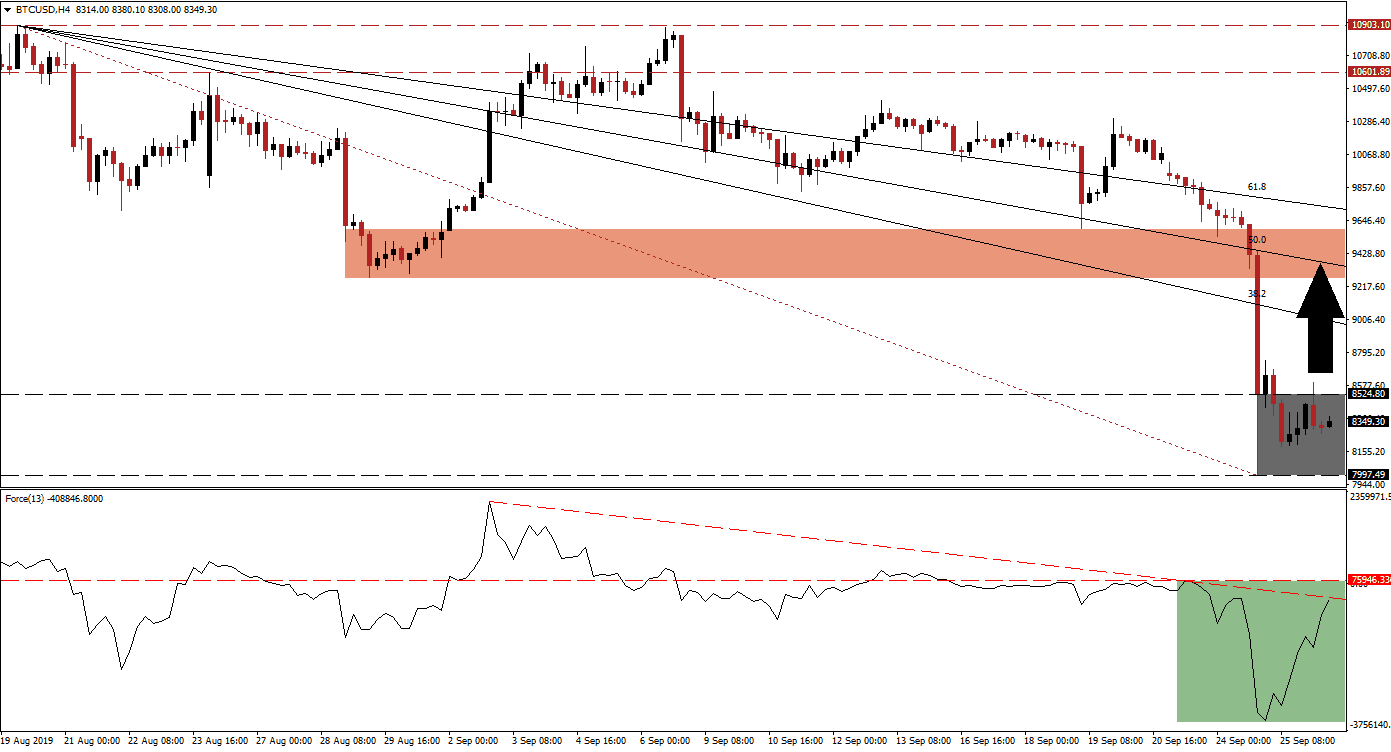

On Monday the Bakkt physically-backed futures contracted started to trade and received a lackluster welcome with depressed trading volume. On the same day the Bitcoin hashrate experienced a flash crash which dropped it by over 40% before recovering. This preceded the massive sell-off in BTC/USD which quickly took it below its resistance zone and through its entire Fibonacci Retracement Fan sequence, turning it from support into resistance. Price action has now paused inside its support zone with the descending 38.2 Fibonacci Retracement Fan Resistance level approaching.

The Force Index, a next generation technical indicator, confirmed the strong sell-off with a plunge to a new low from which a quick reversal emerged as price action started to stabilize inside of its support zone. The descend took the Force Index below its horizontal support level, turning it into resistance; a descending resistance level was also formed and this technical indicator currently remains below both. This is marked by the green rectangle in the chart. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

As price action is starting a sideways trend inside its support zone, located between $7,997.49 and $8,524.80 which is marked by the grey rectangle, bearish pressures are easing on the BTC/USD. The strong sell-off has made this cryptocurrency ripe for a short-term counter-trend reversal, especially with the recovery in the Force Index which could take it above its descending resistance level. The intra-day high of $8,599.90 should be watched closely. It represents a lower high its previous intra-day high of $8,738.63, both marked peaks before reversing.

A series of lower lows inside the support zone suggests that a price action reversal is possible, if the Force Index continues to advance. A breakout above its support zone can take BTC/USD above its 38.2 Fibonacci Retracement Fan Resistance level and back into its short-term resistance zone. This zone is located between $9,275.57 and $9,592.19 which is marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance level is passing through this zone with the 61.8 Fibonacci Retracement Fan Resistance level closing in on the top range. A move into this short-term resistance zone will keep the downtrend intact while a breakout above this level would require a fundamental catalysts. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

BTC/USD Technical Trading Set-Up - Short-Term Reversal Scenario

Long Entry @ $8,325.00

Take Profit @ $9,425.00

Stop Loss @ $7,950.00

Upside Potential: 110,000 pips

Downside Risk: 37,500 pips

Risk/Reward Ratio: 2.93

Should the Force Index fail to push through resistance, BTC/USD will be exposed to the potential of a new breakdown which could close a previous price gap to the upside. The next support zone is located between $6,550.99 and $7,121.41. Unless the long-term downtrend will be invalidated, price action may extend its losses into this support zone. The current technical picture favors a short-term reversal before resuming the sell-off.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ $7,850.00

Take Profit @ $7,125.00

Stop Loss @ $8,150.00

Downside Potential: 72,500 pips

Upside Risk: 30,000 pips

Risk/Reward Ratio: 2.42