After a bearish correction during last week's trading, Gold prices dropped to the $1483 support level. Gold was supported by the Chinese negotiating team canceling a predetermined meeting with US farmers without giving any reasons, raising investors' fears that the round of talks between the world's two largest economies could fail, prompting investors to buy safe havens and gold.

Global central banks are adhering to their monetary policy orientation towards further easing, underlining the persistence of global concerns about the future of global economic growth and thus will motivate investors to buy gold. Currently, the most prominent support for gold is the continuation of the Brexit crisis, the US-China trade dispute, the slowdown in the growth of the Eurozone economy and the situation in the Middle East. This week we will be have an important date with comments from central bank chiefs; Mario Draghi of the European Central Bank, Mark Carney of the Bank of England and Jerome Powell of the US Federal Reserve and their signals will affect the Gold performance.

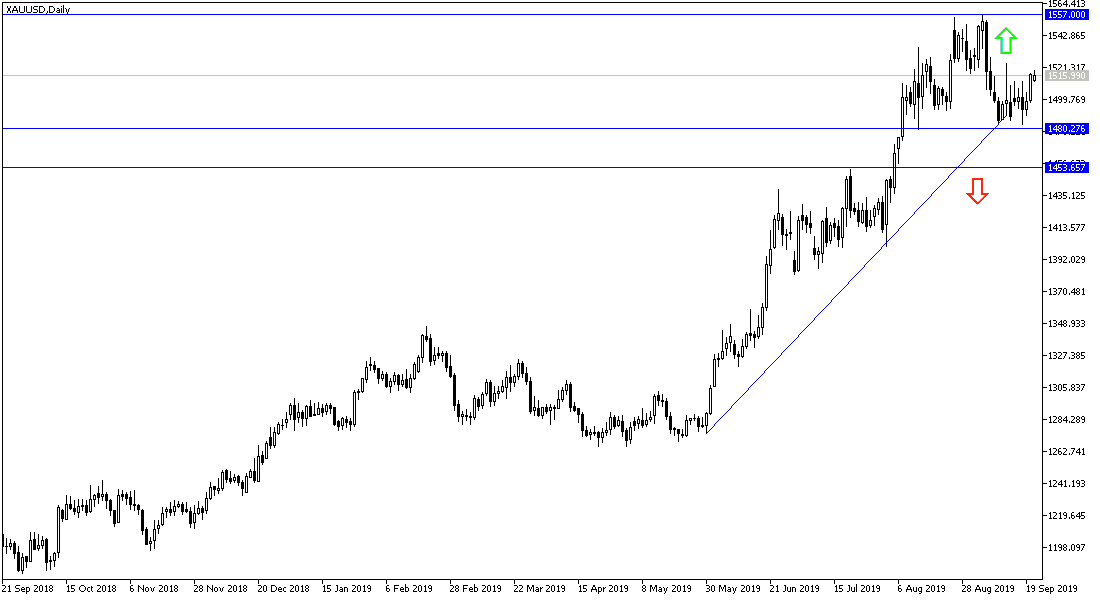

According to the technical analysis of gold: As I expected in recent technical analyzes, that the return of stability around and on top of $1500 psychological resistance will continue to support the strength of the upward trend, which is currently closest to test the remaining resistance levels we have identified at 1527 and 1540 respectively. Continued global trade and geopolitical tensions will further fuel gold purchases. On the downside, the nearest gold support levels are currently at 1509, 1494 and 1481 respectively. I still recommend buying gold from every bearish level.

On the economic data front today: The economic calendar today will focus on the release of PMI indicators for the manufacturing and services sectors for the Eurozone economies. There are no significant US data releases expected, but the dollar may react to comments from some members of the Federal Reserve's monetary policy.