Gold markets were all over the place during the trading session on Thursday as the European Central Bank has had an interest rate decision and a press conference, cutting interest rates by 10 basis points, which is very little. Beyond that, we have seen that the ECB is going to continue to buy bonds, but unless they change some of the rules, they can only do so for roughly 12 months. While that goes far beyond the scope of this article, there are a lot of concerns at this point.

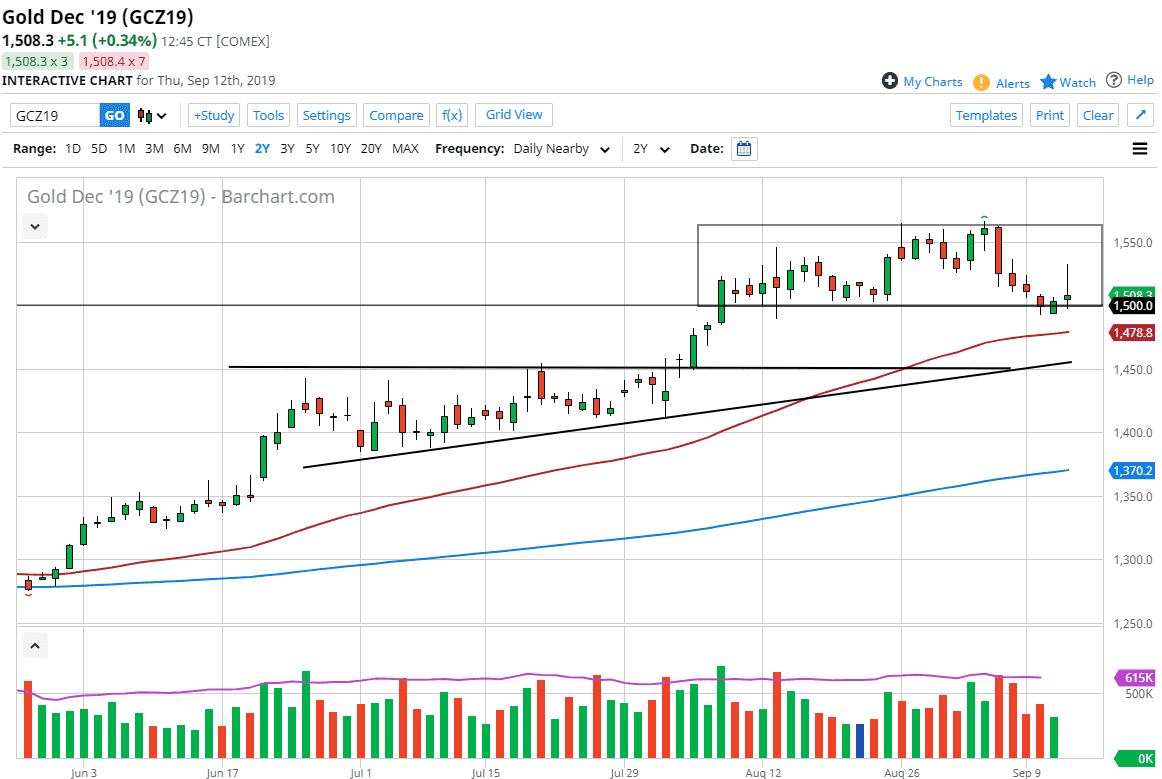

That being said, gold markets gave back their initial surge higher and don’t look very good suddenly. This isn’t to say that the uptrend will be over anytime soon or that you should jump in and start selling the market, rather than you may wish to avoid buying it until we get a bit more support or an impulsive movement to the upside. The daily candle stick forming a bit of a shooting star is not a good look, and it does suggest that we could drop below the $1500 level again and go hunting the 50 day EMA. This is painted in red on the chart, but below there even we have an uptrend line that comes into play and that should be massive support as well. I anticipate that if we do break down a bit, it’s likely that we will find support at one of these areas.

The alternate scenario of course is that we break above the shooting star, then of course the market could go towards the $1560 level, which was the recent high. This probably needs some type of “risk off” help or perhaps a central bank cutting rates drastically. Lost in the shuffle is that the Turkish central bank also cut interest rates during the day, with a whopping 325 basis points being sliced off the rate. However, that central bank was not enough to move the needle as everybody else is focusing on Europe during the day.

All things being equal I still believe that this market goes to the $2000 level but we may need to pull back a bit in order to buy based upon value more than anything else. Overall this is a market that will probably need to come back in a bit so that value hunters can take advantage of it longer term.