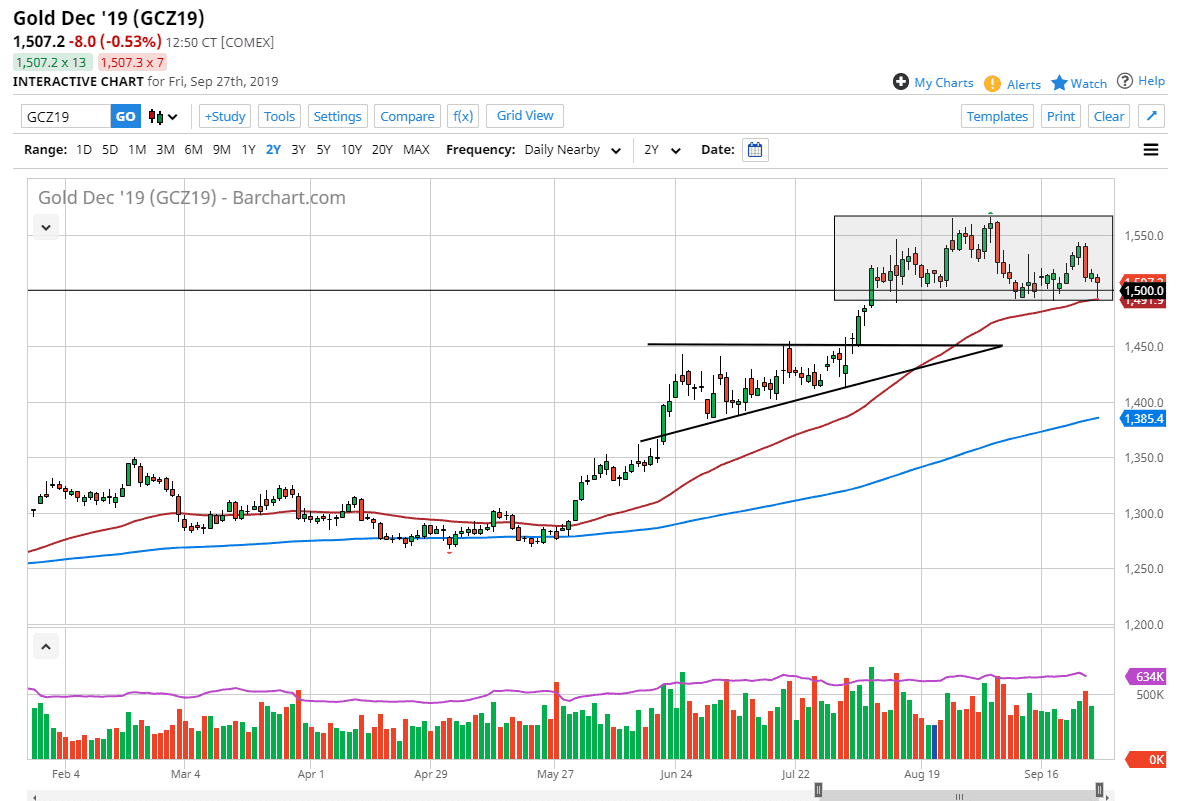

Gold markets looking to bounce from major level.

Gold markets initially fell during the Friday session, reaching down towards the 50 day EMA and of course the $1500 level. By bouncing the way we have late in the day, we have formed a bit of a hammer, and that of course is a bullish sign. On a break above the top of the daily candle stick, it is a classical technical analysis to start buying. However, if we were to break down below the 50 day EMA and the bottom of the hammer, that would send this market much lower, down to the $1450 level.

The $1450 level is the top of the previous ascending triangle, so therefore it’s very likely that the market will probably find some type of support in that general vicinity. That area should hold, but if it doesn’t that would be a very negative sign. All things been equal though, if we do rally from here it’s likely that the $1550 level will probably be the short-term target. Keep in mind that gold has a lot of fundamental issues going back and forth, and at this point I think it’s very likely that the market is going to probably have to take back some of the gains as we had gotten a bit ahead of ourselves. Even though we have formed a hammer on the Friday session we are most certainly running into a bit of trouble. The question now is whether or not the market is turning around on Friday to form a hammer because there is some type of significant support here, or is it simple short covering going into the weekend? I suspect it might be a bit of both.

Pay attention to the US dollar, and the signs of strength or weakness that it exerts. The US dollar can work against the value of gold if it’s strengthening as gold is priced in that very currency. All things been equal though, it’s likely that the uptrend will eventually continue, as the market has been so driven lately. However, in the short term it looks as if we are trying to form some type of head and shoulders pattern, which surprisingly enough measures down to the $1450 level. All things being equal I think that either direction could happen but I’m not necessarily looking to short a break down, I’m simply looking to pick up value.