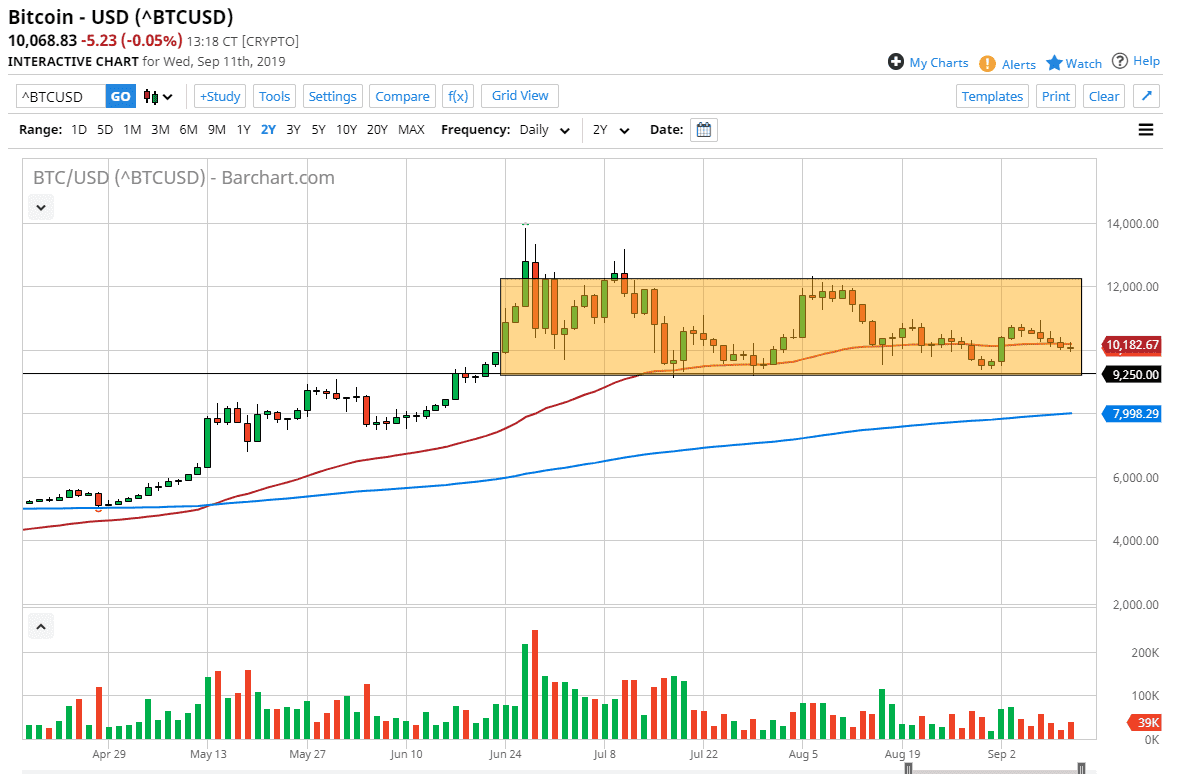

Bitcoin did very little during the trading session on Wednesday, as we are simply doing nothing. At this point in time it’s likely that we continue to swing back and forth across the 50 day EMA, which is painted in red on the chart. As you can see, I have a larger rectangle on the chart that suggests the consolidation range that we will be stuck in going forward. With that, it’s likely that we continue to see a lot of slow consolidation more than anything else as we are reaching towards the bottom of this range.

Keep in mind that the fundamental reasons continue to support the Bitcoin markets, as the central banks around the world are likely to cut monetary policy back. If that’s the case, then it’s very likely that money will continue to flow away from various fiat currencies, not just the US dollar. Ultimately, this is a market that is a way to escape a lot of that wealth destruction, which of course is one of the main drivers of the whole idea behind crypto. Crypto traders continue to benefit from the idea of fiat falling over the longer-term. Ironically, they tend to be at odds with gold traders, but both have been benefiting from the same thing.

There is also the aspect of capital flight from certain particular country such as Venezuela, Hong Kong, and China. That being the case, the market is very likely to continue to benefit from that as we have a lot of economic concerns around the world. This is a market that I think continues to try to build up a significant amount of momentum, and then reached towards the top of the overall consolidation. If we break down below the $9250 level, then it opens up the door to the 200 day EMA which will be even more supportive as it is closer to the $8000 handle which will attract a certain amount of attention due to the fact that it is a large, round, psychologically significant figure. True, the markets are quiet but they still seem positively pointed, and it should also be pointed out that there is the old adage “never fade a quiet market”, and I think that probably applies here as well. This is a market that I think is going to go higher but we may get a little bit of a slow drift in the process.