For the second week in a row, gold prices closed lower. Last week's losses extended to the support level of 1,485 dollars an ounce, a one-month low. These losses were supported by the continued strong investor risk appetite following the positive outlook for both, the future of the World Trade War and Brexit. We have seen the United States and China willing to conclude a deal, albeit provisionally, as Trump said recently. After measures to ease trade tensions, Trump postponed the imposition of the recently scheduled tariffs for two weeks as a goodwill gesture for their round of negotiations a few days later in Washington.

This week, financial markets will be on schedule with the announcement of monetary policy by a number of global central banks, led by the US central bank. Any new event, as with the ECB last week, and the announcement of new stimulus plans, will increase investor appetite for risk and hence gold losses.

Expectations are for a quarter-point cut in US interest rates at Wednesday's meeting. The price of gold will remain in a limited range until the actual announcement of the bank's decisions, monetary policy statement signals and Jerome Powell's remarks thereafter.

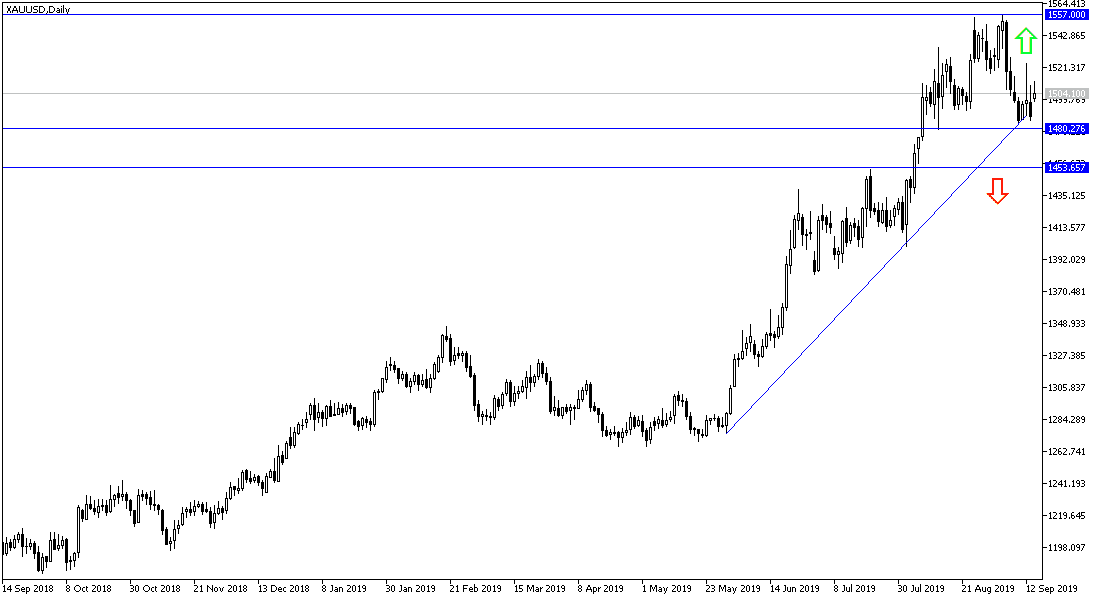

According to the technical analysis of gold: As we see on the daily chart, there is a clear break of the upward trend by moving below the $ 1500 psychological resistance level. Continued selling may push it towards support levels at 1481, 1473 and 1460 respectively. The latter level is a stronger confirmation that the general trend has turned bearish. In contrast, if the price of the yellow metal returns to the resistance areas at 1510, 1525 and 1540 respectively, it is expected to test the strongest peaks, exceeding the last resistance of 1557 dollars and the highest in more than six years.

Economic data and important events this week must be taken into account, as they may cause strong volatility in the gold price performance.

On the economic data front today, all focus will be on the release of China's economic data, mainly industrial production and asset investment. The price of gold is very sensitive to the growing global trade and geopolitical tensions as it is one of the most important safe havens.