EUR/USD continued to decline strongly reaching the 1.0937 level in light of the US dollar strength and increasing pressure on the single European currency from the continued weak economic performance of the Eurozone. Increasing calls for more stimulus plans by the European Central Bank to revive the economy of the bloc amid continuing external risks. Germany is leading the weakness, as shown in the results of recent economic indicators. We expected in recent technical analysis that the pair will complete the pace of decline by clearing the 1.1000 level.

US economic data is generally better than the Eurozone. Investors are increasingly buying the US currency despite expectations that the Federal Reserve may cut US interest rates at least once before the end of the year to counter the risks facing the US economy, most notably the prolonged trade dispute with China. The two sides showed no signs that they will agree to resolve the crisis that has plagued global economic growth and has been a major reason for the global central banks to ease monetary policy.

The pair will react strongly with awaited statements from the Federal Reserve Governor, Jerome Powell, and outgoing European Central Bank Governor, Mario Draghi, looking for strong evidence about the future of the two banks' policy for the rest of 2019.

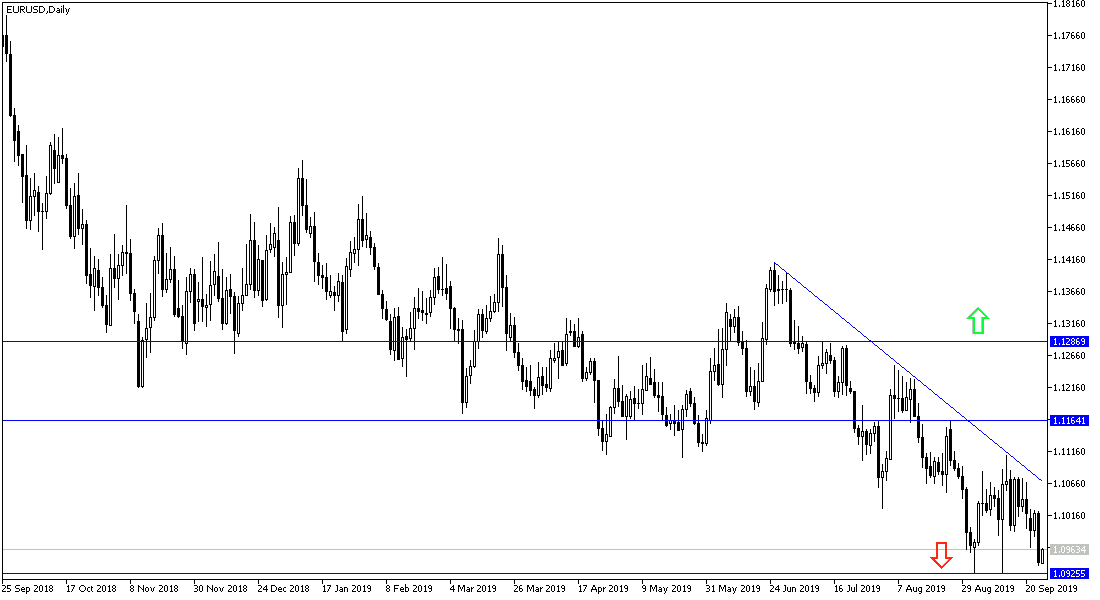

According to the technical analysis of the pair: The direction of the EUR / USD pair is still bearish, and the stability below the 1.1000 psychological support will support the rapid move towards stronger bearish levels. The pair is currently closest to testing its lowest level since May 2017. The drop will culminate in a test below 1.0900 support. On the daily chart, the EUR / USD is still in a strong bearish channel. Bears may target support at 1.0926 or 1.0832 or below at 1.0672. As we have previously stressed, there will be no chance for a bullish correction without testing the 1.1100 resistance level. Otherwise, pessimism will continue to dominate the EUR.

On the economic data front: Today's economic calendar will highlight the release of the German GFK Business Climate Index and the ECB's monthly report. Later, we will have statement by Governor Mario Draghi. From the United States, there will be the announcement of the most important figures; the country's GDP growth, jobless claims and pending home sales, followed by remarks by Federal Reserve Governor Jerome Powell.