There is no doubt that the increased investors’ risk appetite is hurting the price of gold , which has now happened with the price falling to $1495 an ounce, and failed at the beginning of this week's trading, to penetrate the $1512 height, recorded after the recent tensions in the Middle East. At the same time, it should be noted that the yellow metal will be on an important date this week with the announcement of monetary policy decisions of a number of central banks, most notably the Federal Reserve, the Bank of England, the Bank of Japan and the Swiss central bank. Last week, the gold price jumped to the $1,524 resistance after the European Central Bank announced massive stimulus plans to revive the Eurozone economy. The shift in policy from other global central banks this week towards policy easing could support the return of gold's gains. The most notable may be the US central bank's cut of the US interest rate by a quarter point to counter the risks to the country's longest economic growth period.

The recent bearish momentum of the gold price was supported by the easing of the trade war between the world's two largest economies and weakening fears of a no-deal Brexit.

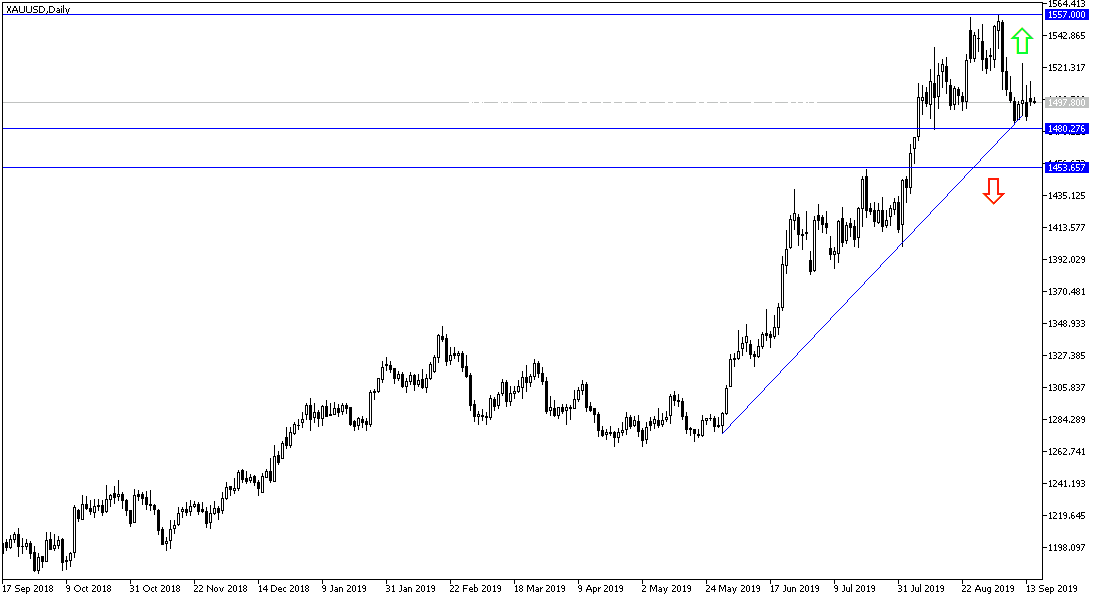

According to the technical analysis of gold: Gold prices are currently in a neutral position, and in the long term, are still heading towards the completion of the uptrend, which culminates in the $1500 psychological top. We still prefer to buy gold from every bearish level. Currently, the closest support levels are at 1488, 1479 and 1465 respectively. If it returns to test the resistance levels at 1510 and 1525, the bullish momentum will increase again, and then the price will move to new highs. We may see a strong volatility in gold prices immediately after the release of important economic data this week, led by monetary policy decisions of global central banks.

On the economic data front today: Gold prices will react to the release of the German ZEW Economic Sentiment as well as industrial production from the US. Since gold is one of the most important safe havens, it may be strongly influenced by renewed global trade and geopolitical tensions.