Investor risk appetite and strong US dollar pushed the gold price to collapse from the $1535 resistance to the $1500 during Wednesday's session before settling around 1510 dollars per at the time of writing. The safe havens were dispensed with after Trump's remarks at the UN summit, saying: "I think China wants a trade deal, and they are starting to buy more US products". As for the confrontation with the US Parliament, He said that the democrats can have a copy of the transcript with Ukraine, and that he wants transparency with Biden and the Democrats. Thus, gold prices recorded their biggest daily decline in nearly three weeks. The US dollar index DXY, which is moving inversely with gold, rose to the top of the 99.00 top. The strong gains of US stocks contributed to the pressure on gold prices.

For economic news, US new home sales were reported to have increased strongly in August after a sharp decline the previous month. Sales rose 7.1 percent to an annual rate of 713,000 homes in August after falling 8.6 percent to an average of 666,000 in July. Economists had expected new home sales to jump 3.9 percent to 660,000 from the 635,000 reported last month.

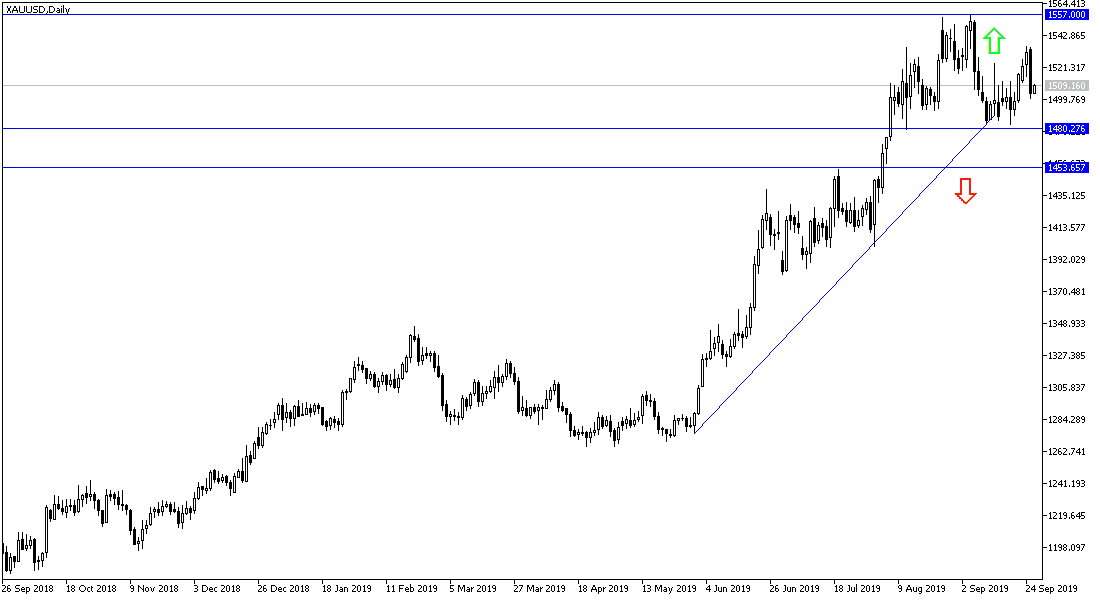

According to the technical analysis of gold: Despite the recent decline in gold prices, it is still within the range of the bullish channel in the long run, and may decline below $1500 psychological resistance for investors to think about buying gold again, as the global trade and political tensions still exist. The closest buying levels currently are best at 1500 and 1492 And 1484 respectively. With resistance targets in the near future down to 1515, 1525 and 1540 respectively before targeting the next psychological resistance at $1600.

On the economic data front: The price of the dollar, and hence the price of gold, will react with the announcement of the economic growth rate of the United States, along with the unemployed claims and pending home sales, in addition to the statements of Mario Draghi, Governor of the European Central Bank, Mark Carney, governor of the Bank of England and Jerome Powell, governor of the Federal Reserve.