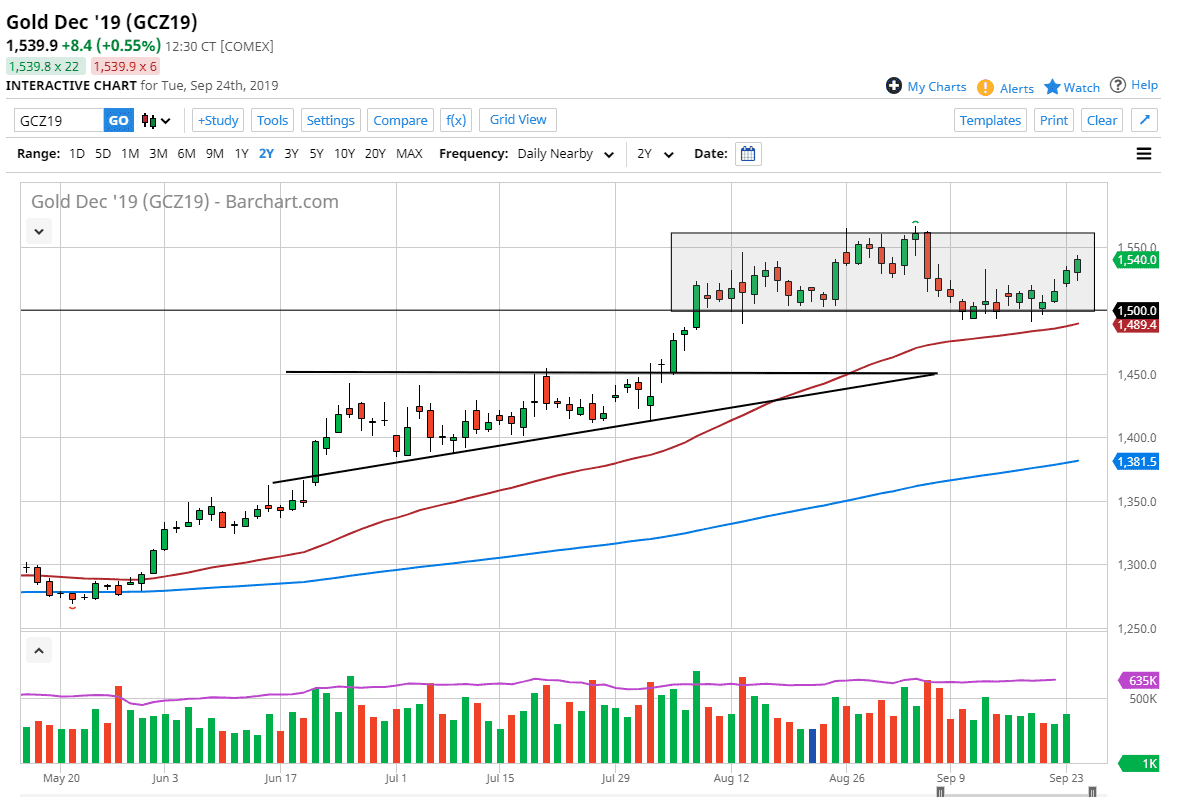

Gold markets went back and forth during the trading session on Tuesday, initially falling before turning back around to break towards the $1540 level. This is a market that should continue to reach towards the top of the rectangle that I have drawn on the chart, but we may get a short-term pullback, giving the market the ability to build up a bit of momentum.

Underneath, the $1500 level should offer a significant amount of support, extending all the way down to the $1490 level. Not only has that $10 range offers a lot of support, the 50 day EMA sits just below there so it’s very likely that it will only add to the buying pressure and support. To the upside, short-term pullbacks continue to be buying opportunities as the uptrend continues and has been very strong as of late.

Central banks around the world continue to cut interest rates and loosening monetary policy so that’s the fundamental reason for gold to go higher, not to mention the fact that there is a trade war going on and a whole plethora of geopolitical tension. The Gold markets are most certainly in an uptrend as of late, so I simply look at the market as one that you can pick up value every time it dips. While the US dollar has been strengthening against most currencies, gold is going to be different because although the Federal Reserve has been very dovish as of late, they are not as dovish as other central banks such as the European Central Bank and many others.

The market continues to be very choppy and erratic, but I think given enough time the uptrend continues now that we have digested a lot of the gains. Remember, gold has been rather negative been lackluster for some time, so the last couple of months will probably take a certain amount of digesting to make longer-term traders get involved and start pushing. At this point though, gold should be a lot more trustworthy for longer-term traders, because we have seen consecutive months of not only bullish pressure but sideways pressure as well. Ultimately, as we stabilize at these higher levels it means that traders are becoming more and more comfortable with being in this area. The more comfortable they are, the more likely they are to buy more gold, pushing this market much higher.