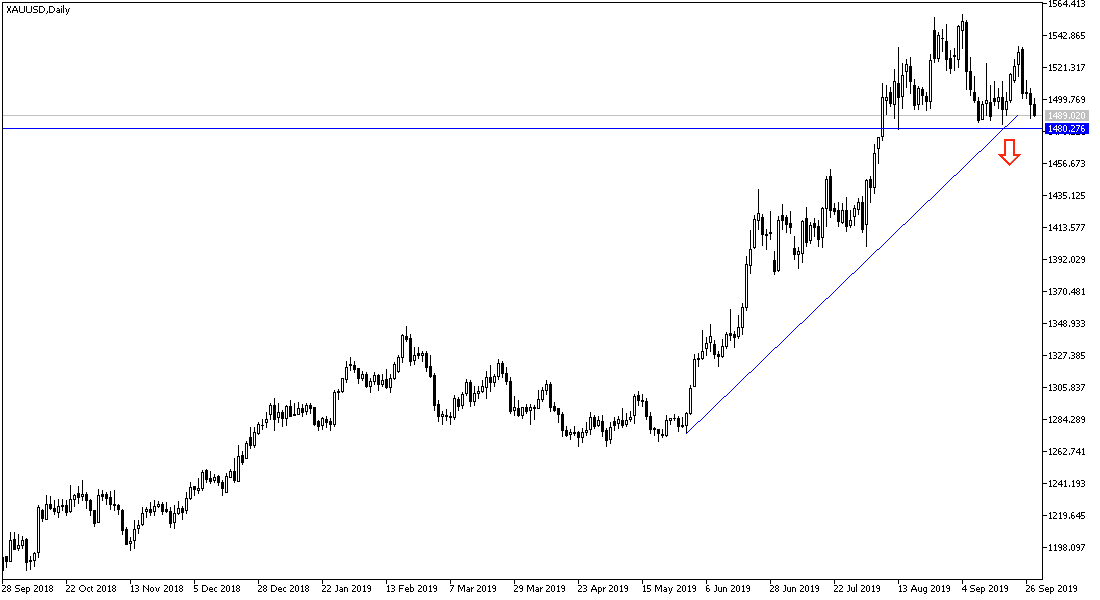

On the daily chart below, it seems clear that the gold price is in a stage of breaking the uptrend, especially if it stabilizes below the $1480 support level. On the other hand, the continuing trade and global geopolitical tensions will remain strong momentum factors for investors to return to buy gold again, and that the correction is normal after the price of gold reached the highest level in six years. Gold losses were halted by a decline in US stocks amid little fading trade optimism after reports that Trump administration officials were discussing ways to curb US investor portfolio flows to China.

On the economic news front, a Commerce Department report said US durable goods orders rose unexpectedly by 0.2% in August after jumping 2% in July. The steady increase surprised economists who expected orders to fall by -1%. Another report from the ministry showed that US personal income rose in line with economists' expectations in August, rising 0.4%, after rising 0.1% the previous month. Meanwhile, personal spending rose 0.1% in August after rising 0.5% in July. Spending was expected to rise 0.3%. In a report from the University of Michigan, US consumer confidence rebounded more than initial estimates in September, showing a marked increase from a three-year low of 89.8 in August.

According to the technical analysis of gold: $1500 psychological resistance is still key to the strength of the upward correction of gold prices, and the move above it again will support the move towards the resistance levels 1510, 1525 and 1540 respectively. Keeping in mind that the continued strength of the US dollar will remain an obstacle to gold to achieve this. But this could be a reality if trade and political tensions around the world increase again. Gold is the ideal safe haven for investors in times of uncertainty. On the downside, testing the 1480 support level and stabilizing below it will support the current bearish correction, after which it will be ready to test the 1472 and 1460 support levels respectively, which confirm the strength of breaking the trend and turning into a stronger bearish trend.

On the economic data front: The economic calendar today contains many data, the first of which are the Chinese manufacturing PMI and then the unemployment data from Germany and the Eurozone, The growth rate of the British economy and the purchasing managers' index from Chicago.