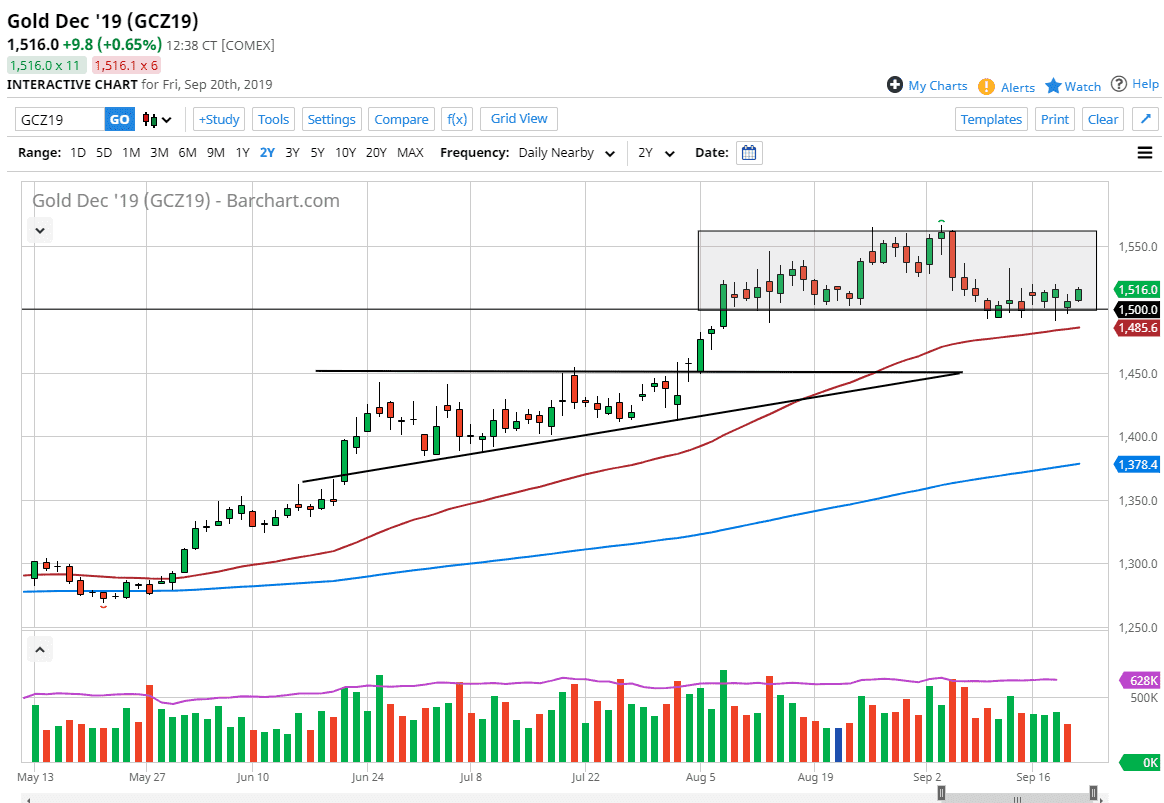

Gold markets rallied during the trading session on Friday again, as the $1500 level continues offer a significant amount of support. However, there is a lot of noise in this general vicinity so I would not be overly surprised to see this market pull back from here. Looking at this market, the $1490 level underneath would be massive support and essentially the bottom of the “support zone” that features a $1500 psychologically important figure.

Underneath there, we have the 50 day EMA just below that is starting to grind to the upside and of course the $1450 level. That is the top of the ascending triangle that sent this market higher, so at this point it’s likely that the top of that pattern should offer plenty of market memory based support. That being said, I don’t know that we fall towards that area, as there continues to be a lot of concern out there and of course central bank meddling when it comes to the fiat currencies. After all, the Federal Reserve has recently cut interest rates, adding yet another name to the list of central banks out there who have either cut interest rates lately, done a bit of quantitative easing, or both. In other words, this easy money policy should continue to propel precious metals higher due to the fact that the metals are based in fiat currencies.

Looking at this chart, we could go towards the $1560 level next, which is essentially where we found quite a bit of selling previously. Having said that though, I think that we will break above there and then go to the $1600 level, and then eventually the $1800 level after that. Beyond that, the $2000 level is eventually the target, but obviously it will take quite a bit of time to get there. I continue to buy short-term pullbacks, as the market continues to reward those moves. That being said, look for value as gold is going to be “on sale” every time we see signs of lower pricing. As far as selling is concerned, I don’t really have a scenario in which a willing to do so unless of course the central banks around the world decide to start raising rates. But beyond the interest rate situation, we have plenty of geopolitical concerns and of course trade concerns out there to drive the Gold markets higher.