At the beginning of this week, the EUR/USD is trying not to break below the 1.0900 psychological support to avoid further downside pressure. The pair is stable around 1.0936 at the time of writing. Besides the economic slowdown in the Eurozone, we have seen disagreement among ECB officials over the renewal of asset purchases after they were terminated at the end of last year. The German representative resigned from the ECB's executive directors list, which is a surprise. The ECB's recent decision to reactivate its asset purchase program has been controversial. According to reports, the French joined the Germans, Dutch, Austrians and Estonians, who objected to the purchase of assets from the beginning. Draghi was clearly asked about the dispute at his press conference and admitted that it was the only action which was disputed.

The main data for the Euro this week is the inflation and retail sales figures for September. Inflation performance sets European Central Bank interest rates, which are highly correlated with currency strength, and inflation is expected to remain unchanged at 1.0% in September, with core inflation - which excludes volatile energy and food items - expected to rise to 1.0% from 0.9%. If inflation rises more than expected, it will support the Euro, but if it falls more than expected, it will weaken the currency. Low interest rates are negative for the currency because they make them less attractive to foreign investors. Retail sales are expected to show a 0.3% increase from -0.6% previously.

The dollar will remain cautious awaiting the official US job numbers by the end of this week.

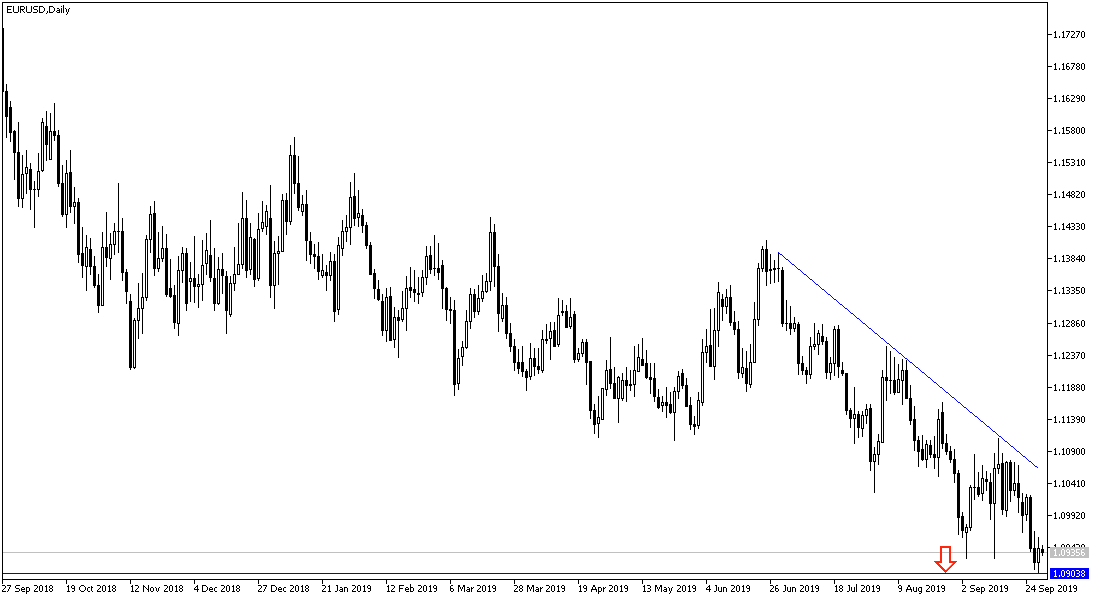

According to the technical analysis of the pair: As per our expectations, the general trend is still bearish, and if the price of the EUR/USD pair succeeds in breaching the 1.0900 psychological support, the sell-off may increase, and consequently the pair can move down to the support levels at 1.0865, 1.0780 and 1.0700 respectively . Traders are ignoring technical indicators reaching oversold areas, as the economic situation of the Eurozone, especially from Germany, is still a factor supporting the Euro’s losses for a longer period. In case of a correction to the upside, the pair should return above the 1.1000 resistance.

On the economic data front: The economic calendar from the euro zone will focus on German retail sales, consumer prices from Spain and Germany and the change in German unemployment along with the unemployment rate in the Eurozone. From the US, there be the PMI data from Chicago.