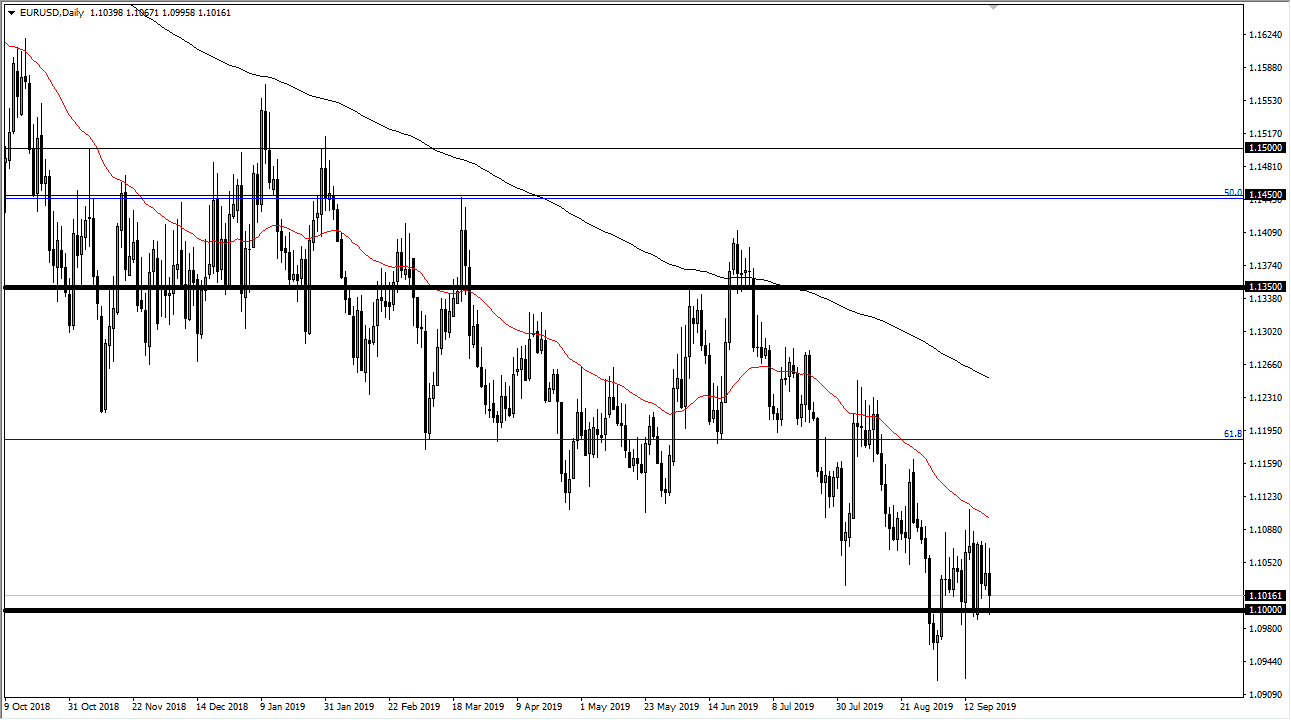

The Euro went back and forth during the trading session on Friday as we continue to see a lot of choppiness overall. While we are in a longer-term downtrend, you can see that the downtrend hasn’t exactly been a smooth and rapid one. In fact, we haven’t had a significant run lower in any one shot since about 18 months ago. With that being the case, it makes sense that we will continue to see an overall chop with a negative bias. We certainly have seen that over the last couple of sessions, so I think it’s only a matter time before rallies continue to get sold off.

The 1.10 EUR level underneath of course will offer certain amount of psychological support but we have sliced through it a couple of times. It doesn’t mean that there will be some type of pushback at the 1.10 EUR level, because certainly we had seen that during the day on Friday. However, as it has given way a couple of times it’s only a matter of time before traders are comfortable below that level and then finally take out the 1.09 level. In fact, when you look at the Fibonacci retracement studies, it makes sense that we do break down below there and go to much lower levels.

The 61.8% Fibonacci retracement level is close to the 1.12 level, and as long as we remain below there it is a very bearish market to say the least. In fact, it’s likely that the market will continue to grind its way towards the 100% Fibonacci retracement level which is closer to the 1.04 EUR region. I continue to see this as an opportunity to short this market every time it rallies. Ultimately, this is a market that offers plenty of nice short-term trading opportunities, but longer-term trading is a bit difficult to simply because it takes far too much patience to make a significant profit. This is without a doubt the domain of short-term day trading types of firms.

Beyond that, the Federal Reserve did cut rates but they are nowhere near as dovish as the European Central Bank, so it makes sense that this market continues to grind lower as there is a bit of a “race to the bottom” between Central banks around the world. This isn’t necessarily an easy trend to follow, but it is most certainly an obvious trend.