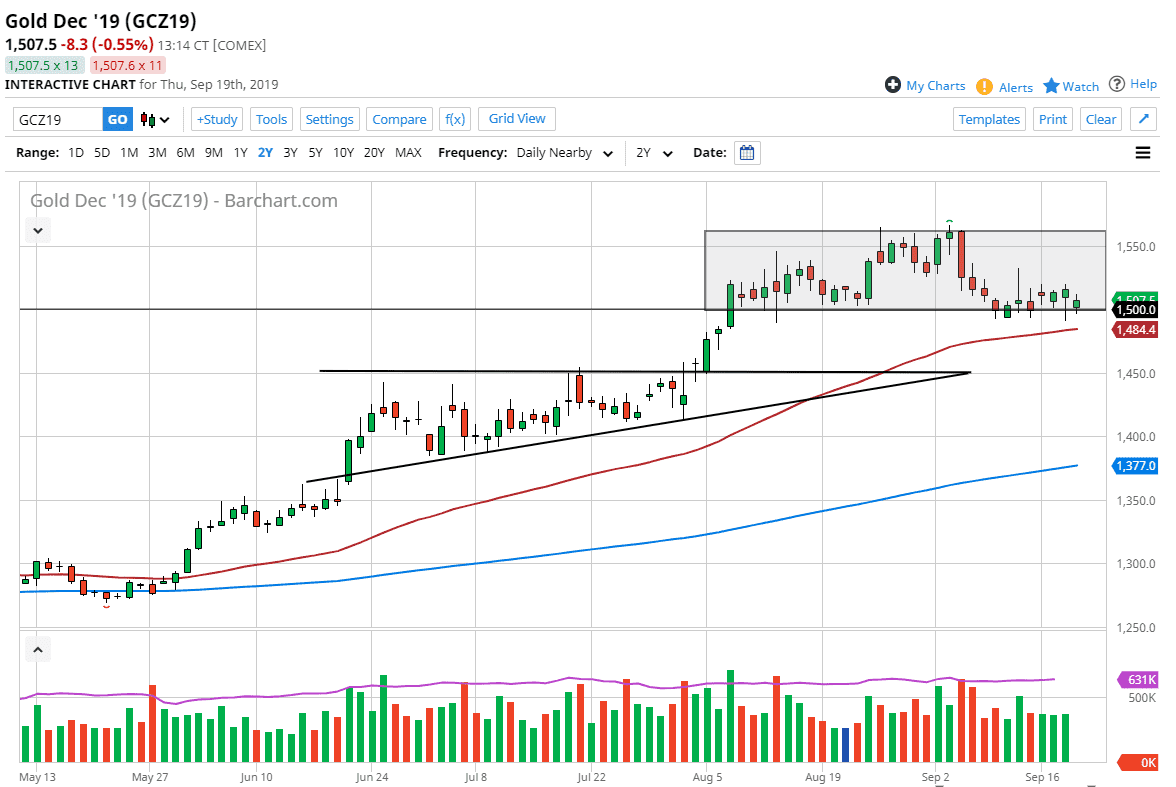

Gold markets drifted a little bit lower to kick off the trading session on Thursday but then rallied again to continue to show the $1500 level as being crucial. That is a large, round, psychologically significant for some time, and it should be thought of more as a “zone” down to the $1490 level which of course has the 50 day EMA just below it. In other words, the market may have just killed off enough time to digest the gains that got it up to this level, so that we can start the longer-term rally to the upside yet again.

The hammer that formed during the Wednesday session was of course a very bullish sign, so if we can break above the top of the Wednesday session, it’s very likely that we go towards the top of the rectangle on the chart. If we can break above the top of that, the market is likely to go much higher, and therefore extend towards the $1600 level, the $1800 level after that, and that of course the $2000 level given enough time. We also have a lot of support underneath down at the $1450 level, which is of course the top of the ascending triangle that got us up here to begin with.

Central banks around the world continue to ease monetary policy, with the Federal Reserve being the last central bank to do so. In fact, you would be hard-pressed to find a central bank around the world that looks even remotely hawkish, so given enough time it’s likely that you have the perfect storm for gold to rally for a bigger move. Beyond that, the geopolitical situation continues to get dicey at best, so one would think that we are only a headline or two away from a jolt to the Gold markets to the upside as well.

Pullbacks at this point should continue to offer value that a lot of people will be willing to take advantage of, as getting gold “on the cheap” is without a doubt one of the smartest move is that traders have been able to do during this past year. Expect volatility, but if you can add slowly and build up a larger core position, you can ride the wave to the upside. $2000 seems like it is far away, but I suspect we will see that within the next 18 months.