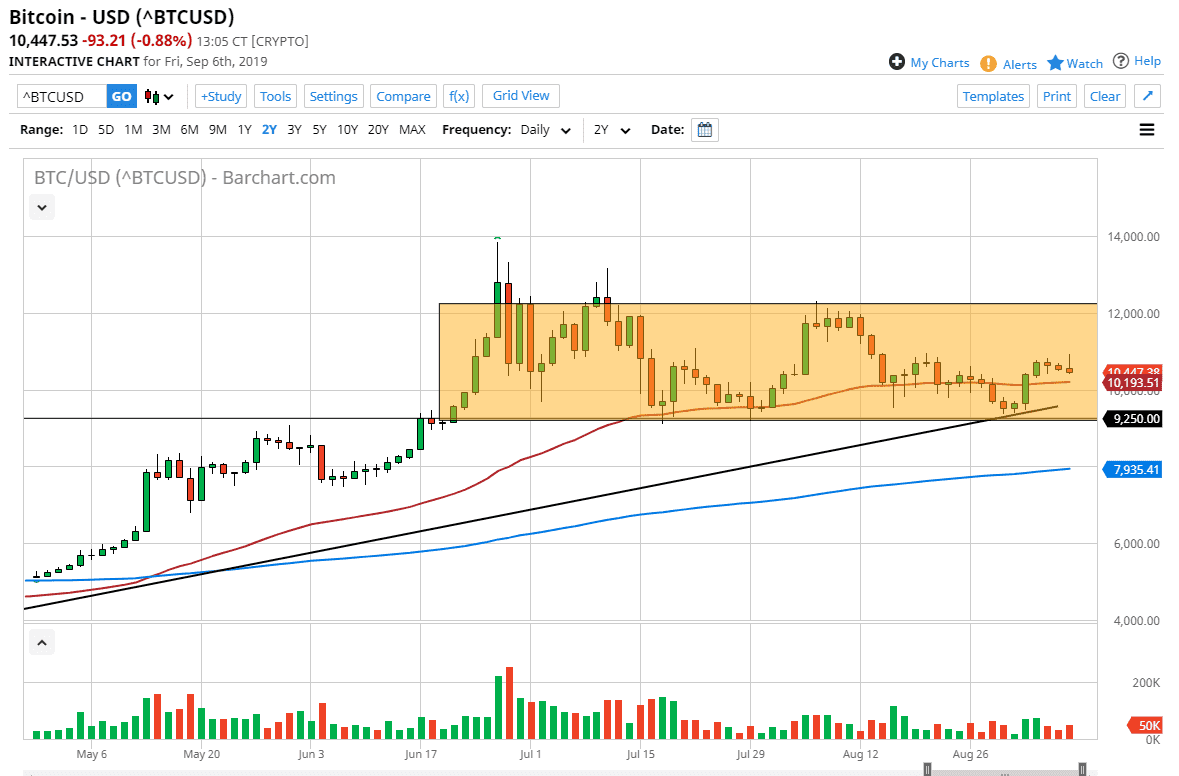

The Bitcoin market continues to be very choppy and sideways, but at this point we initially tried to rally during the day on Friday but has given back some of the gains later in the day. We are currently dancing around the 50 day EMA, which is currently trading at the $10,192 level. At this point, it’s likely that we will continue to find plenty of buyers underneath, especially at the uptrend line that is marked on the chart and then of course the $9250 level.

Ultimately, we are consolidating between the $9250 level on the bottom and the $12,000 level on the top. We are very likely to continue to find buyers in this area, so as long as we can stay above the $9250 level is time to start buying on little bounces. After all, money has been flowing into the Bitcoin market as a way to protect wealth in various hotspots around the world over the last several months. Venezuela has purchased more Bitcoin this year than ever, and we are starting to see similar volume in places such as China and Hong Kong, despite the fact that there are capital controls going on in that country.

Looking at this chart, we have been going sideways for some time but that is actually a healthy sign considering that we have gained so much previously. At this point, it’s likely that we continue to try to build more buying pressure in this area, and the fact that we are comfortable here is a very good sign. At this point, if we can break above the $12,000 level it’s likely that we could run all the way to the $14,750 level, which makes quite a bit of sense considering it is so close to the $15,000 level that will obviously attract a lot of attention.

If we do break down, I believe the 200 day EMA underneath will attract a lot of attention near the $8000 level. If we were to break down below there then the uptrend is over and we could go much lower. The volatility is going to continue to be a mainstay of this market but that’s nothing new for anybody who has ever traded Bitcoin. It looks healthy, although it looks as if it is taking its time and simply trying to consolidate and digest the gains so that we can go much higher.