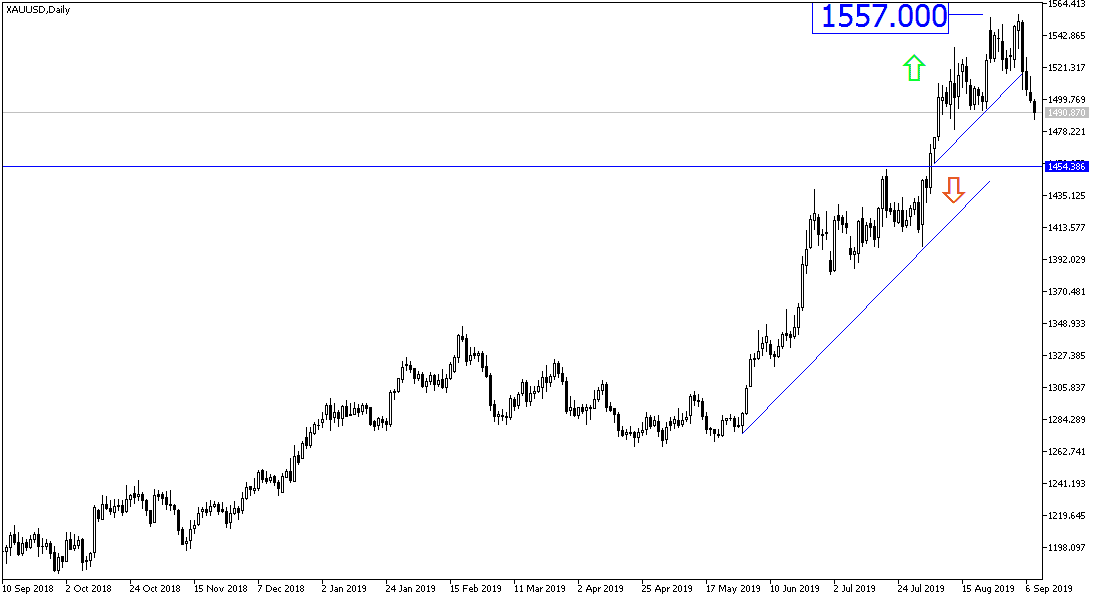

The price of gold today succeeded in confirming the break of the uptrend which lasted for 17 consecutive trading sessions. The price of gold fell to the $1486 support, and the correction was from the $ 1557 resistance level, the highest in more than six years. Recent gains received the attention of investors around the world and stressed that gold is a historically safe investment. The US dollar held steady after the release of US jobs figures and Jerome Powell's recent comments, along with risk appetite, contributed strongly to the recent correction in the gold price. The US economy has succeeded in creating new jobs in the non-farm sector, less than expected, and at the same time we have seen an increase in average hourly wages and steady unemployment in the country. The strong US labor market continues to support the central bank's adherence to its policy, which often angers Trump, as he sees it as hindering his economic plans.

Jerome Powell has reaffirmed that the Fed will “act as necessary” to maintain US economic growth and not consider what the Trump administration wants. US inflation figures this week may affect market expectations for what the US Federal Reserve will announce next week on its monetary policy.

According to the technical analysis of gold: As we mentioned in recent technical analysis, the attempt of gold prices to move below the $1500 psychological resistance will stimulate the break of the current gold’s bullish trend. It has already moved towards the support levels we expected at 1493 and 1486, and is now closest to testing 1480 and 1465 lows, which already confirm the strength of the trend break. At the same time, new buying levels will be ideal for investors. Global trade and geopolitical tensions are not over. On the upside, a return to stability above the 1500 psychological resistance will stimulate the uptrend again, and the next move towards the 1510, 1525 and 1537 peaks may be back. We prefer to buy gold from every bearish level.

As for today's economic data: The price of gold will react to the release of UK jobs and payroll numbers as well as investors risk appetite, as gold remains the safe haven of choice for investors in times of concern.