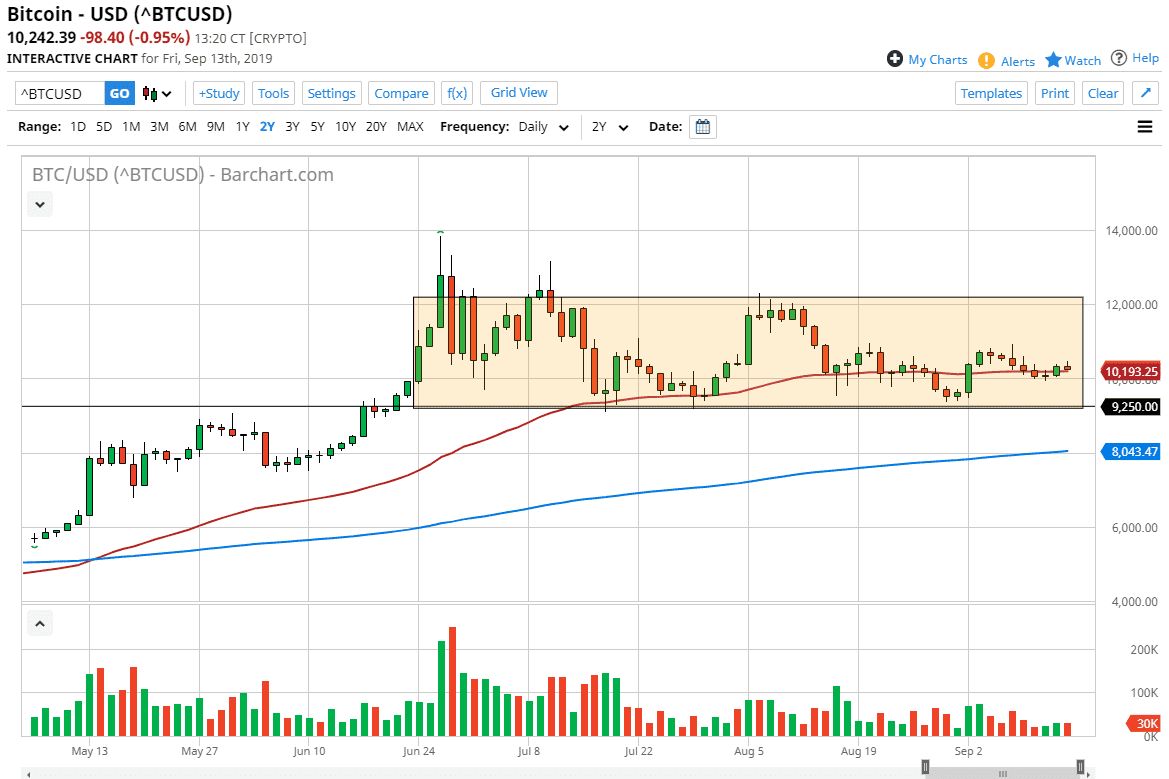

Bitcoin markets tried to rally initially during the trading session on Friday as we continue to see a lot of confusion and sideways chop overall. At this point, the market has pulled back a bit to hang around the 50 day EMA which is debt flat at this point. That is of course a good sign from the longer-term standpoint though, because the market has been simply parabolic and then has been grinding sideways to absorb those gains. At this point, I think the market is trying to decide whether or not it can keep up the inertia to the upside, and I think that given enough time it’s very likely that it will.

The $9250 level underneath continues to be supportive, and I believe it’s the bottom of the overall range. The $12,000 level above is the top of that range, so ultimately it appears that we are trying to build up enough momentum to continue the move higher. If we can break above this $12,000 handle, then it’s likely that we go looking towards the $14,750 level. That would be the “measured move” of the consolidation, and therefore it’s very likely that makes a lot of sense due to the fact that the $15,000 level above is a large, round, psychologically significant figure. That will obviously attract a lot of attention so it’s worth paying attention to.

On the other hand, if we break down below the $9250 level, it’s likely that the market goes looking towards the 200 day EMA underneath at the $8000 level. It’s at that point that we would have to reassess the overall trend, because breaking the 200 day EMA would of course be very negative. All things being equal though, it seems to be very unlikely to happen at this point, considering that the central banks around the world continue to cut interest rates and therefore it’s likely that alternate currency such as Bitcoin should continue to go higher, right along with precious metals. Beyond that, there are lot of countries around the world where we are seeing money running out of, so it’s likely that we will continue to see crypto benefit and of course Bitcoin is the main beneficiary from that move. Short-term traders continue to pick up Bitcoin on the dips, as seen over the last couple of weeks. This doesn’t mean that we go straight up in the air, but more than likely we are going to see lots of choppiness.