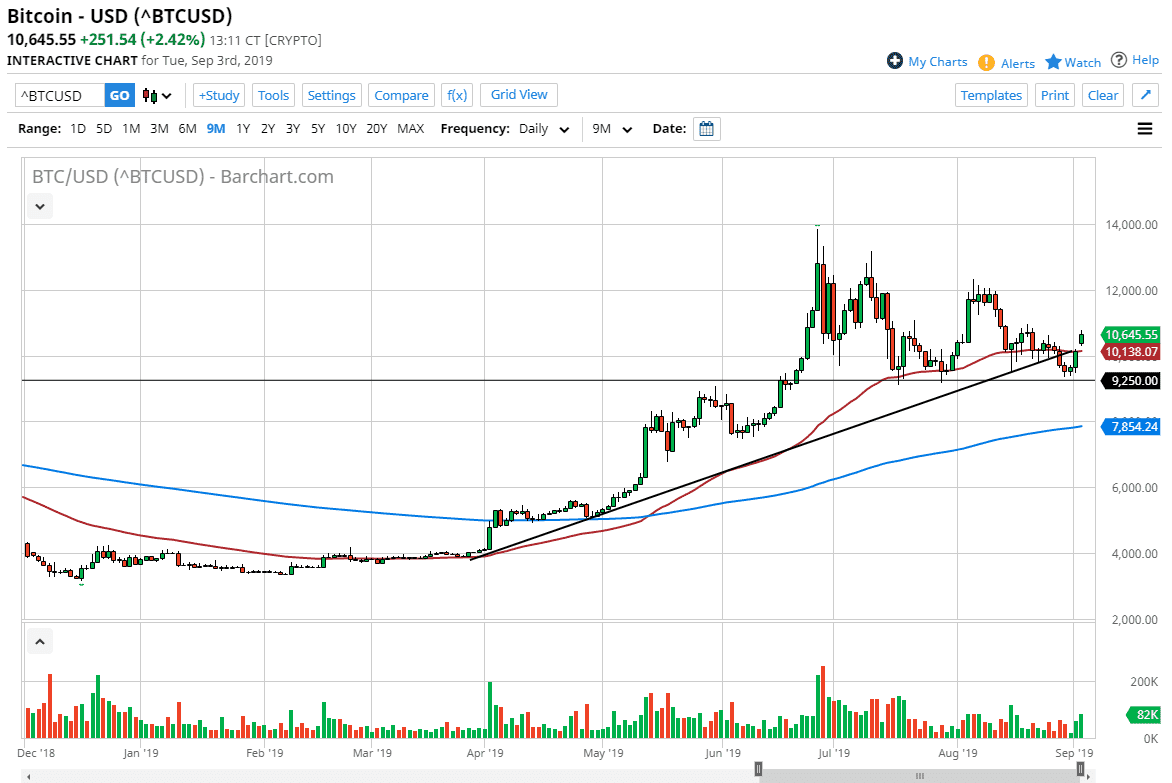

The bitcoin market rallied significantly during the trading session on Tuesday as traders came back to work. At this point, it’s obviously a very bullish market, and the fact that we have gapped higher to kick off the session shows a lot of faith in Bitcoin at this point. Ultimately, when I look at this chart the fact that we gapped and jumped above the previous uptrend line is a very bullish sign. It simply means that the sellers have failed to break this market down.

Beyond that, the 50 day EMA is now below current pricing, so it makes quite a bit of sense that some longer-term traders will be attracted to this market. When I look at this chart, now that we have recovered that trend line it’s obvious that the $9250 level offered significant support as it had in the past. At this point, when you look at the market it’s very likely that we are entering a significant consolidation phase, or at least extending the one that we had been in. If that’s going to be the case, then it’s likely that we are going to go towards the $12,000 level above which should be massive resistance. Having said that, it is also very likely to be a target of interest as it has been tested several times in the past.

I look at this chart, I recognize that a pullback could very well, but I think that the $9250 level should continue to be the “floor” in the market, and therefore I think as long as we can stay above that level we are probably going to attract quite a bit of buying pressure. Beyond that, we are starting to see a lot of money flow out of specific countries and into the Bitcoin markets. Places such as Venezuela are sending record amounts of volume into the market, as people are trying to protect what will they do have left. At this point, I think it’s going to be difficult to break above the $12,000 level but if we did we could see another leg higher. Regardless, over the next several days I expect to see buyers come into this market every time it pulls back. If we were to turn around and break down below the $9250 level, then we could see a move towards the blue 200 day EMA which is currently just below the $8000 level.