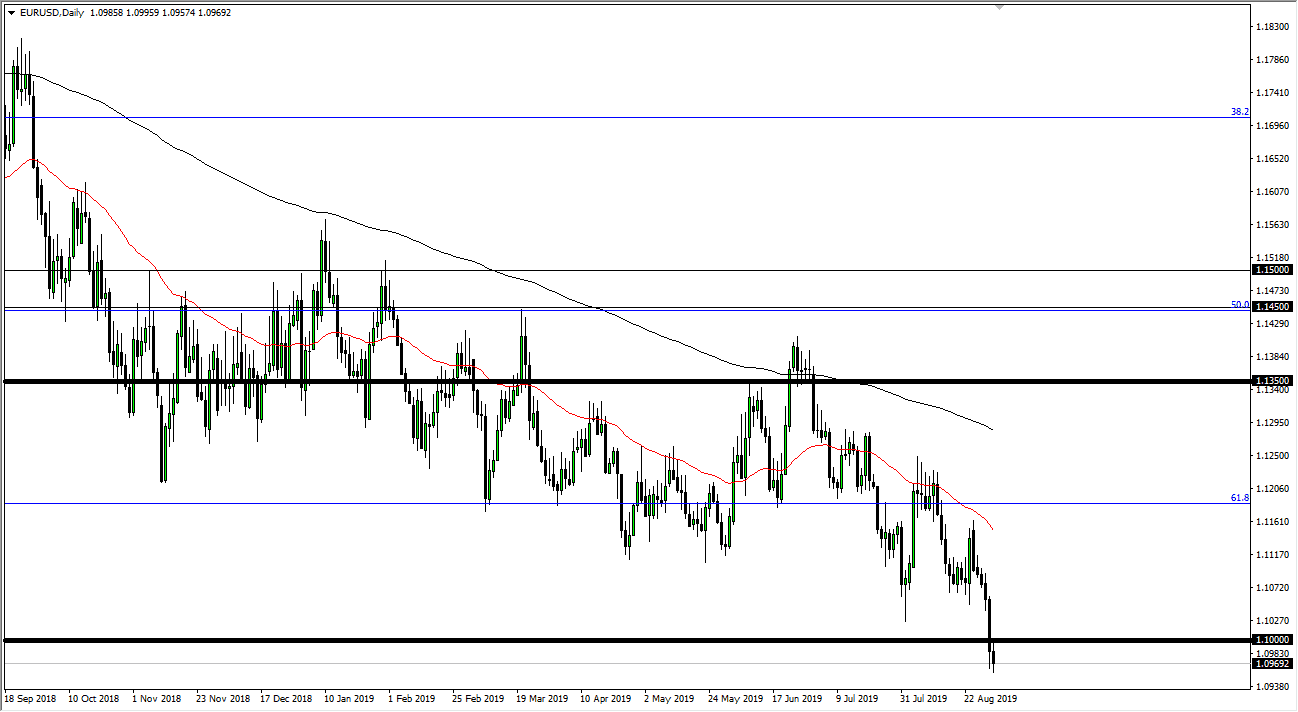

The Euro has initially tried to rally during the trading session on Monday but found enough resistance at the 1.10 level to turn things around and sell off yet again. At this point, the market is likely to continue to go much lower, perhaps reaching down towards the lower levels underneath, and opening up the possibility of reaching down to the 100% Fibonacci retracement level. We are well below the 61.8% Fibonacci retracement level, so it makes quite a bit of sense that we will finish out this move. That opens up the idea of the 1.05 level going forward.

Rallies at this point should be sold, and I think that the 1.1075 level is the beginning of major resistance. Beyond that, we also have the 50 day EMA just above causing significant resistance, and at this point I think there are plenty of reasons to think that rallies will be treated with suspicion. The technical set up at this chart is horrible, but beyond that we also have plenty of fundamental reasons to think that the Euro should continue to struggle anyway.

Germany is enduring a recession, and the European Central Bank is likely to loosen monetary policy going forward. With the ECB looking to loosen monetary policy, that will continue to have a lot of money flowing towards the United States as people will prefer the positive yields in the bond markets coming out of the United States as opposed to the European bonds which offered negative yields. Negative rates are extraordinarily destructive to investment, and more importantly saving. I believe at this point it’s very likely that the market continues to be very noisy, but most certainly very negative. I have no interest in trying to buy the Euro anytime soon, at least not until we get a daily close above the red 50 day EMA which seems to be very unlikely to happen. If that did happen, I think that we could go to the upside. That being said, I think that a break down below the candle stick for the Monday session could be another reason to start selling as it would signify even more bearish pressure. I think there is a lot of a “risk off” attitude out there, and if that’s going to be the case I think the US dollar will probably continue to benefit from this.