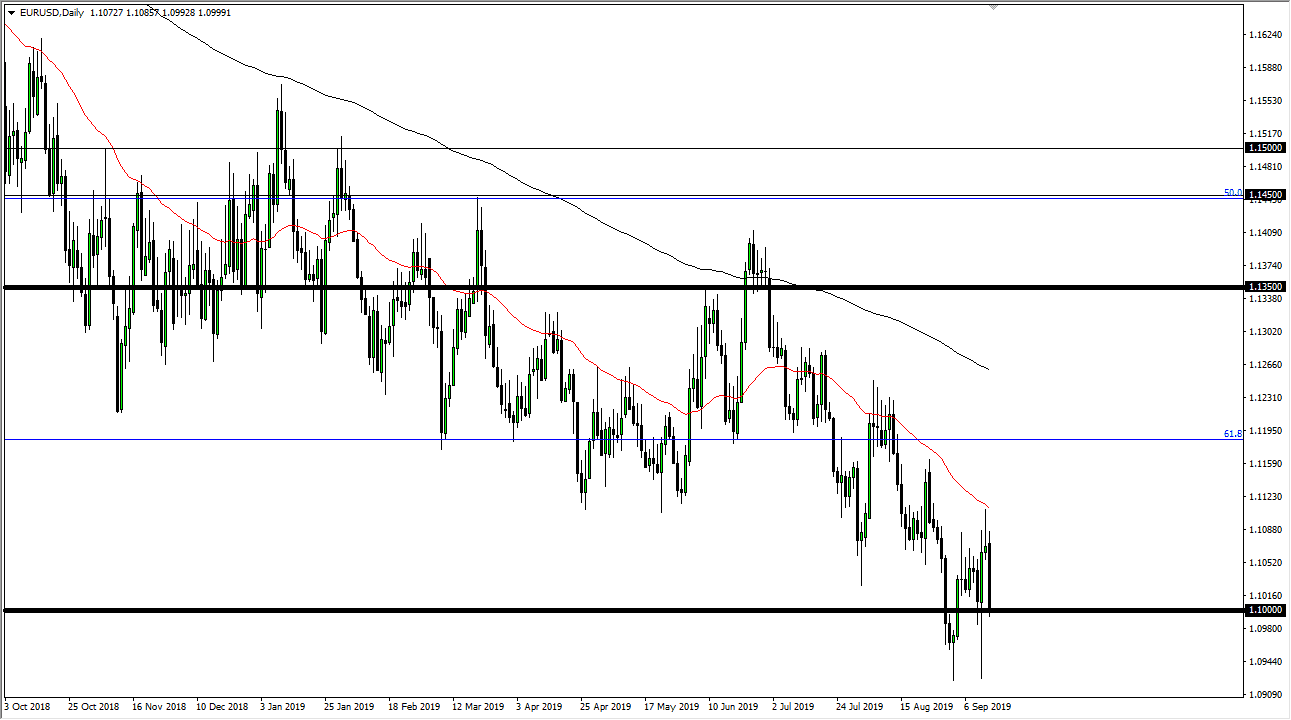

The Euro initially tried to rally during the trading session on Monday but then broke down rather significantly to crash into the 1.10 EUR level. At this point, we already had a bit of negativity anyway, as we formed a shooting star to close out the previous session. With that, the 50 day EMA continues to cause significant bearish pressure and we are without a doubt in a very significant downtrend. All things being equal it looks very likely that we are going to go down towards the 1.09 EUR level eventually, and the huge trend that has been very negative makes it even more likely in my opinion.

This doesn’t mean that we go straight there, but obviously short-term rally should be sold as the market has been so negative for the long term, although choppy. Looking at this chart, we are well below the 61.8% Fibonacci retracement level and it should send this market down to the 100% Fibonacci retracement level which is closer to the 1.04 EUR level longer-term. With this being the case, and the fact that we have such a huge negative candle stick, tells me that this is a very strong negative trend.

Expect a lot of choppiness, but that’s typical for the Euro, as the market continues to simply behave as it always has, choppy and erratic. There is a longer-term trend that is very much in play but longer-term traders struggle with all of this noise. However, short-term traders do quite well when they fade rallies in this trend. It’s a matter of managing expectations, as you are not necessarily looking for massive moves, unless of course you are willing to hang on for several months. To the upside, the 50 day EMA should continue to be a bit of a “ceiling”, but if we were to break above that then the market probably goes towards the 1.12 level after that, possibly even the 200 day EMA which is painted in black on the chart. With that, I’m looking for signs of exhaustion to take advantage of on short-term charts. The market breaking below the 1.09 EUR level would unleash fresh shorts, but at this point it’s very likely to take a lot of patience to make big gains. Short-term day trading the EUR/USD pair tends to be the best way to deal with it, especially if you go with the longer-term negative trend.