The Euro initially fell during the trading session on Tuesday, reaching towards the 1.0925 level before turning around and rallying. Part of this may be due to a lessening chance of a “no deal Brexit” according to whatever is going on in the British Parliament at the moment, which is far too convoluted to go through. There’s also the possibility that the Italian politicians are ready to form a government helps the Euro, but at this point I think it’s only a matter of time before we see sellers come back into this market, because there are a huge laundry list of problems facing the European Union going forward.

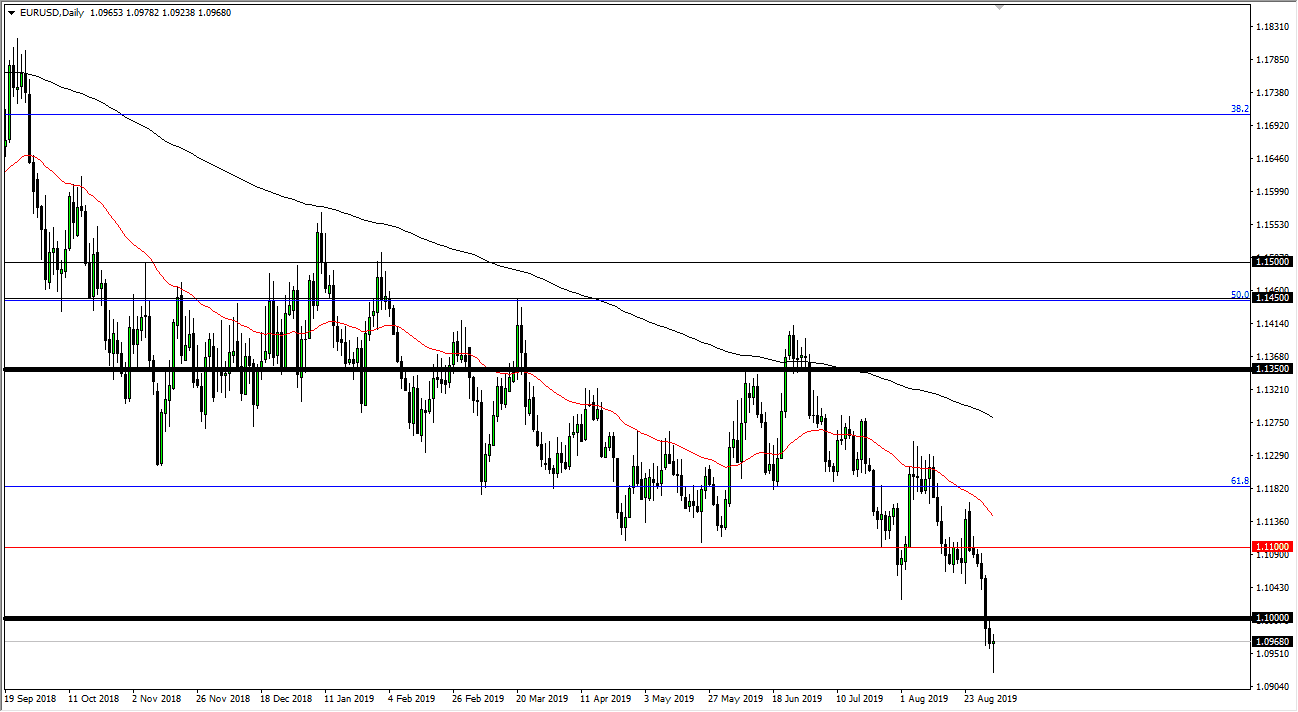

A bounce makes a certain amount of sense though, because we are oversold. Even if we break above the 1.10 EUR level, it’s very likely that we will find plenty of resistance above. This is especially true near the 1.11 EUR level, assuming we even get there. I think at this point fading rallies continues to work because breaking through the 1.10 EUR level was a big deal. Breaking below the bottom of the candle stick for the day on Tuesday would also be a sell signal. I don’t really have a buying signal quite yet, but I would have to stand up and take notice if we broke above the red 50 day EMA on the chart.

While I recognize that the European Central Bank is likely to loosen monetary policy even further going forward, the reality is that the interest rate differential may not widen as much as initially thought. However, Germany is entering a recession and that is a major driver of what goes on in the European Union. With that in mind, it’s difficult to imagine a scenario where the Euro takes off to the upside for any significant amount of time. In fact, you can also make an argument through Fibonacci trading that we should go down to roughly 1.05 EUR, because that’s the 100% Fibonacci retracement level of the entire big move. We have recently broken through the 61.8% Fibonacci retracement level and found it to be resistive near the 1.12 level, so I think we still have quite a bit of downward pressure. Some people are calling for parity, I don’t know if it goes that far but clearly the pressure is still on the downside.