The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets.

Big Picture 8th September 2019

In my previous piece last week, I forecast the best trades would be long of XAG/USD following a daily close above $18.35, and short of EUR/JPY and NZD/JPY. The Silver trade worked out as a loss, as after closing at $18.44 on Monday, it ended the week down from there by 1.57%. Gold fell by 0.47%. The other trades were losers too, with EUR/JPY rising by 0.90% over the week, and NZD/JPY rising by 2.49% over the same period. These trades produced an averaged loss of 1.65%.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar, and the strongest fall in the relative value of the Japanese Yen.

Last week’s market was dominated by Dollar weakness and some strong reversals in trending markets, leading to a confusing picture in the Forex market. Much of the weakness in the Dollar was due to poorer than anticipated non-farm payrolls data released later Friday.

The truly notable market movement over the past week was the strong bullish reversal in the Australian Dollar, and to a lesser extent in the New Zealand Dollar. This was triggered by the Reserve Bank of Australia giving a more hawkish than expected policy guidance this month, in addition to passing on a possible further rate cut – the Australian interest rate is already at a record low.

The Forex market is seeing only one long-term trend persisting in good health right now, as the Euro continues to be sold every time it pulls back.

This week has less high impact news releases due compared to last week, but the Brexit and the U.S. / China trade dispute are likely to remain as the main market drivers. The U.S. inflation data due could also be important.

Fundamental Analysis & Market Sentiment

Fundamental analysis still sees the Federal Reserve as likely to cut rates by an additional two quarter-points over the next few months, although many economists believe only one cut is needed, or even no cuts at all.

The U.S. economy is still growing quite strongly, but there are increasing fears of a pending recession.

The British Pound has been boosted by a greater expectation that the British Parliament may be able to stop Brexit against the wishes of the government. As Parliament is also refusing to allow an election, they are forcing the Prime Minister into an impossible position and hanging him out to dry. It is hard to see how the Prime Minister can escape from this unless he has legal advice that Parliament’s instruction to him to request a Brexit delay cannot be lawfully enforced.

The increased risk-on sentiment in the market is likely to see money flow into the commodity currencies this week, while flowing out of safe havens such as precious metals and the Japanese Yen. The Euro and British Pound are currently being driven more by Brexit developments. The ECB will be giving input this week which could produce volatility or a trend reversal.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index fell, printing a normal-sized bearish candlestick which closed within the bottom quartile of its range. This is a mildly bearish sign. However, the price is still up over both 3 months and over 6 months, indicating a bullish trend. The nearby support at 12364 has also continued to hold up. Overall, the odds are slightly in favour of a continuing Dollar advance, yet the greenback is likely to open weaker as the U.S. economy is seen as weaker and more prone to rate cuts following last week’s disappointing NFP data.

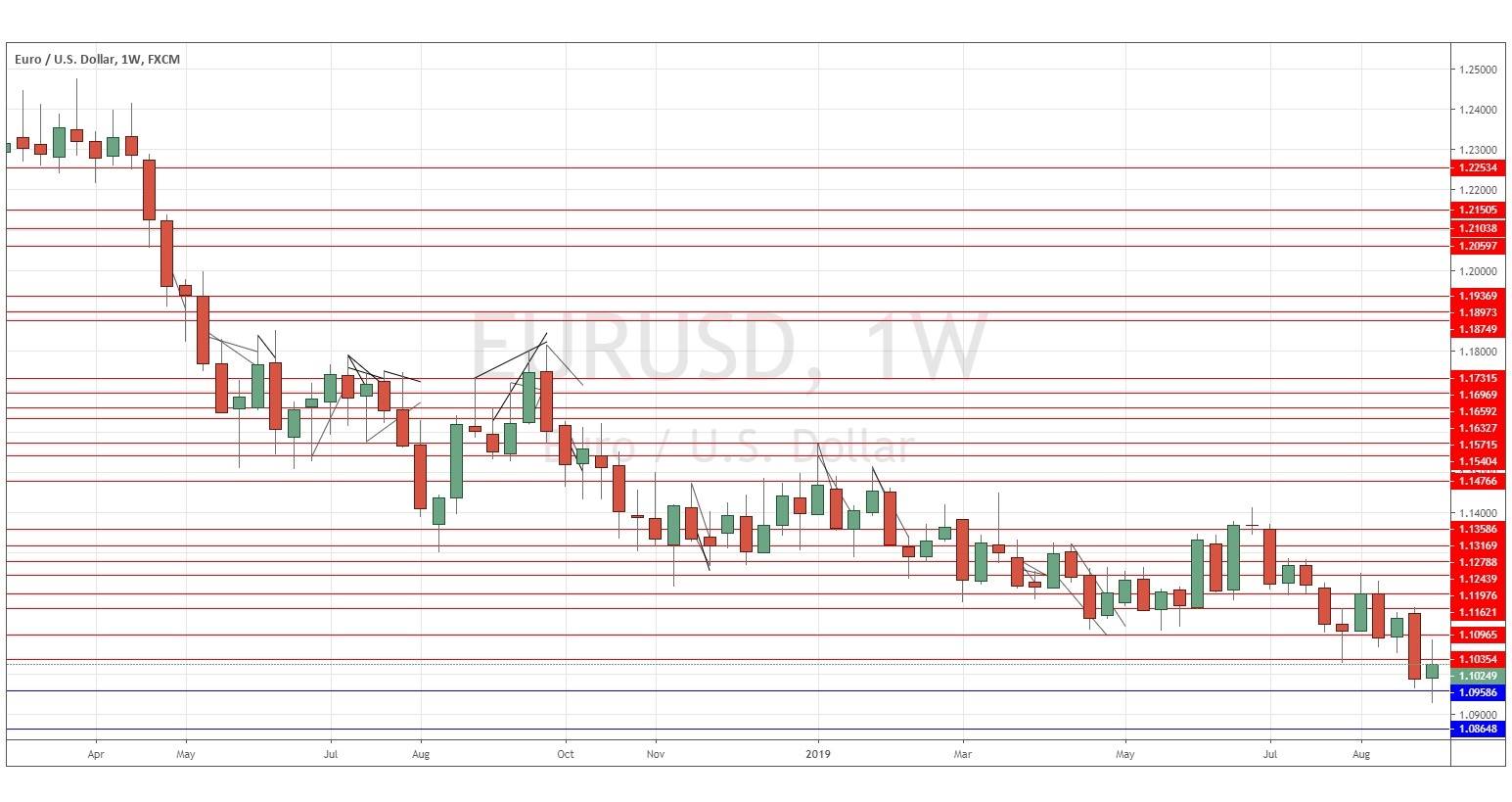

EUR/USD

This currency pair made its lowest weekly close in almost 2.5 years last week. The past week saw a recovery, but by the end of the week, the weekly candlestick has printed a doji, which suggests that a move down further to new lows continues to be possible. This is a slow but solid long-term bearish trend, driven currently by Euro weakness, so shorting the Euro against currently strong currencies such as the Australian Dollar could also be interesting.

Conclusion

This week I forecast the best trade will be short of EUR/USD following a daily close below 1.1000.