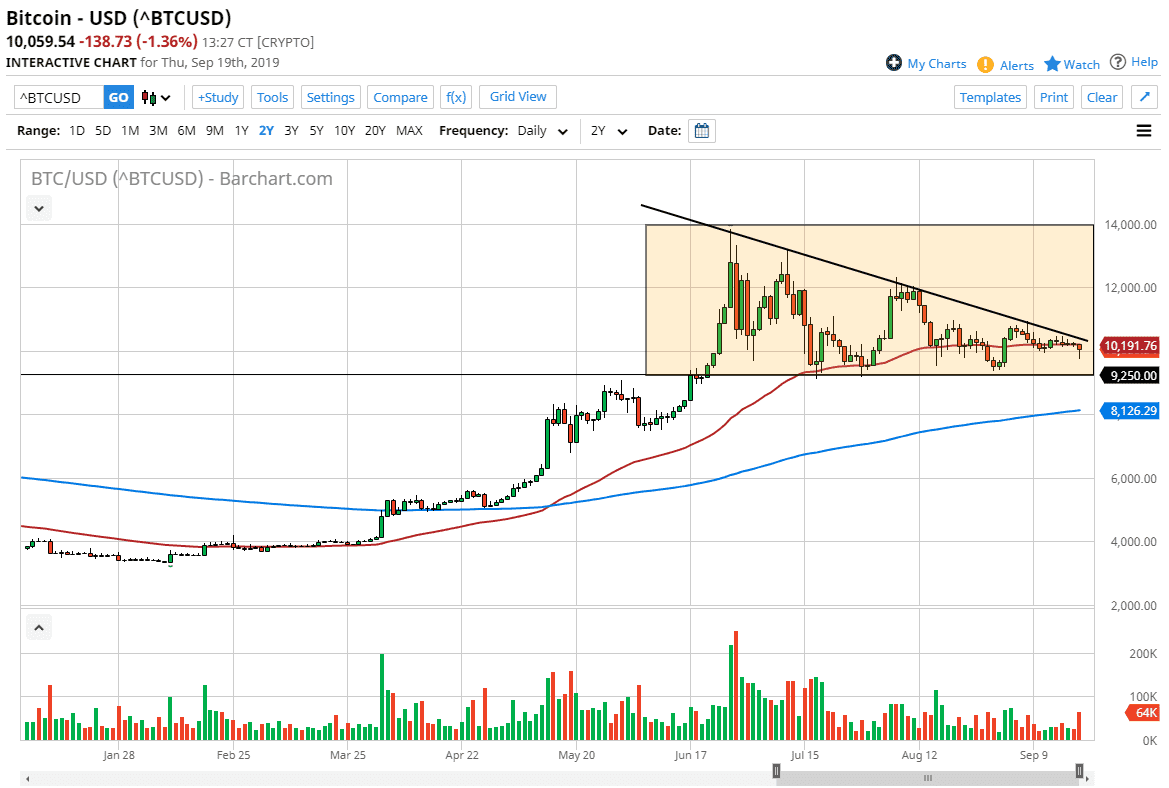

Bitcoin markets fell a bit during the trading session on Thursday but have recovered towards the end of the day. That at least gives the market some kind of hope, but at this point we are approaching a rather important apex of a massive descending triangle. At this point, the market looks very likely to make some type of move, and it could be rather explosive.

To the downside, the $9250 level should offer support, just as the downtrend line should offer resistance. If we break out of this area, then it’s likely that we go much further. One thing is for sure though, the ascending triangle is rather negative in general, and a break down below the $9250 level opens up a move of almost $5000 to the downside. This means that you are looking at a potential move below $5000 and perhaps even down to the $4500 region. If that does happen, the market should break down rather drastically, and send this market to the downside. That would in fact be the end of the uptrend and it’s very likely that Bitcoin would take quite some time to recover from that.

However, if the market breaks above the downtrend line, then it gives the market a chance to get to the $12,000 level, and then possibly even the $14,000 level at the top of the triangle. Either way, Bitcoin will need to make a decision rather soon, and I will be the first person to admit the fact that the interest rate cut and the potential continued quantitative easing out of the Federal Reserve not dragging down the value of the dollar and therefore bringing up the value of Bitcoin is a rather negative sign.

While for some time it did look like we were simply trying to build up enough momentum and digest the massive move to the upside, it now is getting to be a “now or never moment”, and therefore things are starting to get a bit dire for those who are bullish. With everything being equal, we will get a large and impulsive candle sooner or later that will tell us where we go for a longer-term move. Until then, Bitcoin is essentially going to be a bit of a “dead money market.” The 50 day EMA is currently flat as well, and that can only go on for so long.