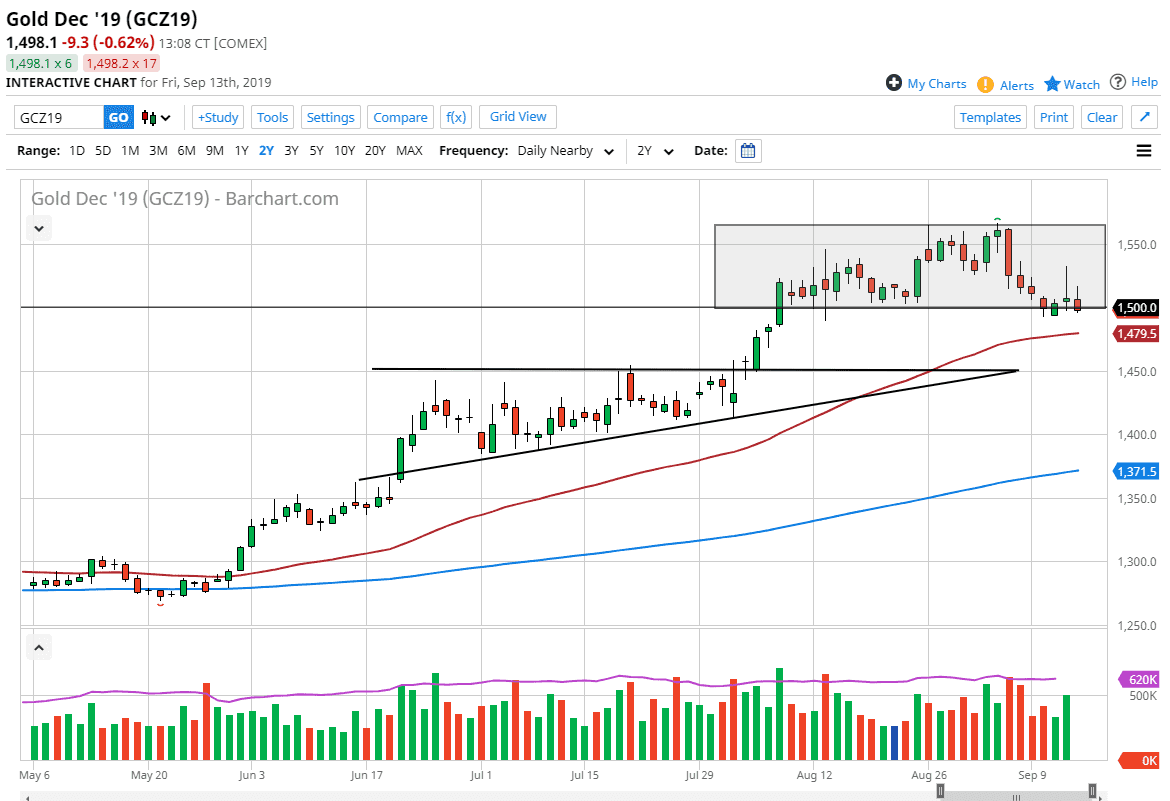

Gold markets fell again during the trading session on Friday after initially trying to rally. After forming the shooting star from Thursday, it suggests that we are going to continue going lower, and the Friday candlestick of course confirms that. Nonetheless, this is a strong uptrend that we have been in and I think this market will remember that given enough time. However, it’s obvious that we are starting to struggle, and I think that the market then goes looking towards the 50 day EMA where we should start to see quite a bit of support.

Beyond that, we also have a lot of support just waiting to happen at the $1450 level, as the uptrend line from the ascending triangle should continue to be supportive regions where the market will be looking to pick up value in the Gold markets which is still apparent. With the Federal Reserve coming out with an interest rate decision this coming week, it’s very likely that the market will be reactive to that, and gold will react to perceived quantitative easing down the road when it comes to the Federal Reserve.

The alternate scenario is of course that we turn around and rally, and if we can break above the top of the shooting star from the Thursday session it would be a very bullish sign. In fact, that would be very impulsive and should send this market much higher. However, the US/China trade relations seem to be going a bit better so some of the “safety trade” continues to fly out of this market. Don’t worry though, it’s only a matter time before something happens to make that turn around and rally again. I will be looking for some type of supportive candle stick or bounce to take advantage of in less we turn around and blow through that shooting star.

I have no interest in shorting this market even though I recognize it’s very likely to fall over the next couple of days. I think it’s simply a matter of letting the market to stabilize and turn things around. If we were to break down below the $1450 level I would become a bit more concerned but will have to take that as it comes. It’s very likely that people are simply trying to collect profits heading into the Federal Reserve statement and meeting which could be massively disruptive.