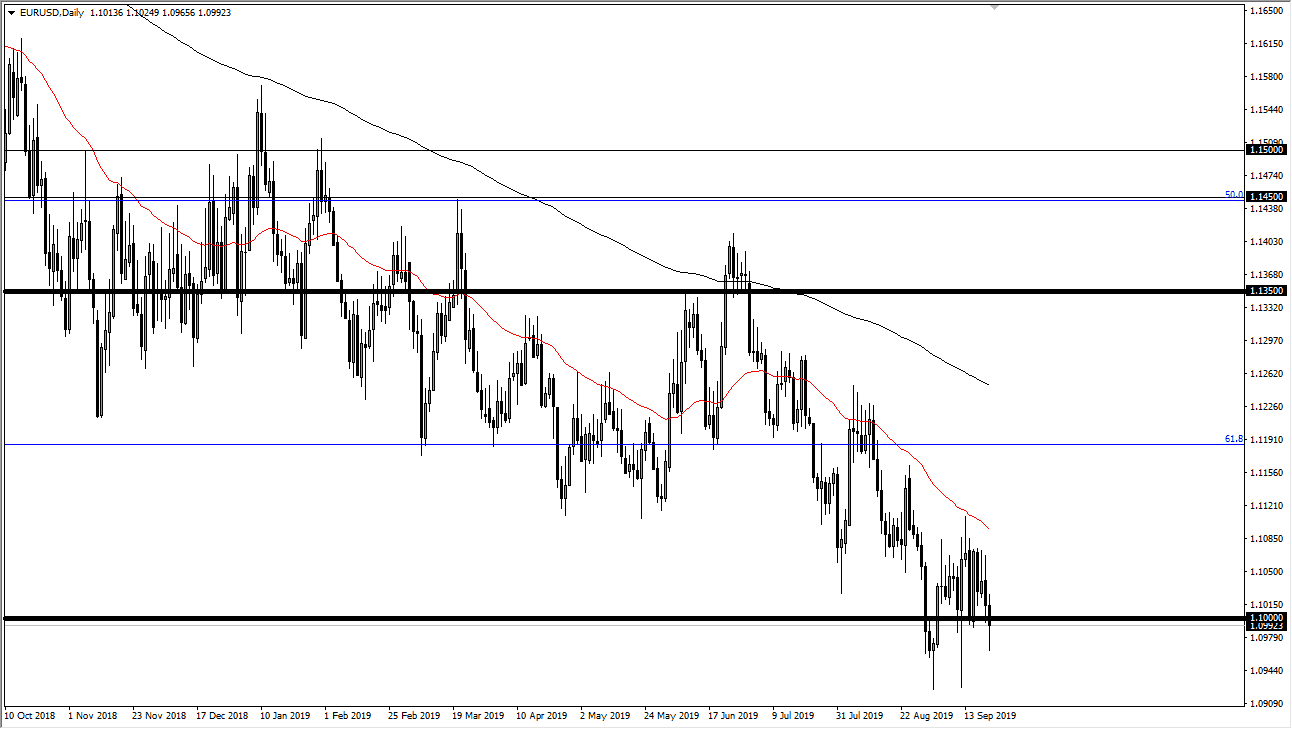

The Euro has fallen a bit during the trading session on Monday, slicing through the 1.10 EUR level in the process. The market has bounced since then, as we continue to go back and forth and consolidate in this general vicinity. The Euro continues to struggle quite a bit, as the economic numbers coming out of both Germany and France earlier in the morning was very negative. Ultimately, this is a market that is in a major downtrend, but it is a very choppy market to say the least.

The 1.10 EUR level of course attracts a lot of attention, and so will the 50 day EMA above which is painted in red. If that gets tested again, it’s very likely that the sellers will come back in and push to the downside. It’s hard to imagine a scenario where the market suddenly changes its attitude, even if we do get some type of nice bounce. Ultimately, this is a market that has been chopping with a downward bend to it for ages now. If we continue to drop from here, we will eventually break down to a fresh, new low, sending the market to even lower levels.

The Fibonacci retracement level that we have recently tested, the 61.8% Fibonacci retracement level, has in fact held as resistance. The market typically will go to the 100% Fibonacci retracement level once that levels broken, which means that we should be aiming for the 1.0450 level. That doesn’t mean that it’s going to happen overnight, but it is a longer-term trade. That being said, this is a very choppy situation where the market has been grinding away to the downside, not necessarily breaking down. In fact, it’s essentially a short-term “day traders market”, meaning that you should be selling short-term rallies to take advantage of the overall attitude. As far as selling and holding is concerned, it would be very difficult to do, simply because of all of the choppiness involved.

The US dollar continues to be bid up due to safety, and of course the fact that Germany could be heading into a recession, while on the Italians are essentially there now. With poor economic numbers coming out earlier in the day, obviously nothing has come out to change the attitude. Beyond that, there’s also the Brexit going on which will certainly have an effect on the EU as well, making the US dollar more attractive.