The Euro has been all over the place during the trading session on Thursday as the ECB had a press conference and interest rate decision. The central bank of course cut rates by 10 bps and added more quantitative easing. However, the quantitative easing can’t go on forever if it is the follow the structure demands of the European Union. In other words, this was probably a little less impressive than a lot of traders thought. Because of this we have seen a bit of a bounce but at the end of the day it’s very unlikely that the Euro catches a major bit higher, simply because it is representative of an economy that is struggling to say the least.

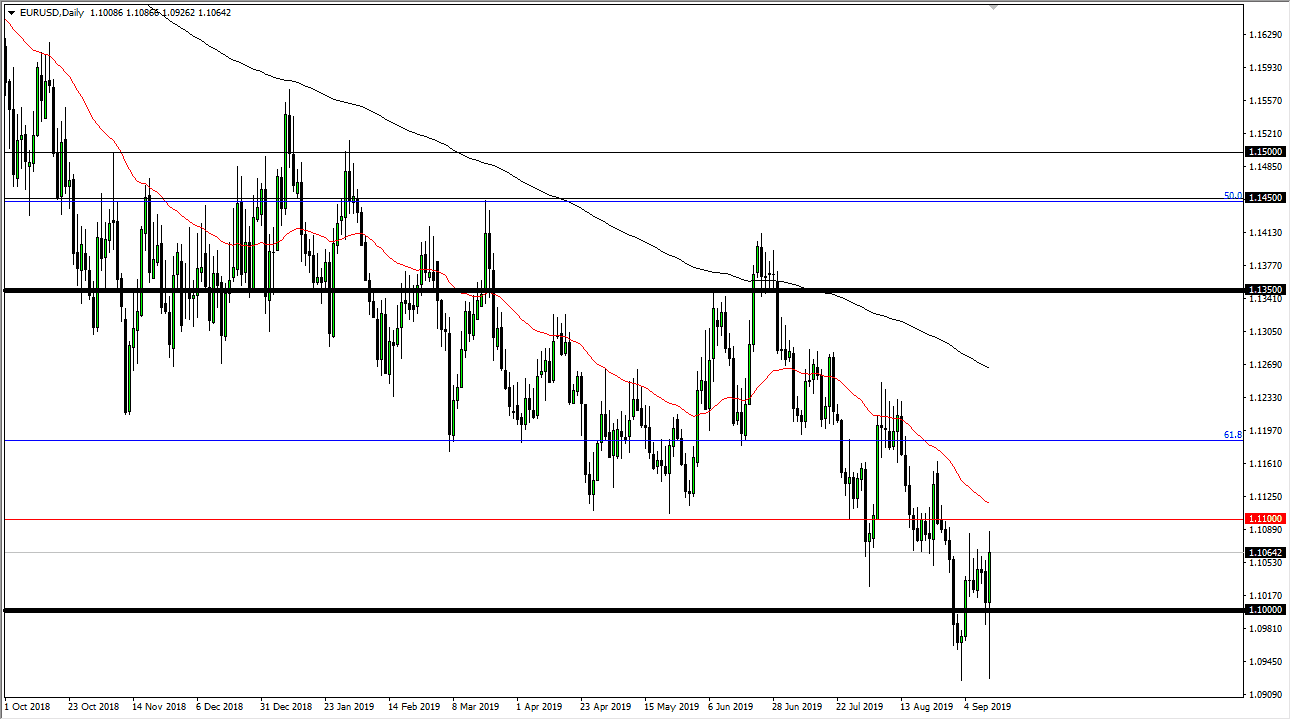

The market is now turning its attention to the Federal Reserve, and the next question will be how much will they cut? All things being equal, this is a market that will continue to chop around the slowly downward attitude, just as it has for two years. This is simply a market that is a chop fest so you look for short-term opportunities at best. To the upside the 1.11 EUR level is resistance, which is also backed by the 50 day EMA. That being the case it’s only a matter time before the sellers come back in and push this market lower towards the 1.10 EUR level. Even below there the market could go down to the 1.08 EUR level, and beyond. The market is lower than the 61.8% Fibonacci retracement level so it’s likely that we will then go down to the 100% Fibonacci retracement level.

All things being equal it’s very unlikely that we see any cohesive move in one direction or the other, and at this point nothing seems to have changed. Obviously, next week will focus on the Federal Reserve but once we get past that there is in a whole lot to move the market. Fading short-term rallies are a nice way to play this market, as it continues to be profitable but it’s very unlikely to give us a massive move anytime soon. The Euro continues to weaken, but at this point it’s very difficult to jump “all in” when markets are this noisy. Most of the time, I use this chart to tell me what to do with the EUR/JPY pair or perhaps even the EUR/CAD pair.