Bitcoin markets have done very little over the last several days, simply following the 50 day EMA. This is a very important technical indicator for this market as the 50 day EMA does seem to be respected over the longer-term. The fact that we are walking along it tells me that the market is simply waiting for something. That something of course would be the Federal Reserve announcement tomorrow, because obviously it will have a crucial effect on what happens next with the US dollar. Remember, Bitcoin is a way to get away from fiat currencies, especially the US dollar.

While the Federal Reserve is expected to be dovish during the announcement and perhaps cut 25 basis points, the reality is that it will be the statement and the press conference after that the people will be paying the most attention to. The Federal Reserve sounding like they are going to cut rates and continue to do quantitative easing will more than likely have money running into the crypto market area, and that of course means Bitcoin initially.

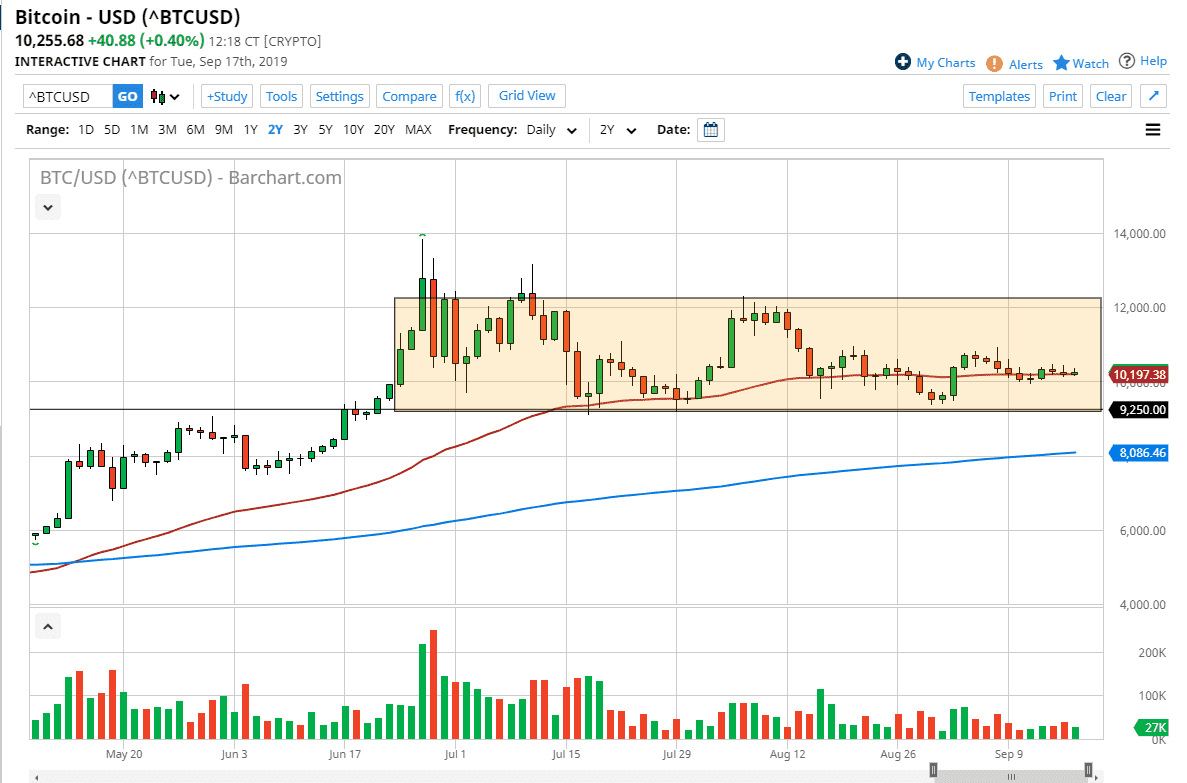

To the downside I see a lot of support at the $9250 level underneath as it is the bottom of the recent consolidation and then of course the resistance at the $12,000 level should be paid attention to as well. The market continues to simply churn ahead of the announcement, but it should be noted that it makes quite a bit of sense that we have seen a massive move to the upside and then a bit of digestion as needed.

If we do break above the $12,000 level, then it opens up the door to the $14,750 level as suggested by the height of the rectangle. All things being equal, the market should continue to offer buying opportunities on dips, as certainly the downtrend has been broken pretty significantly as of late. The 200 day EMA is just above the $8000 level, which of course is a large, round, psychologically significant figure in the market, and an area that will cause quite a bit of initial support and interest as well. If we were to break down below there, then it’s very likely that the market would break down significantly and could enter a downtrend. Until then, Bitcoin is still something that you should be buying on dips but you may have to be very patient.