Gold markets initially tried to rally during the day on Monday but then drifted a little bit lower. That being said though, the Gold markets are most certainly still in an uptrend and I do think that the markets will continue to be so, as we have seen so much uncertainty around the world. The Gold markets are one of the first places that people will put money towards if they are worried about central banks cutting interest rates or at least easing monetary policy. We have that everywhere around the world so it makes quite a bit of sense that we would in fact see that happen.

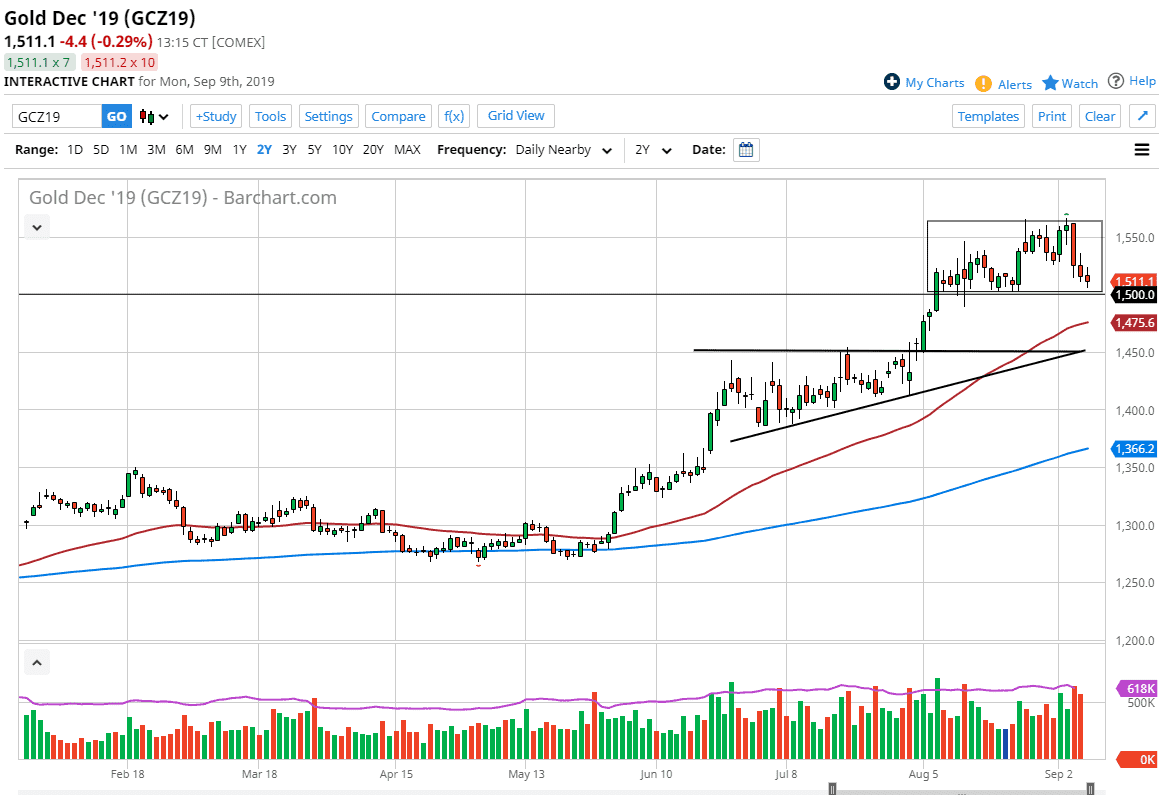

There is also the geopolitical concerns around the world that will continue to pop up occasionally and send this market higher. That doesn’t mean that we can’t get a pullback, because we had been a bit overdone recently. Gold markets continue to be very volatile but they also have the $1500 level underneath offering quite a bit of support. I like the idea of picking up little bits and pieces of value as they occur. This isn’t to say that we can’t break down below the $1500 level, because I see the $1450 level is even more important, as it is the top of the ascending triangle that the market broke out of. Between the $1500 level in there, the 50 day EMA comes into play as well and that should be a buying opportunity also. I’m simply looking for some type of bounce to take advantage of in this market, because I do believe that there are plenty of traders out there that would love to get involved and are simply waiting for a bit of value to appear.

To the upside, the market probably goes looking towards the $1550 level, and then ultimately the $1600 level. Looking at this chart, even though a pullback is somewhat eminent there’s nothing on here that suggests we should be shorting. Beyond that, it’s hard to imagine a scenario where geopolitical situations get better overnight. Yes, there will be the occasional good headline but in the end it’s only temporary as there are plenty of reasons out there to seek the safety that this market can offer. You should start slowly and build up a position as the trade works out in your favor. Shorting is all but impossible right now.