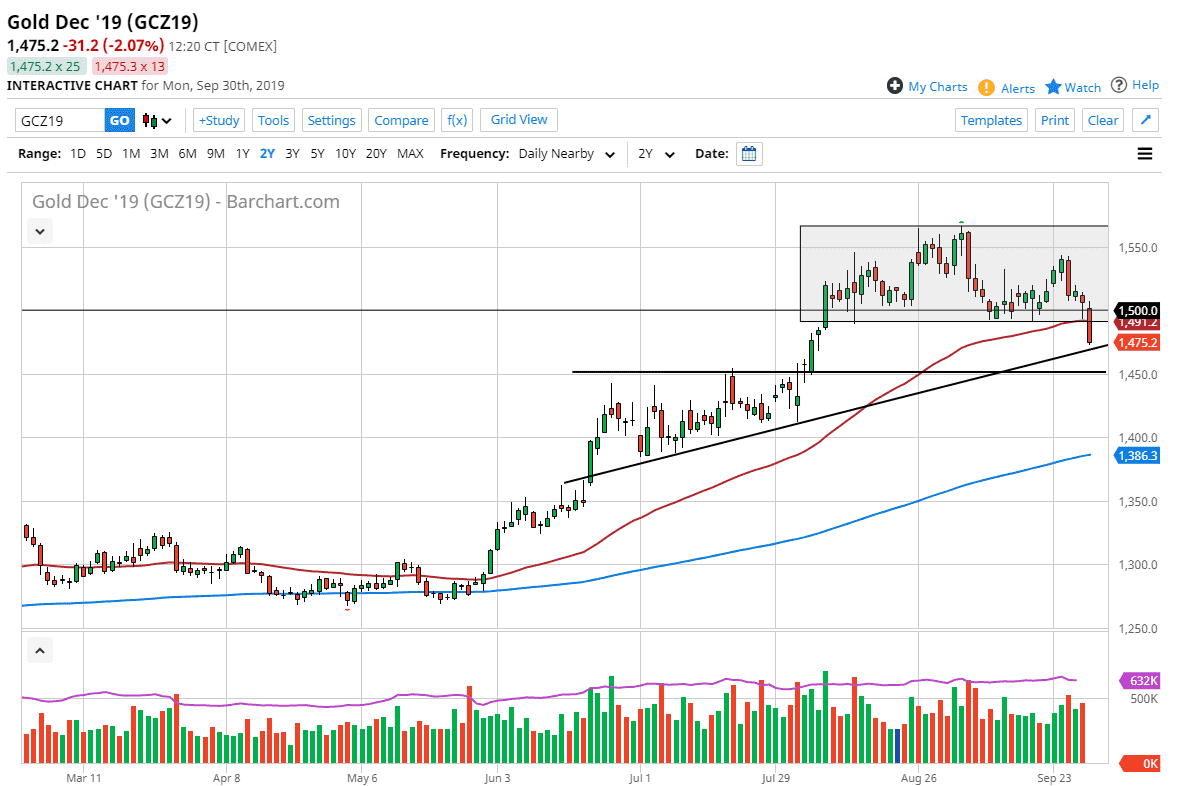

Gold markets have broken down significantly during the trading session on Monday, slicing through the important $1490 level and of course the 50 day EMA. Both of those offer potential support that has now been shattered, but quite frankly this is a market that has been a bit overdone as of late. If you squint, you can make it a bit of a “head and shoulders pattern” that has just kicked off. So here’s the question: “how low can we go?”

If you’ve been trading for any significant amount of time, you know that it can’t truly be defined, as every time we think that the buyers are going to come back in that may not. However, I have a couple of areas that I am paying close attention to for that potential support, with the initial one being at the lows of the trading session for Monday, as we are testing and uptrend line. Underneath there, the $1450 level should offer support not only because it is a “midcentury mark”, but it is also the top of the previous ascending triangle that has previously been the scene of a gap. In other words, there’s a lot of reasoning to think that there should be a certain amount of support in that general vicinity.

Keep in mind that gold is going to move based upon the latest headlines and risk appetite, which currently seems to be stabilizing a bit, which is good for several different assets. Stock markets in the United States rallied during the day, so that could put more bearish pressure on gold. Beyond that, the US dollar itself has been strengthening so that also puts a bit of bearish pressure on gold. However, I do think that it’s only a matter of time before the uptrend continues so the question then will be which one of these levels holds. I think at this point, the easiest thing to do is to simply wait for a daily candle stick to place a trade. Yes, you could have made money shorting Gold during the trading session, but the reality is that the bigger gains are to be made based upon being patient and seeing when the overall trend continues. After all, it’s not as if the world suddenly changed overnight, and therefore all of the things that have made gold attractive are still out there.