Eurozone PMI data suggests that the region's economy is on the verge of deflation, which is likely to see further calls for stronger monetary policy moves from the ECB and consequently the Euro weaker for longer period. The Eurozone Manufacturing PMI came in at 45.6 in September, down from 47.0 in August and from 54.3 expected by economists. The decline in manufacturing was largely due to the ongoing slowdown in German manufacturing, as earlier data confirmed that the Eurozone's largest economy was in danger of falling into a technical recession. Therefore, it was normal for the EUR / USD to fall below the 1.1000 psychological support to the 1.0966 support, before settling around 1.0988 at the time of writing.

The Eurozone manufacturing sector is moving from bad to worse, suffering from a severe recession since 2012, but there are concerns that the service sector will also expand its vulnerability, said Chris Williamson, IHS Markit's chief business officer, since 2014: The survey details that risk indicate a shrinking economy in the coming months”.

Weak data supports expectations that the ECB will have to ease monetary policy again in December. We expect another rate cut and an expansion of the asset purchase program. A side effect of the ECB's moves is that the euro remains weaker for a longer time, so we will not see much chance of a quick recovery for the euro.

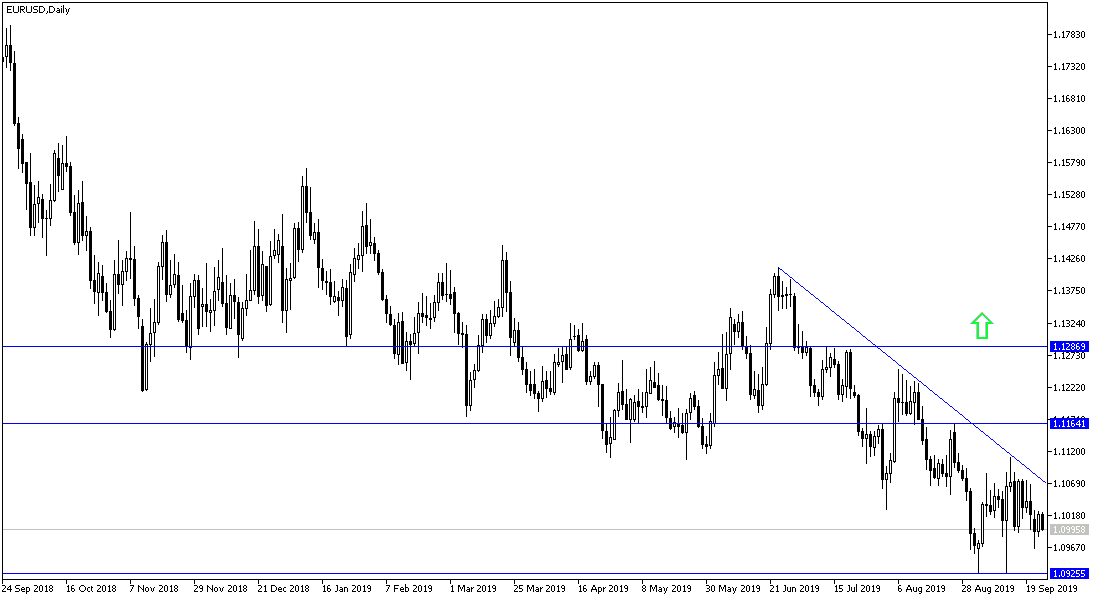

According to the technical analysis of the pair: The continuation of the move below 1.1000 level will continue to support the downward pressure on the performance of EUR / USD, and we may see support levels 1.0945, 1.0880 and 1.0790 respectively very soon. The poor performance of the economic data from the Eurozone will continue to support the pressure on the single European currency. On the upside, the pair will not have a strong opportunity to correct higher without moving above 1.1100 resistance. I still prefer to sell the pair from every bullish level.

On the economic data front: Today's economic calendar will focus on the release of the German IFO Business Climate Index. From the US, there is the Consumer Confidence and Richmond Industrial Index.