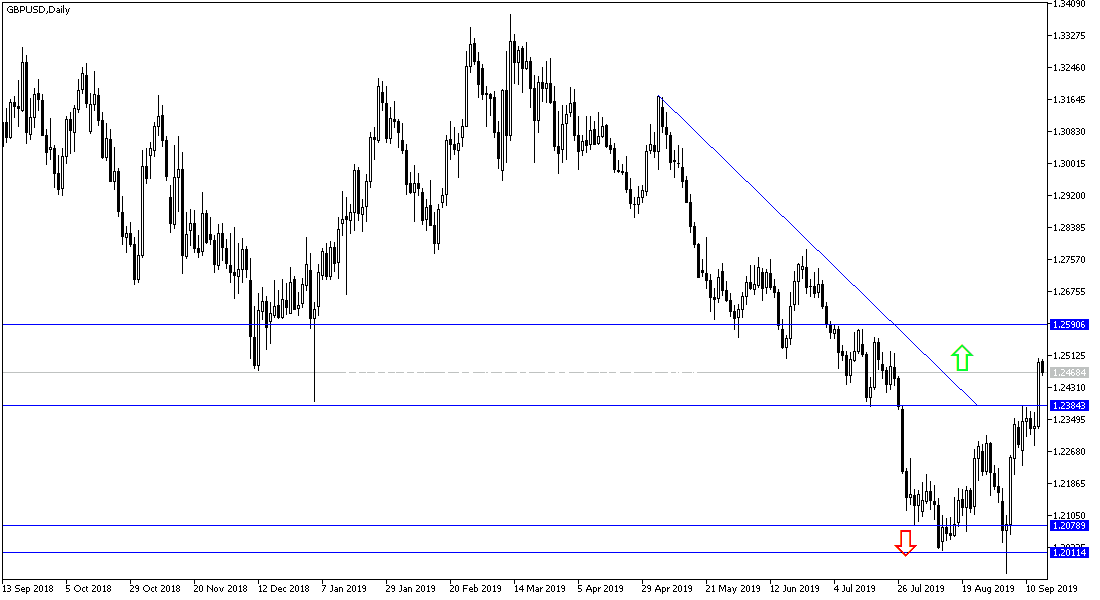

According to the technical analysis of the pair: On the daily chart, and with the stability of the GBP / USD price above the 1.2500 resistance, breaking the downtrend and turning higher is clear. The pair’s bullish momentum could increase if it moves towards 1.2560, 1.2630 and 1.2700 zones respectively. On the downside, any price drop to the 1.2300 support level will restore the bearish strength again and negatively affect the upside correction expectations.

On the economic data front, the pair is not expecting any significant economic data from the UK or the US today. Starting next Wednesday, we will be on a date with a package of important economic data from both economies.