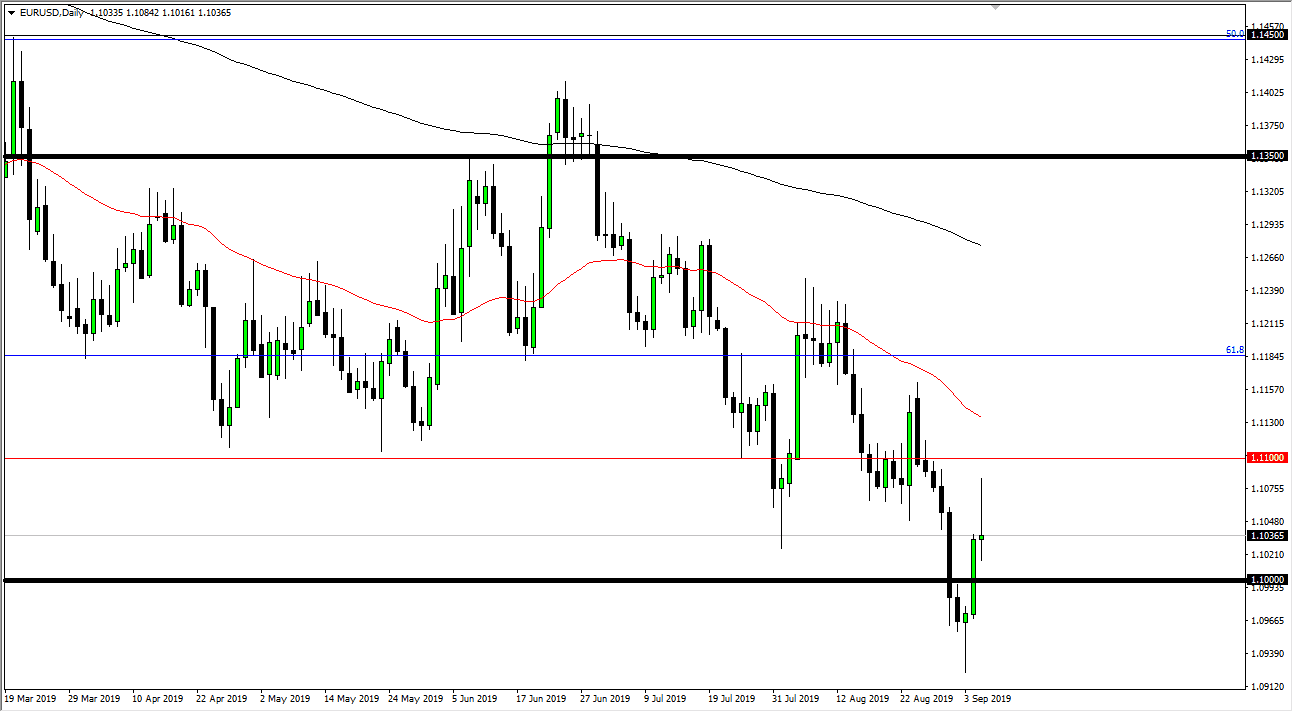

The Euro shot higher during the trading session on Thursday, reaching towards the 1.11 EUR level before rolling over again. By forming a nasty shooting star for the trading session on Thursday, it looks as if the Euro will not be finding enough bullish pressure to make it go higher. At this point, it’s very likely that we should reenter the 1.10 range, and therefore I think it’s only a matter of time before we fall even further.

Beyond that, we also have the jobs number coming out on Friday and that of course will offer a lot of volatility in not only this pair, but anything involving the US dollar. Ultimately, we are in a downtrend so it makes quite a bit of sense that we will continue to see selling pressure going forward. I think ultimately we are going to see a lot of downward momentum to send this market to the lows again, and perhaps even lower than that. That being said though, if we were to turn around and rally, breaking above the top of the candle stick would be the first barrier for buyers to overcome. After that, we would be looking at the 50 day EMA, which should cause quite a bit of resistance as well.

All things being equal, this is a market that is being traded on longer-term fundamentals, namely the fact that Germany is entering a recession and of course the EU offers negative yielding bonds. If that’s going to continue to be the case it’s very likely that the US dollar will continue to attract a lot of attention. After all, you get yield on US bonds while $17 trillion worth of sovereign debt around the world offers negative yield. That helps the greenback strengthen, something that unfortunately most Forex traders to pay attention to. The bond market is crucial and leads everything else.

Looking at the chart, I recognize that the area below the 1.10 level is very sticky and difficult to get through, but clearly rallies still continue to attract a lot of selling pressure in that by its very nature suggests that we should go lower given enough time. I don’t have any interest in buying right now, at least not until we break above the 50 day EMA with a daily close, something that we have not done for a while.