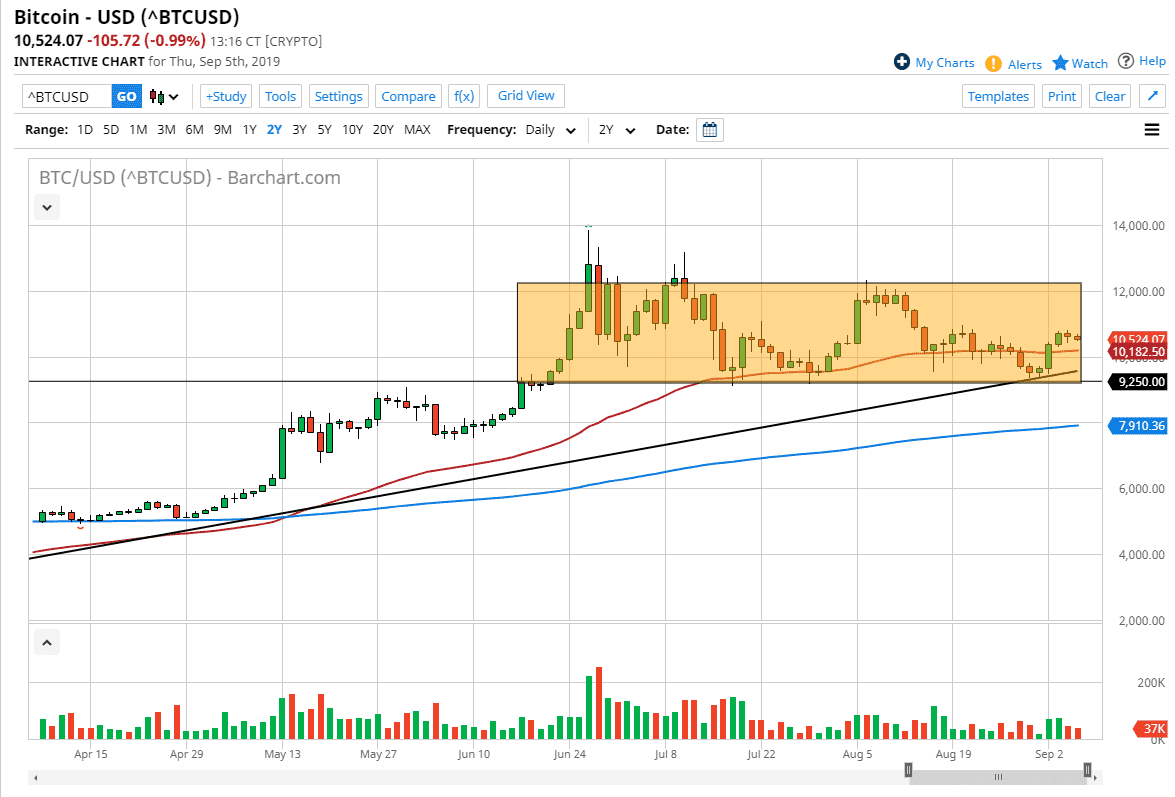

Bitcoin markets continue to calm down, but this is a good sign as the market will continue to go back and forth in the huge orange box that I have marked on the chart. The $9250 level underneath offer support, just as the $12,000 level is massive resistance. The 50 day EMA is right there as well, so it’s likely that we continue to see a lot of back-and-forth trading. Beyond all of that, we also have some fundamental things to pay attention to.

Bitcoin has been a way for money to protect itself, and it has held value as people are throwing money at the Bitcoin market from places like Venezuela, China, and several other places. At this point, the central banks around the world continue to loosen monetary policy, and that should of course drive people out of fiat currency and the like. At this point, gold and the Bitcoin markets both are moving in a very similar way longer-term as people are trying to get away from the US dollar, Euro, British pound, and several other currencies.

The Bitcoin market will continue to attract a lot of attention as it is the biggest crypto out there, and we are starting to see something rather new in the crypto market: differentiation between coins. For example, I did some analysis on Litecoin during the day for a private client, and the one thing that sticks out to me is that Litecoin has not done as well as Bitcoin. Ultimately, the crypto markets are starting to move apart from each other and that something that is necessary for a mature market to present itself. Previously, we have seen crypto move in one direction, with the Bitcoin market leading the way. Now we are starting to see other crypto markets fall by the wayside that aren’t being utilized as much. Monero has done relatively well comparison to Litecoin, but overall it’s likely that the main thrust of crypto will be Bitcoin. With that being the case, it’s likely that money will continue to flow into this market as a means of protection, although you may want to look at short-term pullbacks as a potential entry plan. The grind higher should continue to be the way forward, but ultimately it’s going to be difficult to jump “all in”, but if you build up a position slowly, it’s likely to be very profitable.