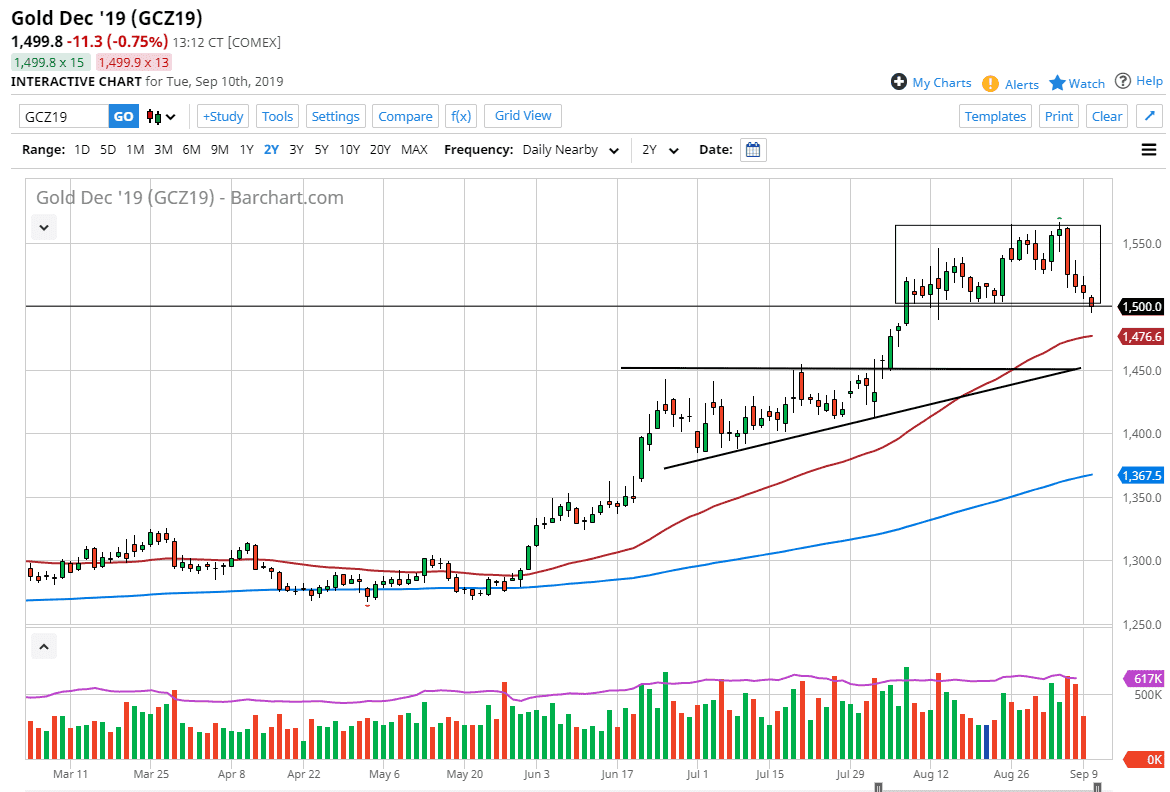

Gold markets have fallen during the trading session on Tuesday, to break below the $1500 level. However, we are starting to see buyers step in just below there and it’s very likely that Gold will continue to attract attention anyway, as central banks around the world continue to ease monetary policy. This week the ECB will do so, and then shortly afterwards we will see the Federal Reserve do the same thing. Loose monetary policy continues to be a major driver of precious metals overall but we had gotten a bit ahead of ourselves. This pullback has brought a little bit of sanity and perhaps even more importantly, value, back into the marketplace.

If the $1500 area doesn’t hold as support, then I believe that the 50 day EMA will which is currently trading at the $1476 level. The gold market does tend to move in $25 increments so this would make quite a bit of sense. A break down below there could send this market down to the $1450 level, which is the top of the preceding ascending triangle that had sent this market higher. All things being equal it’s hard to imagine a scenario where gold goes down to the longer-term so I am bullish of gold but I also recognize that there might be some profit taking in this general vicinity.

What you don’t see quite often is the way volume is laid out the order book suggests that some of the volume underneath might be thin so we may get a sudden pullback but look at that as an opportunity to buy gold “on the cheap.” Ultimately, if we turn right back around and rally it’s likely that we go back towards the $1550 level above, which has been significant resistance. If we can break above there, then it’s likely that we could go to the $1600 level which is my target over the next several weeks. I think that the impulsive and massive move higher is probably done for a while, and now we start to see more of a grind to the upside which makes a lot more sense in a stable and durable uptrend. The “easy money” has already been made so at this point you will have to do a little bit more work finding value on these dips but you should also keep a unidirectional bias to this market and that of course is up.