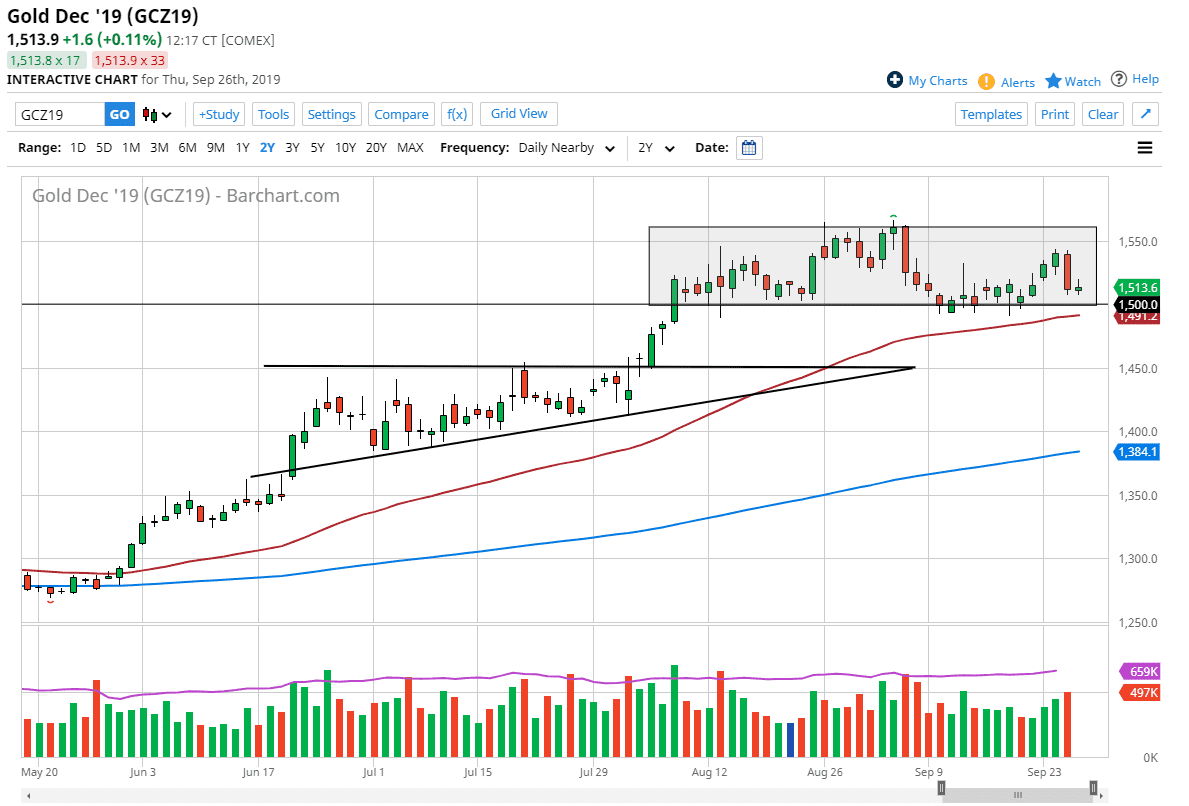

Gold markets have gone back and forth during the trading session on Thursday, stabilizing near a major support level. At this point, the $1500 level should continue to be an area that people pay attention to, followed by the 50 day EMA underneath. All things being equal, it does make sense that perhaps traders will continue to look at this as an opportunity to pick up a bit of value after the significant selloff.

At this point though, what’s particularly interesting is that we have not seen a major break down through the support level that would signify that perhaps the market is trying to change trend. With all of the major issues going on around the world, it makes quite a bit of sense that market participants prefer the potential safety of owning precious metals. If that’s the case, then we should continue to grind back and forth in this relatively reliable consolidation area that we have been in. At this point, that means that the market could go to the $1560 level, which has been resistance previously.

Beyond that though, there is also support underneath at the $1450 level, which is the top of an ascending triangle that initially sent this market higher to begin with. With that, I think that the market is well enough supported to continue going higher. Look at pullbacks at this point as a potential value play, as gold is a great place to hide when central banks around the world continue to loosen monetary policy, and of course there are a lot of concerns when it comes to the idea of geopolitical issues, monetary issues, trade war issues, and of course the potential of recession in places like the European Union. With that, I’m a buyer on dips going forward and fully anticipate that we will eventually break out to the upside.

To the upside, the $1600 level would be an initial target, as the trading probably continues to look at that large round figure as potential selling pressure, and then of course the $1800 level and that $2000 level after that which a lot of traders are starting to think could be the longer-term destination. This is a market that continues to offer plenty of opportunities for short-term traders and of course longer-term traders looking to add to a larger core position for bigger returns.