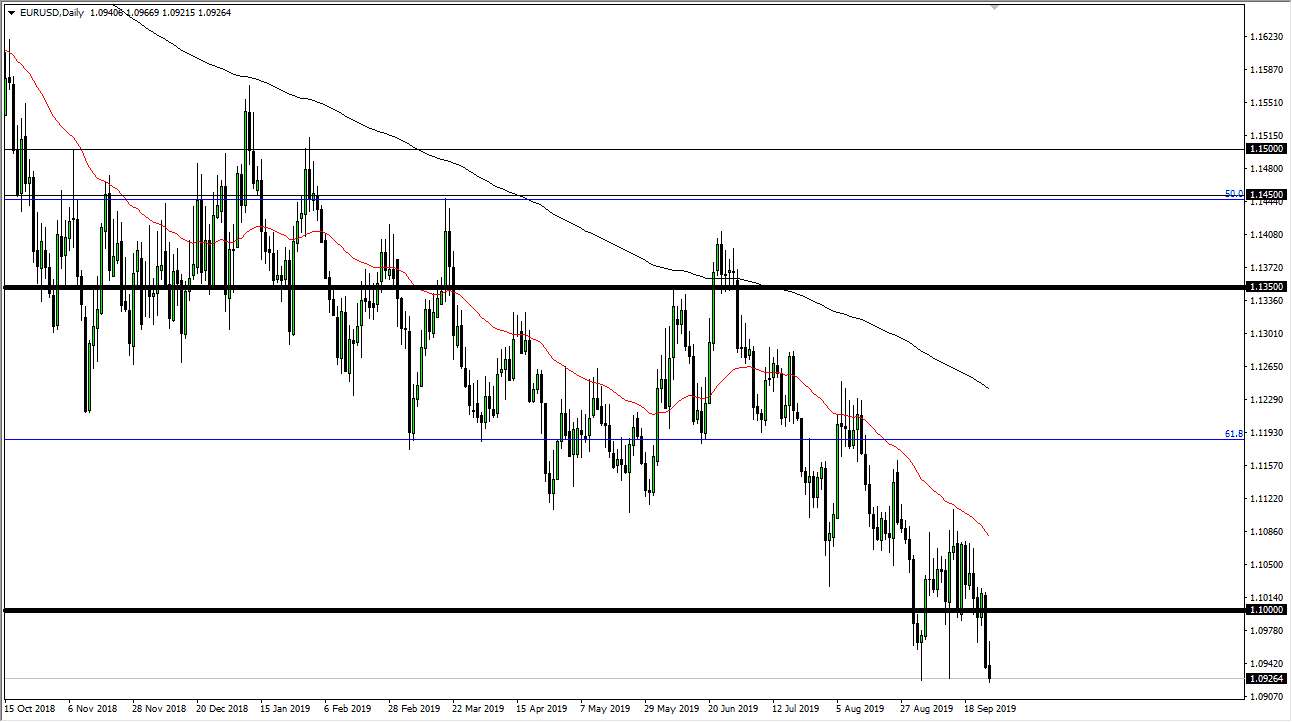

The Euro initially tried to rally during the trading session on Thursday but then rolled over again to reach towards the bottom again. That being the case, the market looks as if it is going to test the 1.09 level, which is an area that has offered support previously. The fact that the market has closed towards the bottom of this level instead of bouncing like we have seen over the previous couple of times, it’s likely that the market is ready to break through. At this point, it’s only a matter time before the Euro breaks down due to the interest rate differential at the very least.

Remember, most of the European Union bonds out there now pay negative yields, and therefore it’s logical that money would flow to the United States as the bonds in America still offer yield. Beyond that, the Euro also has to worry with the prospect of Germany heading into a recession, and quite frankly the Italians are already there. If that’s going to be the case and not to mention the fact that there are so many zombie banks in the European Union, money is running from the continent rather quickly.

There is also a major problem with the Brexit, as it is still a complete mess. After all, one of the largest economies in the European Union is going to leave one way or another, and that obviously is going to hurt. Just above, the 1.10 EUR level should offer resistance, just as the 50 day EMA above should. All things being equal I believe that selling signs of exhaustion continue to work, just as a break down below the 1.09 level would be. Longer-term, the market is likely to continue to go looking towards the 100% Fibonacci retracement level, as we are well below the 61.8% Fibonacci retracement level. At this point, the market could be looking at a move down to the 1.0450 level eventually. That doesn’t mean we get there anytime soon, but it seems to be a scenario where we will continue to grind down there. Keep in mind that this pair has been grinding lower for 18 months or so, so quite frankly it wouldn’t be a huge surprise to see a simple continuation of that action. I continue to fade rallies, but I’m not looking for massive moves in short bursts.