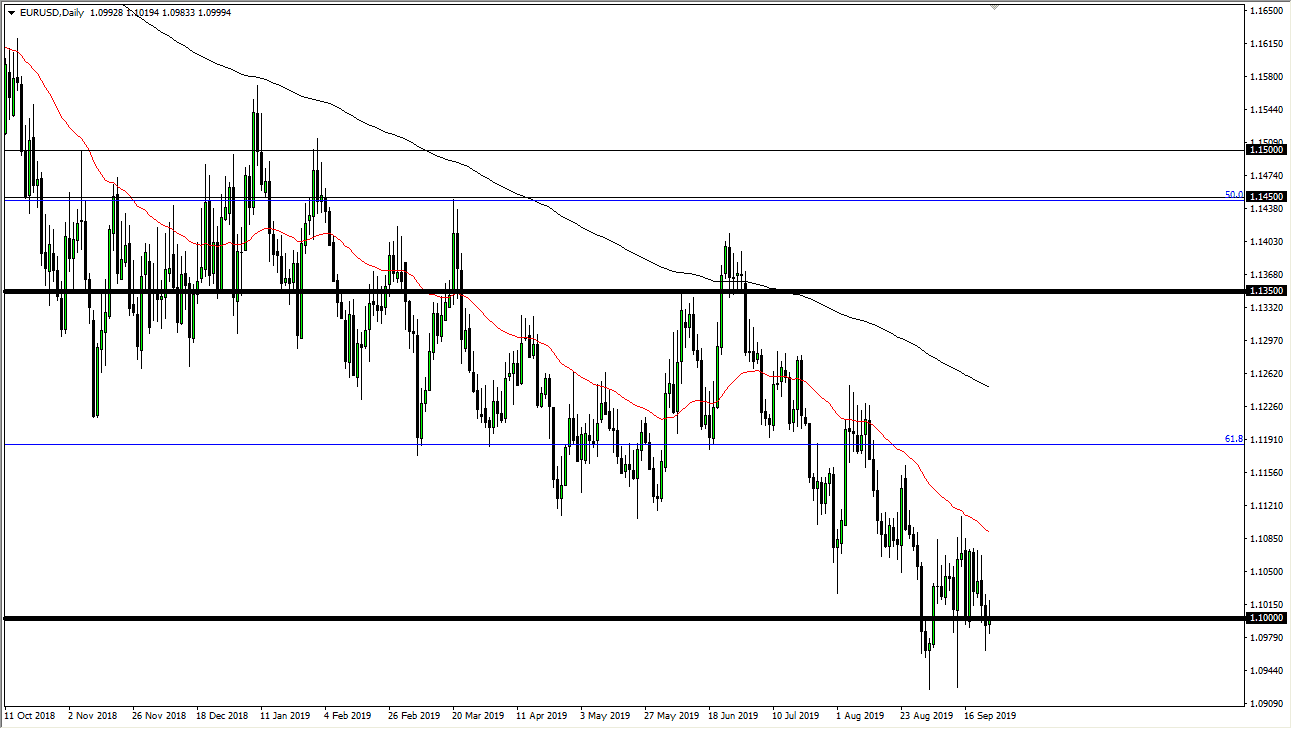

The Euro has gone back and forth during the trading session on Tuesday, as we continue to dance around the 1.10 EUR level. This is an area that obviously is a large, round, psychologically significant figure, and therefore it makes quite a bit of sense that we would see a huge struggle here. That being said though, it has been very choppy and back and forth recently, and I don’t see anything on this chart that tells me it’s going to be different.

The 50 day EMA is above the recent consolidation and choppiness, and it should be considered the “ceiling” in the market currently. Rallies at this point should continue to find plenty of sellers at the first signs of exhaustion, as we have been in a downtrend for quite some time. Longer-term, this has been a choppy and messy pair that drifts to the downside. All things being equal it’s likely that the sellers will return as we have seen over the last 18 months or so. This has been a choppy grind lower though, so don’t expect it to be easy to hang onto a short selling position. In fact, I prefer to simply sell short-term rallies for small gains.

To the downside, the 1.09 EUR level is support, and if we can break down below that level it’s likely that we could go much lower. The 61.8% Fibonacci retracement level has been broken below rather significantly, and therefore it’s likely that we go to the 100% Fibonacci retracement level which is just underneath the 1.05 EUR level. This doesn’t mean that we get there overnight though, and I think it’s going to take some time to get there.

However, with Germany going into recession or at least very close to it, Italy already there, and at the same time a lot of questions and concerns about the Brexit going on, it makes sense that the Euro will continue to struggle. On the other side of the equation is the US dollar, which of course continues to attract a lot of flow in a scenario where there is a lot of “risk off” out there. The US Treasury market continues to attract a lot of attention, and of course the US dollar is the currency you need to invest in the United States overall. While the rest of the world’s stock markets have been struggling, traders continue to find refuge in America. This is yet another reason why this market continues to grind lower. I sell rallies.